Apple stock is the cheapest it’s been since 2001

OK, not literally the cheapest. But according to one of the most widely used methods of valuing stocks, Apple’s shares are the most affordable they’ve been in more than a decade. By the way, we’re looking at the price-to-earnings number from October 2001, that’s the same month when Apple first unveiled a little product called the iPod.

OK, not literally the cheapest. But according to one of the most widely used methods of valuing stocks, Apple’s shares are the most affordable they’ve been in more than a decade. By the way, we’re looking at the price-to-earnings number from October 2001, that’s the same month when Apple first unveiled a little product called the iPod.

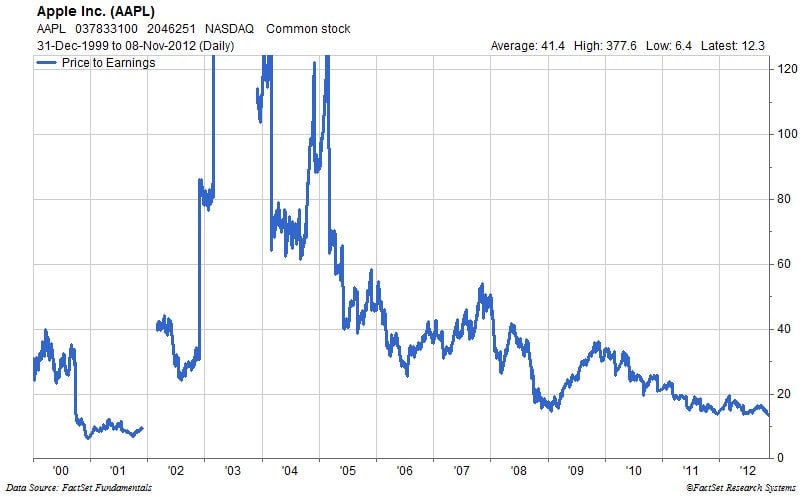

Apple is down 23% since it peaked back on Sept. 19 at $702.10. It closed yesterday at $558 a share. That might not sound cheap. But if you look at it compared to the profits the company has generated over the last 12 months, it is. The price-to-earnings ratio was 12.8, as of yesterday. It hasn’t been that low since October 2001, according to FactSet data. (Apple posted quarterly losses in 2001 and 2002, which is why there are weird-looking are breaks in the price-to-earnings data.)

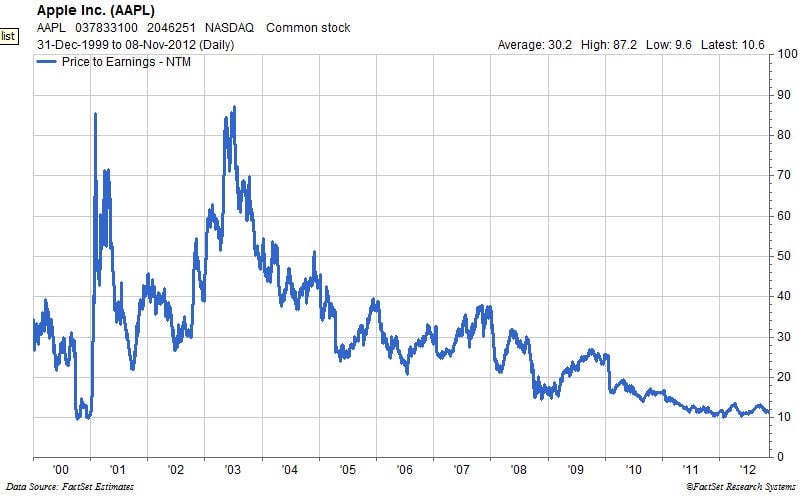

Now, it’s important to note that in the above chart we’re looking at the “trailing” price-to-earnings ratio. That is, it’s based on actual reported earnings over the last twelve months. Some people like to look at the ratio of stock price to earnings over the next twelve months, the so-called “forward P/E.” Apple looks pretty cheap on that chart too.

But the “earnings” that are used to calculate the forward P/E are, of course, not really earnings. They are the consensus estimates of future earnings, by the Wall Street analysts that are paid to track the Cupertino company. In other words, they’re extremely educated guesses. And recently, the collected Wall Street wisdom about Apple earnings has been that they are going to be lower than everybody was previously thinking. In other words, they think that the “E” in forward P/E will shrink, making the company’s shares a less worthwhile buy.

Those analysts might be right. But over the years, Apple has developed a reputation for consistently delivering profits that are better than Wall Street’s best and brightest had expected. So the question that potential (or actual) Apple investors have to ask themselves is whether, in the post-Steve Jobs era, Apple’s ability to surprise Wall Street is gone, or at least greatly diminished. In the long-term, Apple might face some serious challenges, as Christopher Mims recently argued. But in the short term, with the reception that the iPhone 5 got in September and the iPad’s ongoing strength, we wonder if Apple might yet have the ability to deliver jaw-dropping profits for a few more quarters.