This week the markets were clearly focused on one Italian technocrat

Until this week, the European Central Bank’s Mario Draghi had managed to snuff out the European debt crisis mainly with his now-famous vow to do “whatever it takes” to preserve the currency union. Sure, he cut rates and announced programs aimed at boosting bank lending, but he’s been pulling far fewer monetary policy levers than his US counterparts, for example.

Until this week, the European Central Bank’s Mario Draghi had managed to snuff out the European debt crisis mainly with his now-famous vow to do “whatever it takes” to preserve the currency union. Sure, he cut rates and announced programs aimed at boosting bank lending, but he’s been pulling far fewer monetary policy levers than his US counterparts, for example.

So, the markets weren’t expecting much new from Draghi this week at the ECB’s most recently policy decision. But they should have been. Facing evidence that the monetary union was increasingly at risk of slipping into a deflationary vortex, the ECB announced a raft of measures. They cut their key policy rate about as much as they could, given the fact that it’s already near zero. And they announced plans for a bond-buying program similar, in some respects, to the one used by the Federal Reserve in recent years. (The ECB will focus, however, on asset-backed securities, in the hopes of prompting European banks to do more lending.)

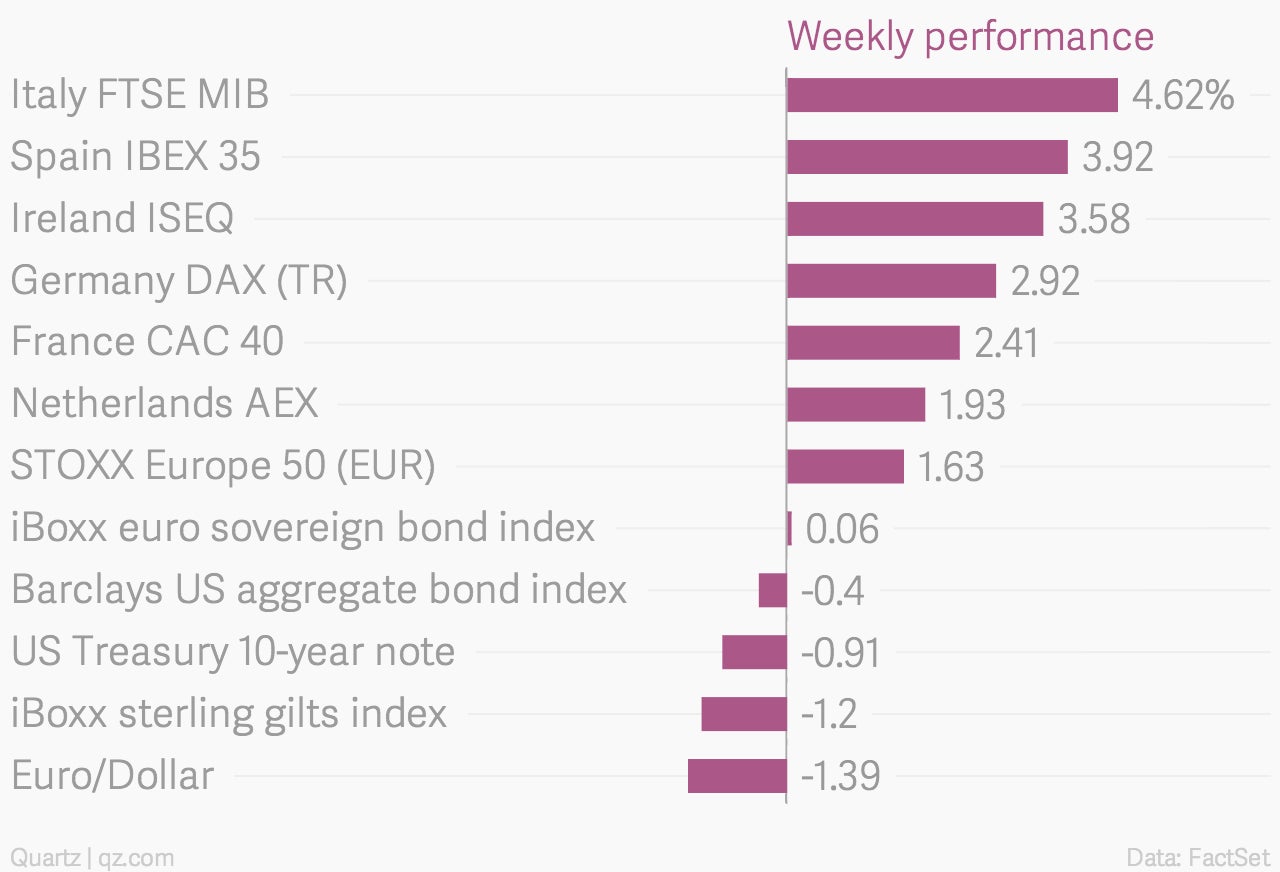

The plans essentially amount to a giant buyer with literally bottomless pockets—after all, the ECB handily creates the very money it intends to spend—showing up to the markets. And the markets responded in the way you might imagine (data for the bond indexes listed here reflect Thursday’s close):

Both stocks and bonds rose, initially. And the euro weakened sharply. But for the week, the super-safe bond markets actually ended down slightly, as investors shifted to stocks. That would be consistent with what we’ve seen in the US, where expectations for central bank bond-buying programs were front-run by markets, with the actual announcement acting as a “sell-on-the-news” event.