All that frantic deal-making in the tech sector seems to have finally slowed down

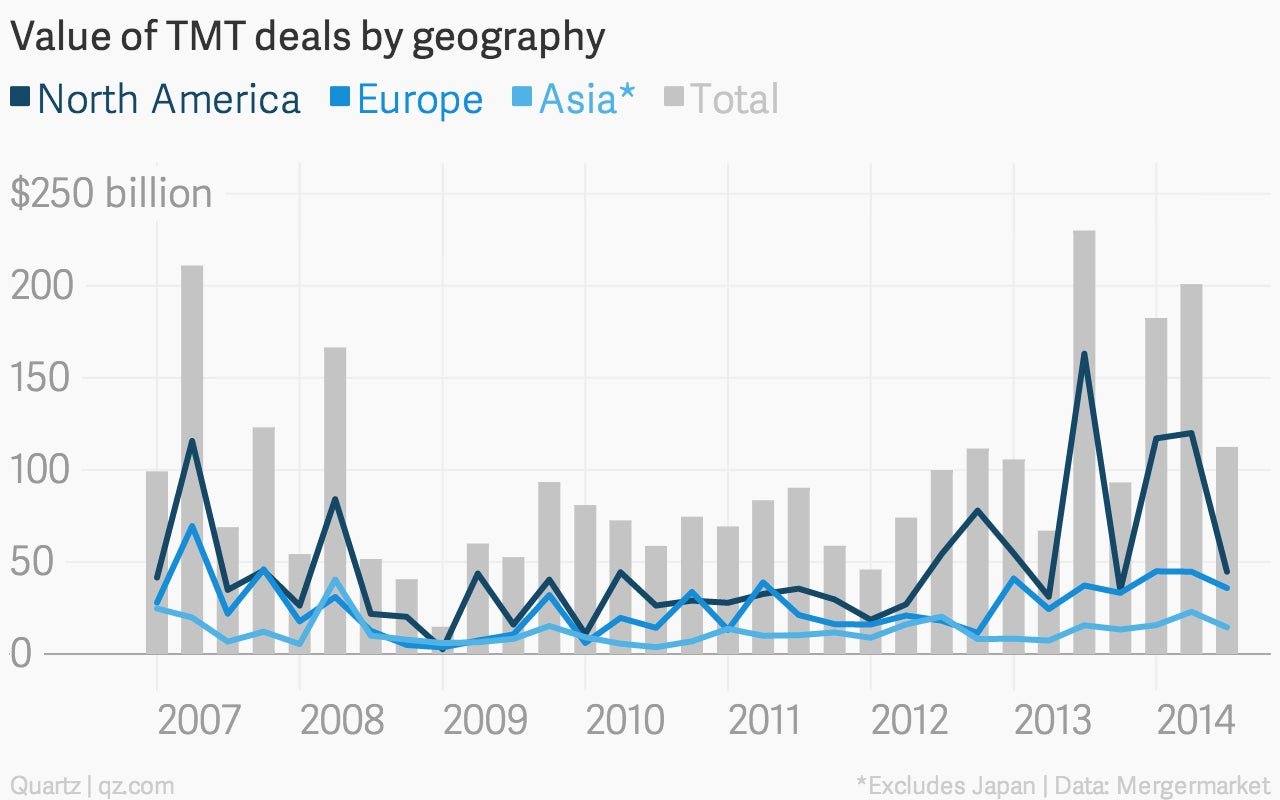

After a breathless first half of the year for acquisitions, the technology-media-telecommunications (TMT) sector is finally taking a rest. There were 579 deals in the third quarter, 100 fewer than the previous three months, and about par with the same time last year, according to Mergermarket, a research group.

After a breathless first half of the year for acquisitions, the technology-media-telecommunications (TMT) sector is finally taking a rest. There were 579 deals in the third quarter, 100 fewer than the previous three months, and about par with the same time last year, according to Mergermarket, a research group.

The sharpest decline can be seen in the technology sector.

More striking is the sharp fall in the value of the deals. TMT mergers and acquisitions were worth some $112.5 billion this quarter, down from $200 billion in Q2 and $230 billion last year. Technology companies are still splashing out; it is telcos that fluctuate.

To be specific: American telcos.

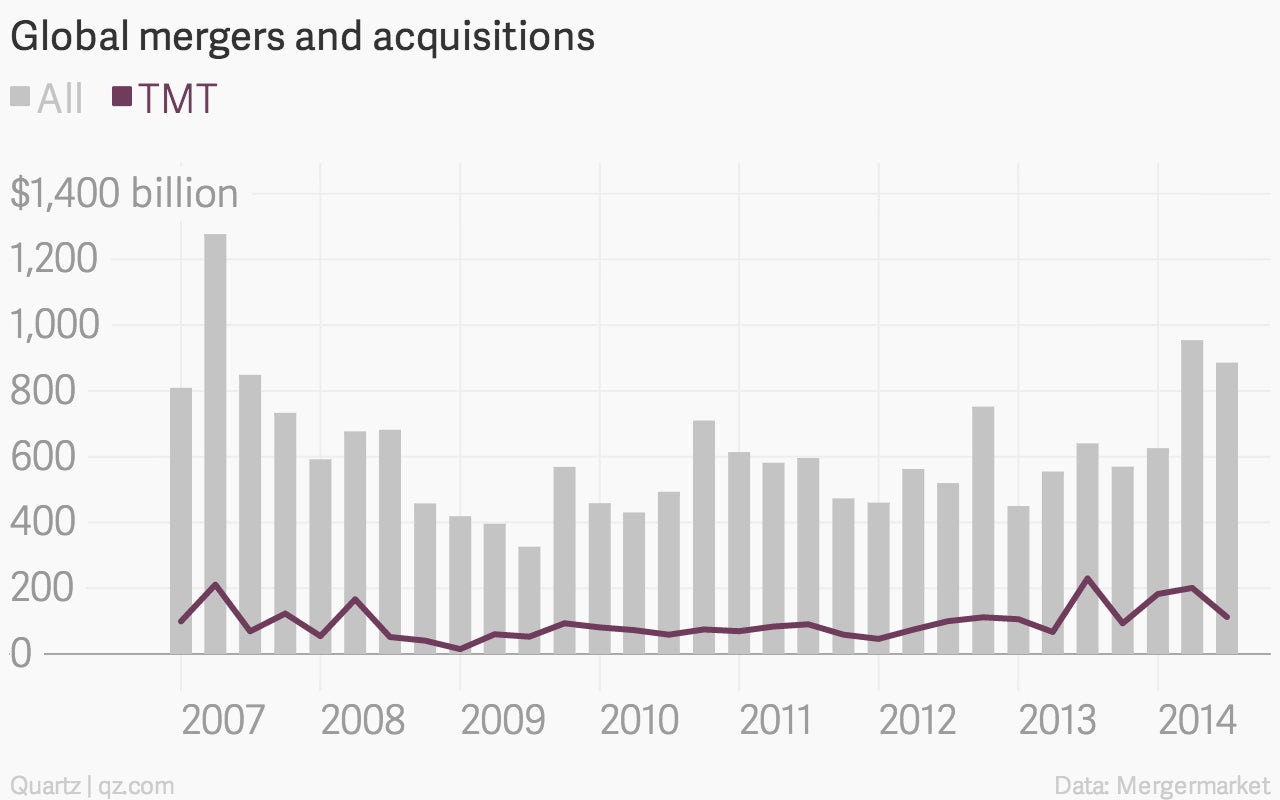

The upshot: the value of deals in the TMT sector accounted for a little under 13% of all deals across the world, down from a peak of nearly 36% this time last year.