Russia’s currency is collapsing—and Putin won’t do anything to stop it

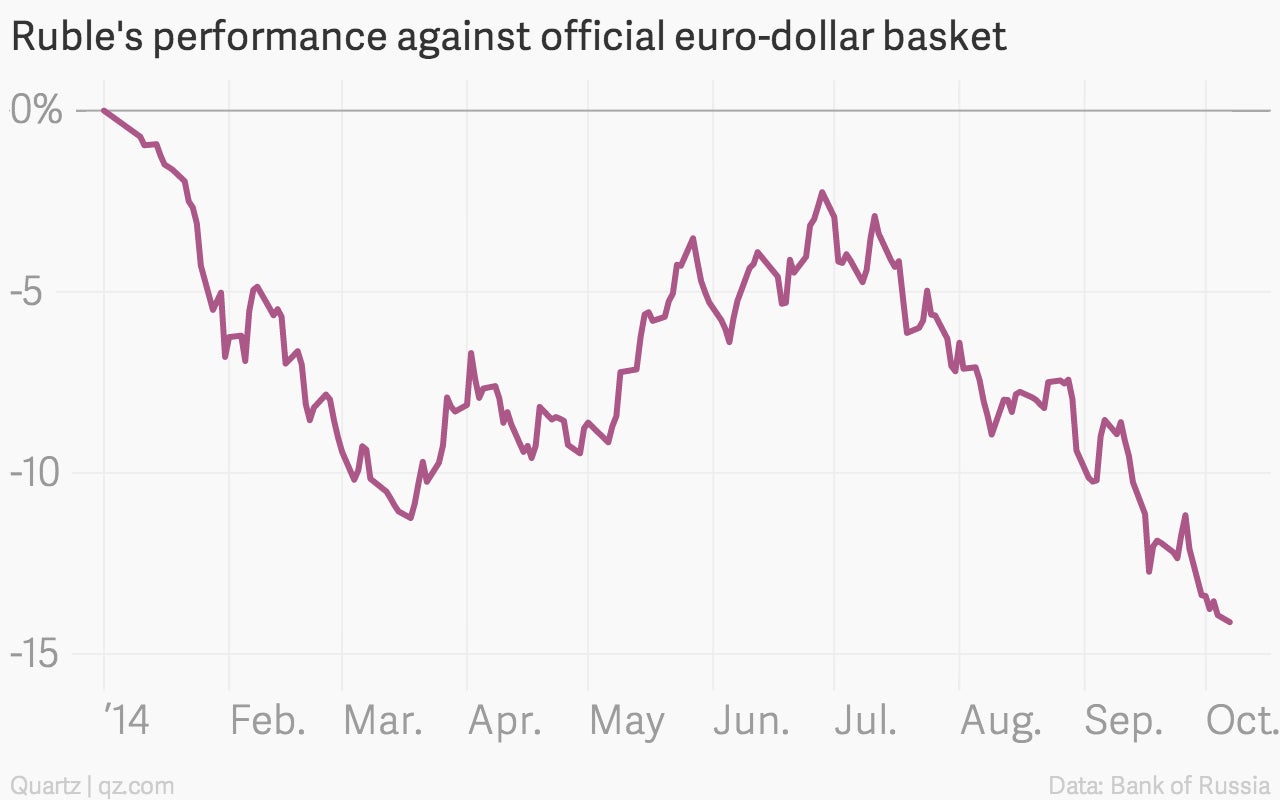

The Russian ruble has set a series of records recently, plumbing new depths against other major currencies almost every day:

The Russian ruble has set a series of records recently, plumbing new depths against other major currencies almost every day:

The ruble’s inexorable decline has made it “one of the world’s top basket-case currencies,” alongside the Ukrainian hryvnia and Argentine peso, according to analysts at Daiwa. The combination of Western sanctions, stagflation, and falling oil prices is battering the Russian economy and scaring away investors.

And most forecasters think it has further to fall.

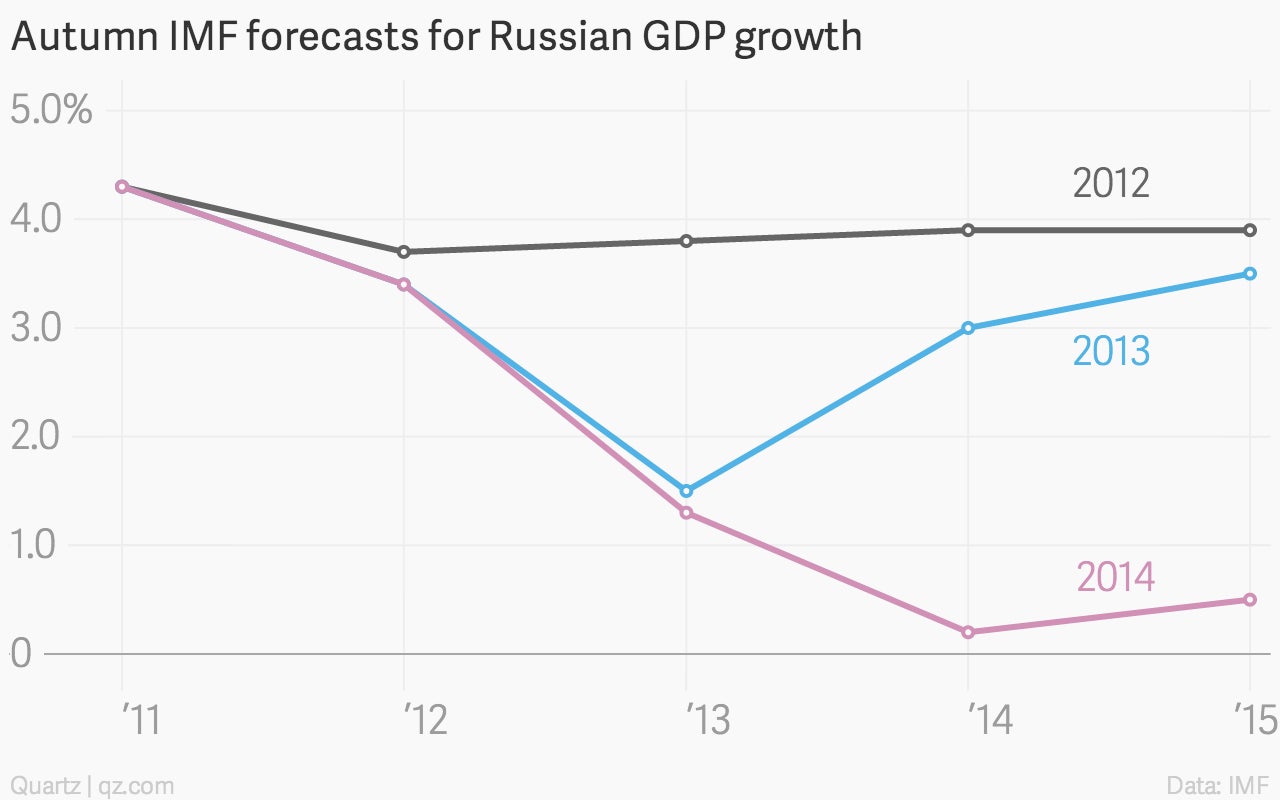

The IMF’s latest economic outlook, published today, shows how far, and how fast, the forecast for Russia has deteriorated. At this time last year, the IMF thought that Russian GDP would expand by 3%; today, it’s on pace for little-to-no growth:

Given the country’s travails, locals and foreigners are expected to pull some $100 billion out of Russia this year, which is one of the factors pushing down the value of the ruble. The latest spate of selling was triggered by reports that the country could introduce capital controls to stem the flight of funds, which the central bank quickly denied.

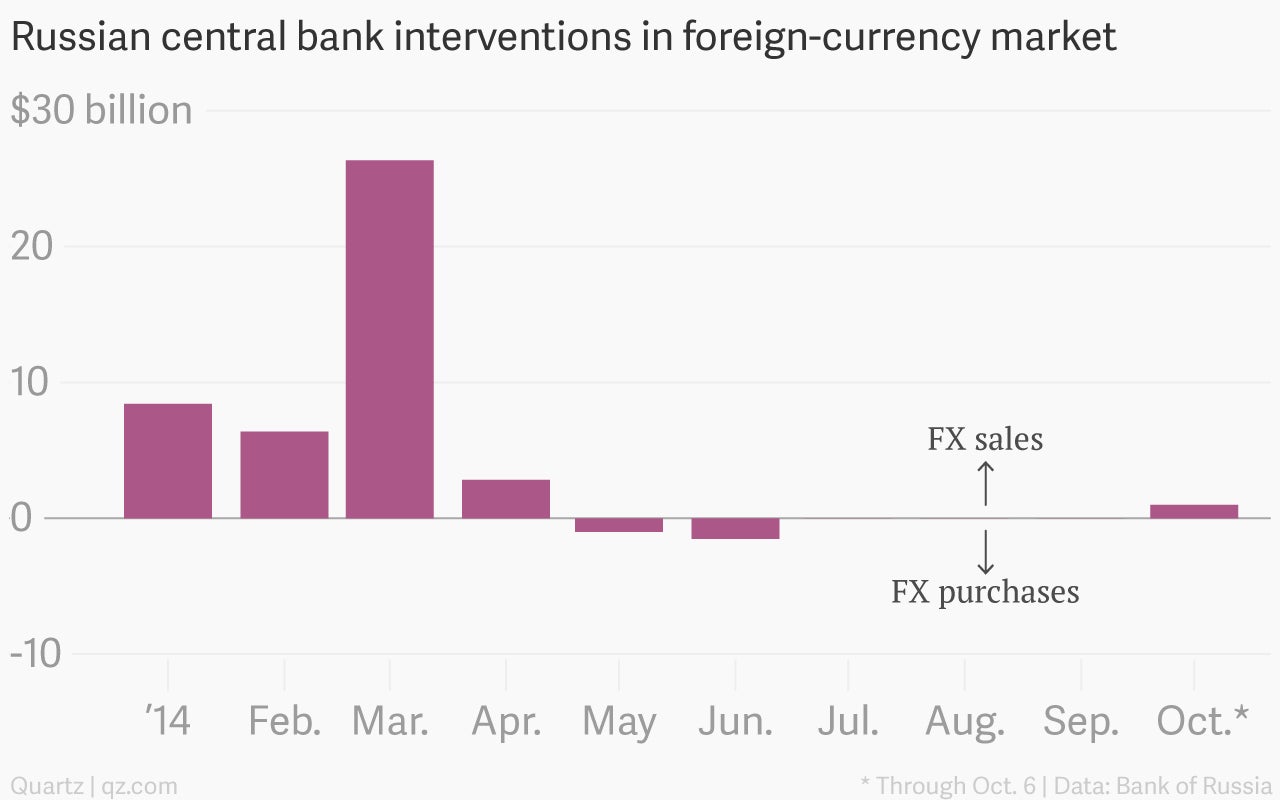

But when the ruble reaches the edge of an official trading band against the dollar and euro, as it has on several recent occasions, it triggers automatic purchases or sales from central bank reserves to stabilize the currency. Some $980 million in foreign currency has been sold so far this month to prop the value of the ruble, according to the latest numbers. Given the continued slide in the currency, the central bank has probably spent around $1.75 billion over the past few days (the data is released with a lag):

This is a far cry from the tens of billions of dollars worth of reserves that Russia spent to defend the ruble earlier this year, around the time of the annexation of Crimea. And with more than $400 billion in reserves, these sorts of sales won’t put that big a dent into Russia’s financial buffers any time soon.

What’s more, Russia won’t go out of its way to support the ruble like it did in the past, as it sticks with a plan to let the currency float freely from next year. (They sure picked a hell of a time to do it.)

The authorities are exploring other ways of providing foreign-currency funding for hard-up local banks shut out of Western capital markets. And although the government recently released a rather defiant budget that rests on some pretty bullish assumptions, it has a contingency plan to bolster its coffers if (or when) the capital flight continues. Investment deals signed with friendlier regimes, like China, will also lend some support.

Still, in the short term, things will probably get worse before they get better. Russian central bank chief Elvira Nabiullina seems committed to introducing a more orthodox monetary policy, steering the economy via interest rates and an inflation target instead of fixating on currency values. With inflation now running at twice the bank’s 4% long-term target, this means more rate hikes are on the horizon, which will put a damper on already moribund economic growth.

Previous rate hikes didn’t stem the ruble’s decline, and future ones might not either, given all of the headwinds Russia faces. What comes with a free-falling currency—inflation, capital flight, and other ills—may eventually force Russian officials to reverse course (and replace Nabiullina), Daiwa’s analysts argue. “Almost anything is possible,” they write. “Russia’s never been boring. And it’s never been predictable. Or risk-free.”