Kamal Nath, India’s urban development minister, is the trillion dollar man. Every few months, he pops up at a foreign investment forum or press conference to proclaim that he has a “trillion dollar budget” for infrastructure. Each time, this tends to get reported as something new. Here he is announcing his $1 trillion plan on Nov. 6. And again last October. And also last June. And again in 2010.

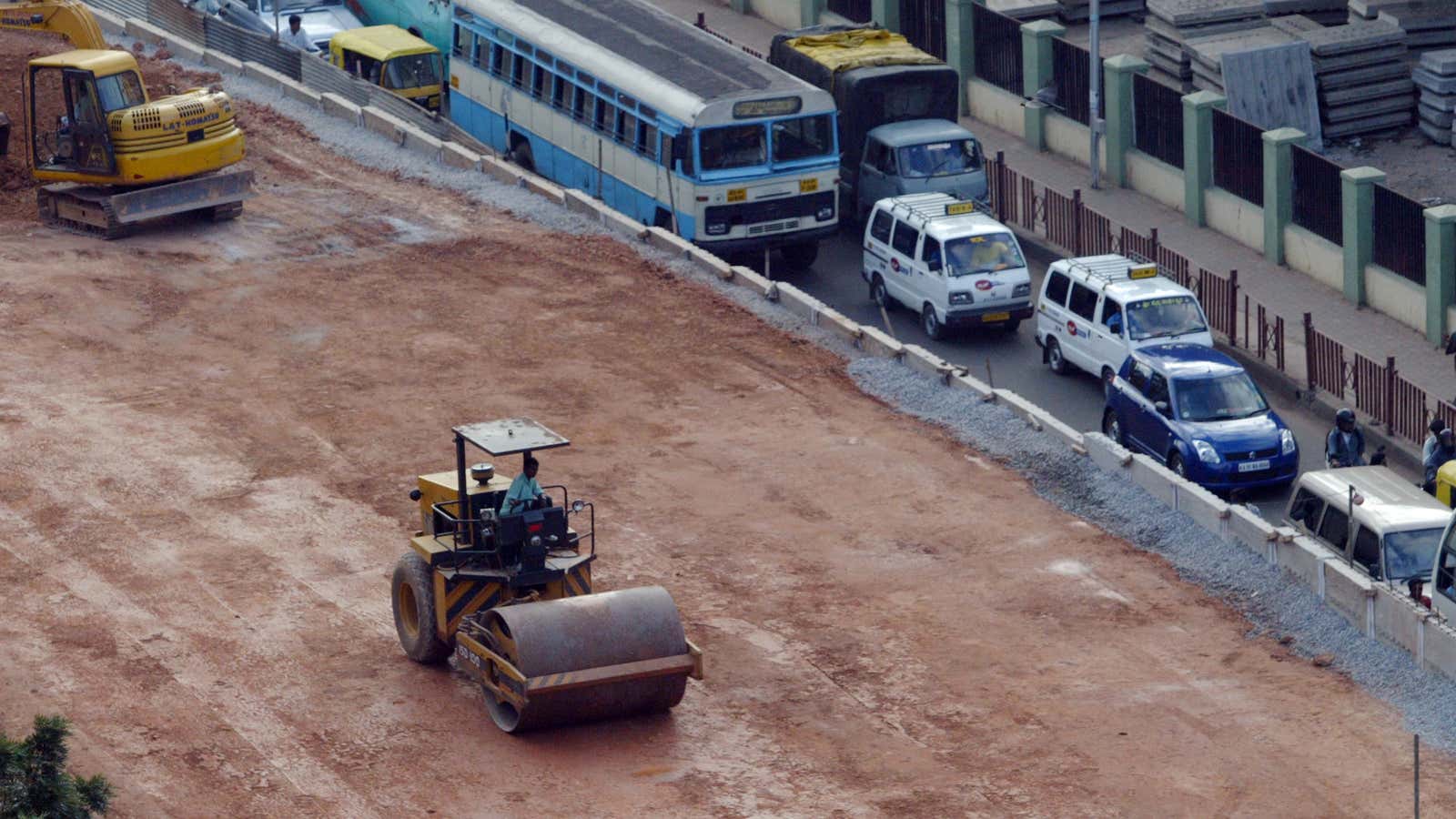

Talk—even $1 trillion talk —is cheap. But India isn’t making any progress on its potholed roads. The Times of India reported on Nov. 5 that while the government has targeted building 9,500 km of new roads by March 2013, just 600 km of contracts have so far been awarded by the National Highways Agency.

Private companies in India seemingly do not want long term infrastructure projects. India’s government is not planning just to hand $1 trillion to private companies. Instead, Nath envisions public-private partnerships where infrastructure companies will stump up around half of the cost of new roads and other infrastructure. But road builders have what India’s Economic Times calls an “acute fund crunch.” They cannot get bank loans. So despite the $1 trillion promise, builders are exiting highway projects, not hurtling towards them.

Indian banks have also been told to reduce their exposure to infrastructure by the Reserve Bank of India, which wants more credit to flow to farmers to end the state subsidies that are causing skyrocketing inflation.

And while banks are exiting infrastructure, contractors are already over-leveraged. “Five to ten years ago, there was so much liquidity,” bemoans a senior executive at an Indian infrastructure company who asked that I not use his name. “So we all took on loads of projects, and now the industry has too much debt to take on more.” As the Economist observed, infrastructure companies’ balance sheets are now “as potholed as the roads they resurface.”

India’s interest rates hit a ten year low of 4.5% in late 2003 and have climbed to 8% since then. Between 2003 and 2007, with rates low, Indian companies rushed to start projects, and their order books filled up fast. Big highway projects can take several years to produce cash, so if construction firms cannot keep borrowing, they are stumped.

So the private sector needs more government help. The Indian government could push more liquidity toward contractors by taking some burden off the nation’s banks. Politicians have been discussing an infrastructure debt fund for several years, and in true Indian fashion, they just keep talking.

Meanwhile, big companies are struggling. Jaiprakash Associates, one of India’s largest privately held infrastructure companies, is prompting concern by analysts over its high borrowing and weak cash flows. In the preamble to its last annual report, the company called on the government to help it find funding. Jaiprakash’s shopping list: “the introduction of tax-free bonds, formation of infrastructure debt funds and [the government] formulating a comprehensive policy for developing public-private partnership projects.”

Instead, the government serves up bureaucratic paralysis. “In India, a project needs about 50 [government] approvals to get started,” notes Will Freeman, an analyst at economic consultancy Gavekal. He also points out that India’s environment ministry is holding up a lot of projects: “We’re seeing that companies wanting to start projects have difficulties getting land and getting approvals. The biggest barrier to investment in India is probably bureaucracy.”

A bill on land acquisition law, currently under debate, would be another barrier for companies who want to build roads. The bill suggests that anyone who needs to resettle people to start a project must acquire land at double the market value in urban areas and four times market value in rural areas. It also requires, in the case of public-private partnerships, consent of 80% of the people who would be displaced by each project.

So when might that $1 trillion budget be spent? “Judging by India’s history at meeting government targets,” says Freeman. “I would say never.”