The media’s lost decade, charted

Ten years. That’s how far away in the past the Google IPO lies. Ten years of explosive growth for the digital world, 10 gruesome years for legacy media. Here is the lost decade, revisited in charts and numbers.

Ten years. That’s how far away in the past the Google IPO lies. Ten years of explosive growth for the digital world, 10 gruesome years for legacy media. Here is the lost decade, revisited in charts and numbers.

The asymmetry is staggering

By every measure, the digital sphere grew explosively thanks to a combination of known factors: a massive influx of capital; the radical culture shift fostered by a “blank slate” approach; an obsessive agility in search of new prey; flattened hierarchies; a shrugged-off acceptance of failure; a renewed focus on the customer; a keen sense of competition; a heavy reliance to technology…

By showing neither appetite nor will to check these boxes, the newspaper and magazine industry missed almost every possible train. In due fairness, some were impossible to catch. But legacy media stubbornly refused to overhaul their culture. They remained stuck in feudal hierarchies, and invested way too late in tech. And, perhaps their cardinal sin, they kept treating failure as an abomination instead of an essential component of the innovation process.

The consequences have been terrible. Today, an entire industry stands on the verge of extinction.

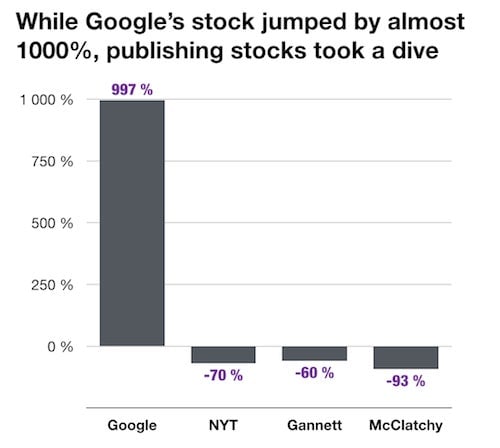

Let’s start with stock performance:

At the Friday, Aug. 29 closing prices, Google was worth $390 billion, the New York Times Company $1.85 billion, Gannett $7.62 billion (82 dailies and 480 non-dailies, TV stations, digital media properties, etc.) and McClatchy $392 million (multiples dailies, digital services…).

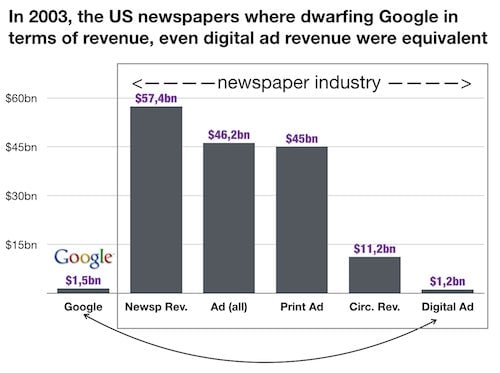

In 2003, Google was minuscule compared to the newspaper industry:

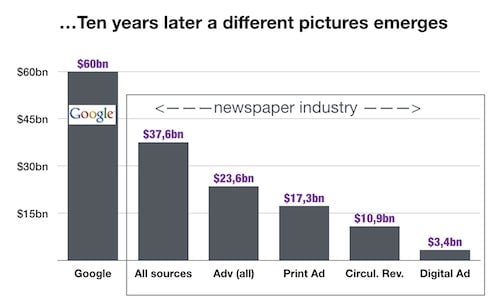

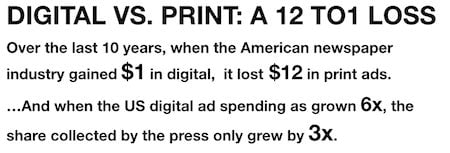

Between 2003 and 2013, Google’s revenue grew by 60x. In the meantime, according to Newspapers Association of America data, the total revenue of the US newspaper industry shrank by 34%. While sales (newsstand and subscriptions) remain steady at $11 billion in current dollars, print advertising revenue plunged by 61%.

For the newspaper industry, the share of digital advertising, despite growing by 180%, remained way too small: it only grew from 2.6% to 14.5% and was therefore unable to offset the loss in print ads.

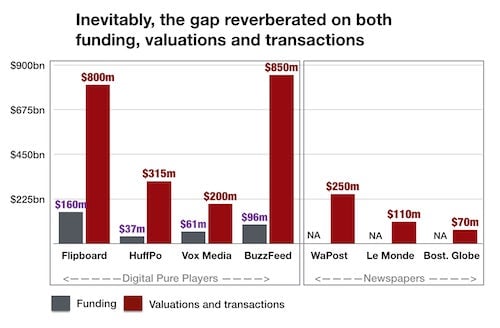

The split in valuation and revenue inevitably reflected on investors perception in terms of funding :

In the chart above, Flipboard’s huge funding (and an undisclosed but tiny ad revenue), was used mostly to grab market share and eliminate competition. Flipboard did both, swallowing Zite (a far better product, in my view) for a reported $60 million, i.e. $9 per user (the seller, CNN, achieved a good upside, while, regrettably, it had been unable to build upon Zite). The Huffington Post was acquired by AOL for $315 million in 2011, an amount seen as ridiculous at the time, but consistent with today’s valuation of similar properties. In the newspaper segment, The Washington Post was acquired last year by Jeff Bezos for $250 million; Le Monde was acquired by a triumvirate of investors led by telecom magnate Xavier Niel for $110 million in 2010; and the Boston Globe was sold by The NYT for $70 million when the Times purchased it for… $1.1 billion in 1993.

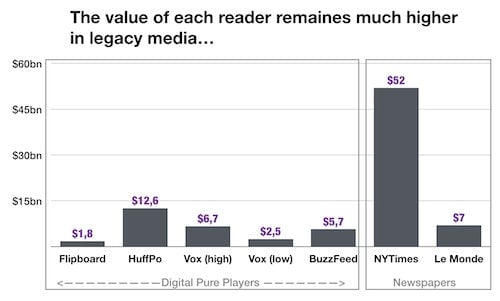

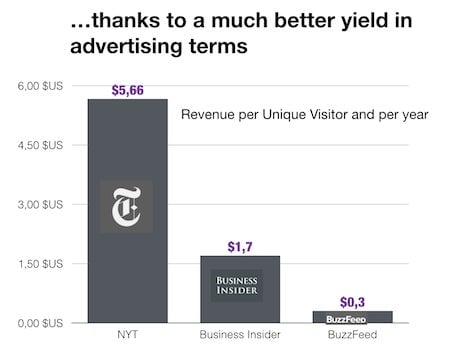

For the newspaper industry, the only consolation is the reader’s residual value when compared to high-audience but low-yield digital-pure players:

In the chart above, Vox Media’s reader value differs widely: Google Analytics grants it 80 million unique visitors per month; Quantcast says 65 million; and ComScore sees 30 million—such discrepancies are frequent, a part of the internet’s charm. As for Le Monde, thanks to the restoration of its P&L (even if its finances seem a little too good to be true), it’s fair to say its readers’ value could be much more than €7, a number based on the 2010 price tag and a combined audience of 14.9 million viewers. These numbers include duplicated audiences of 8.8 million in print, 7.9 million for the fixed web and 3.2 million on mobile (source Audipresse One Global, July 2014).

The reader value gap between digital players and legacy platforms also raises the question of investment attractiveness. Why does VC money only flock to new, but low-yield digital media?

This is a matter of future discussion.

You can read more of Monday Note’s coverage of technology and media here.