Here’s how ridiculously big the Alibaba IPO is

There have been no IPOs this year, and few ever that can match Alibaba’s. The e-commerce giant is a mashup of some of Silicon Valley’s best ideas transported to China, its founder is a quirky English teacher turned multi-billionaire, and the cash generated will be essential to the ongoing saga of Marissa Mayer and Yahoo.

There have been no IPOs this year, and few ever that can match Alibaba’s. The e-commerce giant is a mashup of some of Silicon Valley’s best ideas transported to China, its founder is a quirky English teacher turned multi-billionaire, and the cash generated will be essential to the ongoing saga of Marissa Mayer and Yahoo.

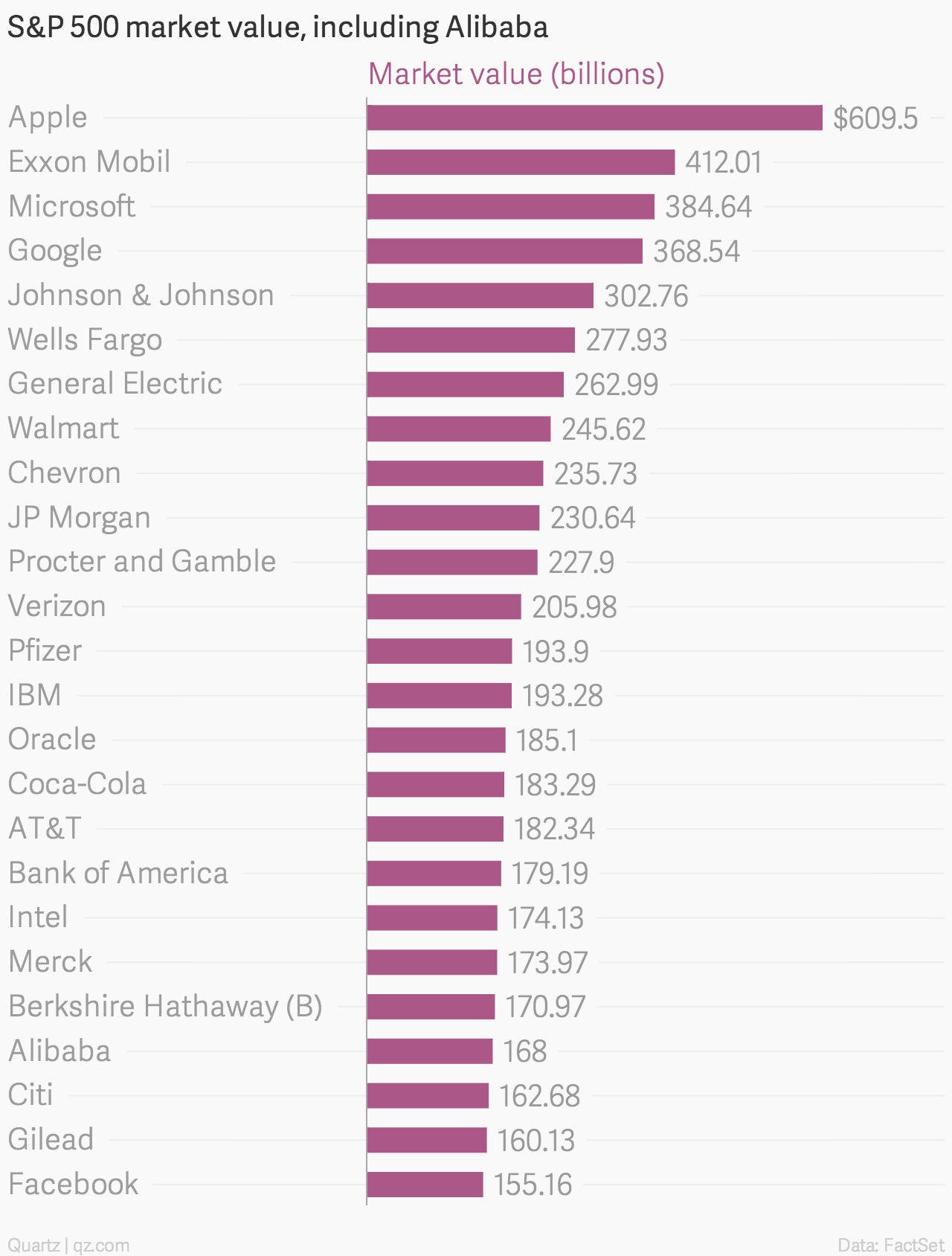

There are spectacular amounts of money involved. At its offering price of $68, and based on yesterday’s closing prices, the company’s market value would the 22nd biggest in the S&P 500 if included, ahead of Citigroup.

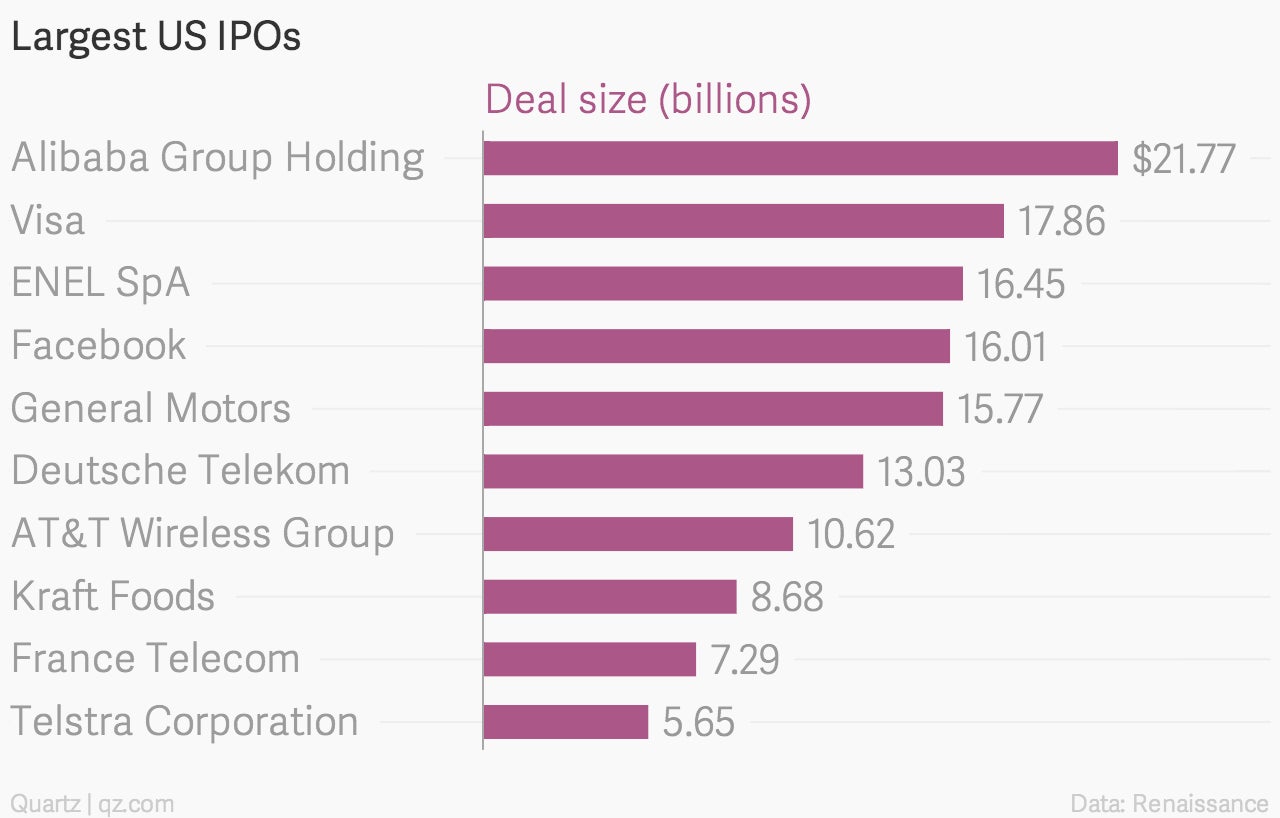

The company’s underwriters are likely to exercise the greenshoe option, which could boost the deal value above $25 billion and make it the biggest of all time.

Alibaba could easily pass Bank of America, Intel, Oracle, and Coca-Cola in market value by the end of the day:

There have only ever been two bigger IPOs worldwide:

It’s set to be the biggest US IPO of all time by a significant margin:

And it positively dwarfs the remaining IPOs expected this year, even at its initial expected deal size of $20 billion: