Goldman Sachs just axed its growth outlook for China

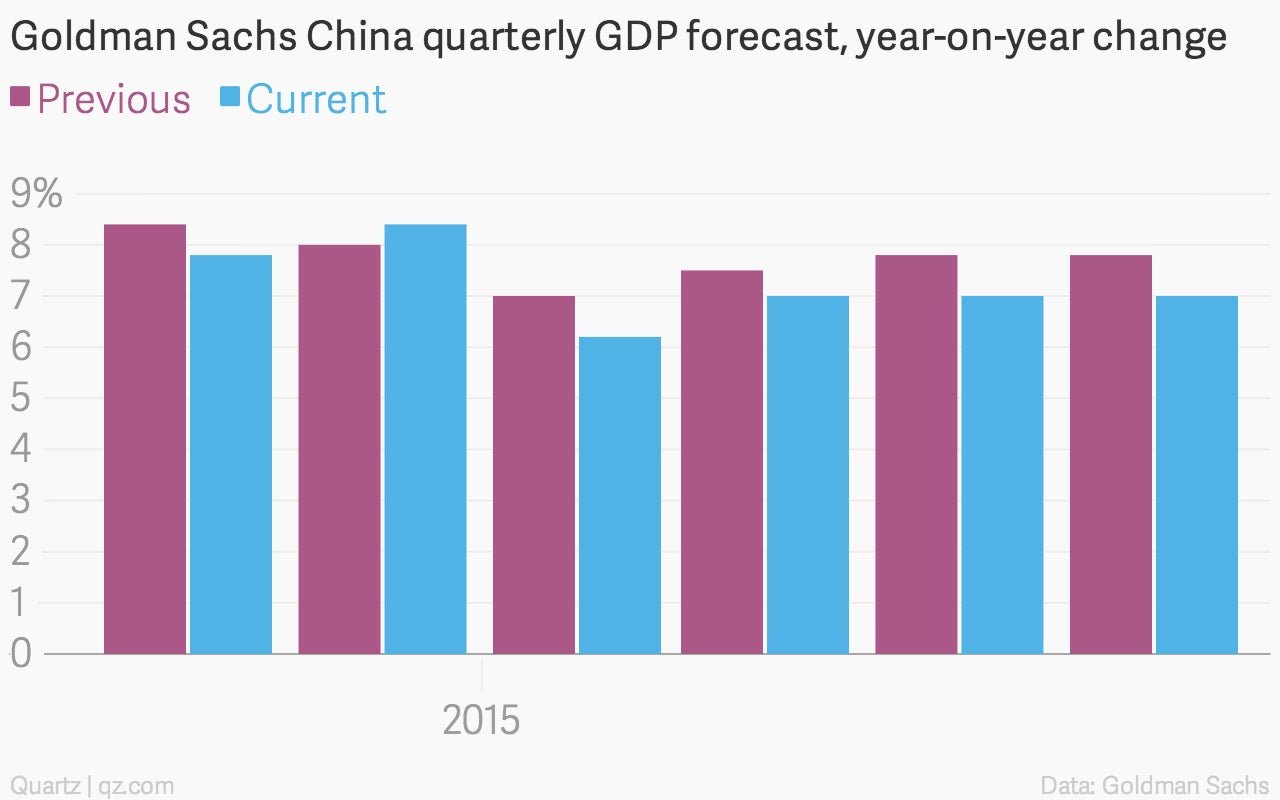

We’ve been telling you the data look weak. Economic analysts at Goldman Sachs agree. This morning they chopped their growth outlook for the Chinese economy between 2015 and 2017. Instead of GDP growth of 7.6% in 2015, Goldman economists now see growth of 7.1%, falling to 6.7% by 2017. Goldman kept its 2014 target of 7.3% GDP growth intact.

We’ve been telling you the data look weak. Economic analysts at Goldman Sachs agree. This morning they chopped their growth outlook for the Chinese economy between 2015 and 2017. Instead of GDP growth of 7.6% in 2015, Goldman economists now see growth of 7.1%, falling to 6.7% by 2017. Goldman kept its 2014 target of 7.3% GDP growth intact.

Over the long term, Goldman’s more downbeat view on Chinese growth is premised on slower labor force and demographic growth—the aftershock of China’s remarkable birthrate decline due to the one-child policy—as well as slower rates of productivity growth related to the fact that China has already closed a lot of the productivity gap with more developed countries.

Analysts also suggest recent rates of growth might have been a bit too high, having been super-charged by excessive debt. “The Chinese economy might be running slightly above its potential level at present. This reflects the idea that the current pace of debt accumulation is unlikely to be sustainable in the long term,” Goldman analysts wrote.