Greece has a depression worse than Weimar Germany’s—and malaria too

Sometimes, among the people who write about world economics and markets, there’s an annoying joviality when it comes to talking about the problems with Greece’s economy. (“Oh, those lazy Greeks are really getting in trouble now!”)

Sometimes, among the people who write about world economics and markets, there’s an annoying joviality when it comes to talking about the problems with Greece’s economy. (“Oh, those lazy Greeks are really getting in trouble now!”)

You can point to a lot Greece has done wrong, such as lying with statistics to get into the euro zone in the first place. Oh, and the widespread tax evasion that seems to have pervaded the country for decades. And yeah, the ridiculously cushy public jobs with lavish pensions. Fine.

But even with all that, there’s no excuse for deriving any kind of glee from the very real difficulties Greeks are facing. The latest report on the return of malaria to the republic shows the shocking decline in recent years.

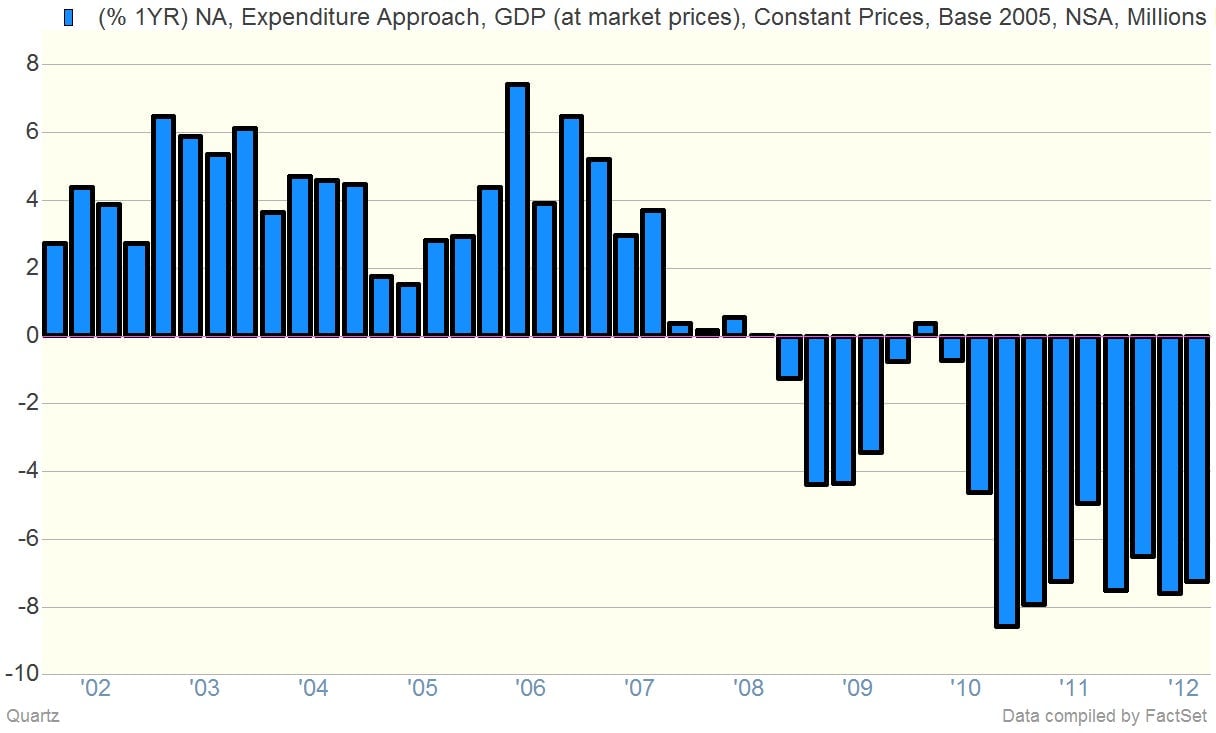

Today the latest numbers on Greek economic output—GDP was about €215 billion in 2011—showed the economy collapsing by 7.2% during the third quarter. Here’s a look at the trend in GDP growth in recent years, which can safely be called an absolute disaster.

The Greek economy is now dying. The powers that be at the EU and IMF don’t seem to get it. They’re projecting that Greece will contract by about 4%-5% through 2012-13. Meanwhile, analysts at Standard & Poor’s expect the Greek economy to collapse by 10%-11% over that period. By S&P’s reckoning that means the Greek economy is likely to to be 21% smaller by the end of 2013, in terms of volumes, than it was in 2007. That’s what five years of outright economic depression does.

By the way, a collapse in economic growth on this order accomplishes very little when it comes to paying back debts. The more the Greek economy declines, the more it has to borrow and the less it has in terms of tax revenues to pay back. That’s why the powers-that-be in the eurozone will likely extend Greece’s payback terms, yet again.

And how will they do that? By loading up Greece with even more debt. This. Is. Madness. And it remains to be seen how much the Greek people are going to be willing to stomach. General strikes are currently under way there and in other troubled countries. S&P analysts are not usually the sort to bring up the prospect for revolution in their research notes. But in their last report on the Hellenic Republic in August, they did just happen to bring up the possibility, albeit obliquely and very much in passing:

The Greek depression has already surpassed and outlasted those of Argentina (1998-2002), Indonesia (1997-1998), and even Germany’s pre-WW2 economic crisis (1929-1932) which contributed to the fall of the Weimar Republic. Only the Great Depression in the U.S. and Russia’s 1989-1998 output collapse saw a steeper and more-protracted loss of national income. As in Russia’s case, the severity of the economic shock has tested Greece’s political and social institutions–in some cases to breaking point.