Why do some CEOs want higher taxes on the wealthy? Lower taxes on their companies

The CEOs of a dozen prominent multinationals—PepsiCo, Walmart, General Electric, and IBM, among others—will arrive at the White House today to discuss the pressing need to avoid America’s upcoming austerity trigger, part of the media pageant that is legislative dealmaking in Washington.

The CEOs of a dozen prominent multinationals—PepsiCo, Walmart, General Electric, and IBM, among others—will arrive at the White House today to discuss the pressing need to avoid America’s upcoming austerity trigger, part of the media pageant that is legislative dealmaking in Washington.

The meeting follows yesterday’s presidential confab with leaders of trade unions and independent liberal groups, with participants spilling out the doors to reassure the president’s base (and warn his Republican interlocutors): Barack Obama will stand firm on his campaign promise to block the extension of the Bush administration’s tax cuts for the wealthiest Americans.

This meeting with business leaders will seek to emphasize a different message: The fiscal cliff is a real threat to the economy—and, more subtly, that a deal should be made on the balanced terms offered by Obama, including his desire to raise more tax revenue.

But these companies—and the coalitions they support financially, like the Chamber of Commerce and the Business Roundtable—have lobbied vociferously for lower taxes. Michael Duke of Wal-Mart has contributed to many Republican political campaigns, and under CEO Mark Bertolini, insurer Aetna gave millions to conservative interest groups in Washington. What are they doing lending their blue chip auras to the tax-the-rich president?

While you shouldn’t underestimate the desire of business leaders to avoid the recession entailed by the fiscal cliff and see some medium-term certainty in budget policy, there’s also (always) a quid pro quo at work. All twelve companies have voiced support for cutting the US corporate tax and switching it from a levy that applies around the world to a more global-business-friendly territorial plan.

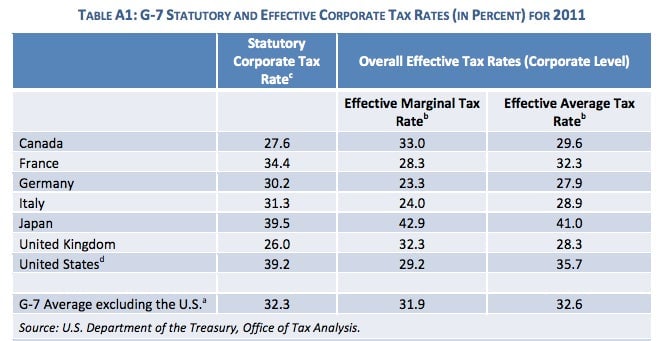

To avoid US corporate taxes, multinationals keep billions of dollars in foreign income shuffling from country to country, prompting annual hand-wringing when news reports reveal that profitable companies like Google or GE pay little or no tax. This costs the Treasury revenue, but it also costs the American economy when money that could be invested here is invested or simply stored abroad. US companies complain most about America’s statutory tax rate, which is higher than rates elsewhere, though it becomes more competitive when you take loopholes into account and consider effective rates:

During the Obama administration’s 2011 campaign to woo business, there was much discussion of cutting the corporate tax rate, culminating in a revenue-neutral proposal that offered few thrills but at least put the White House on the record supporting lower rates. If tax reform becomes part of a fiscal deal—a likely scenario—they’ll want to remind the president of how they offered a symbolic show of concern. Indeed, four of the twelve executives at the White House (the heads of Aetna, Honeywell, GE, Dow) have explicitly endorsed this bargain by adding their names to the “Fix the Debt” lobbying campaign, which is based on a bipartisan fiscal plan that raises income tax revenue while moving the corporate system to business’s preferred territorial approach.

Of course all of this kabuki is merely stage dressing for Friday’s big event: the first post-election gathering of Congressional leadership with the president. What Republicans say about Obama’s mini-campaign—and his reported opening bid—will determine whether Obama’s support from the electorate and these executives will have relevance at the negotiating table.