Here’s who shareholders think can run Berkshire after Buffett

Warren Buffett is so closely identified with both the financial and philosophical design of Berkshire Hathaway, the conglomerate he has painstakingly constructed since the 1960s, that some wonder whether anyone else could actually run it when the 84-year-old Buffett is no longer in charge.

Warren Buffett is so closely identified with both the financial and philosophical design of Berkshire Hathaway, the conglomerate he has painstakingly constructed since the 1960s, that some wonder whether anyone else could actually run it when the 84-year-old Buffett is no longer in charge.

Certainly Buffett’s approach to managing a sprawling entity—one that sells everything from prefabricated homes to candy to underpants to incredibly complex reinsurance products—is less well understood than his legendary approach to investing. But his strategy as a holding company CEO, which essentially involves buying companies with enduring competitive advantages (“moats,” as Buffett likes to call them) and strong management—and then largely leaving them alone to operate with considerable autonomy—has created a deep bench of talent that Berkshire can draw on in the post-Buffett era. So argues George Washington University professor Lawrence Cunningham, who has closely studied and extensively written about Buffett for the past two decades.

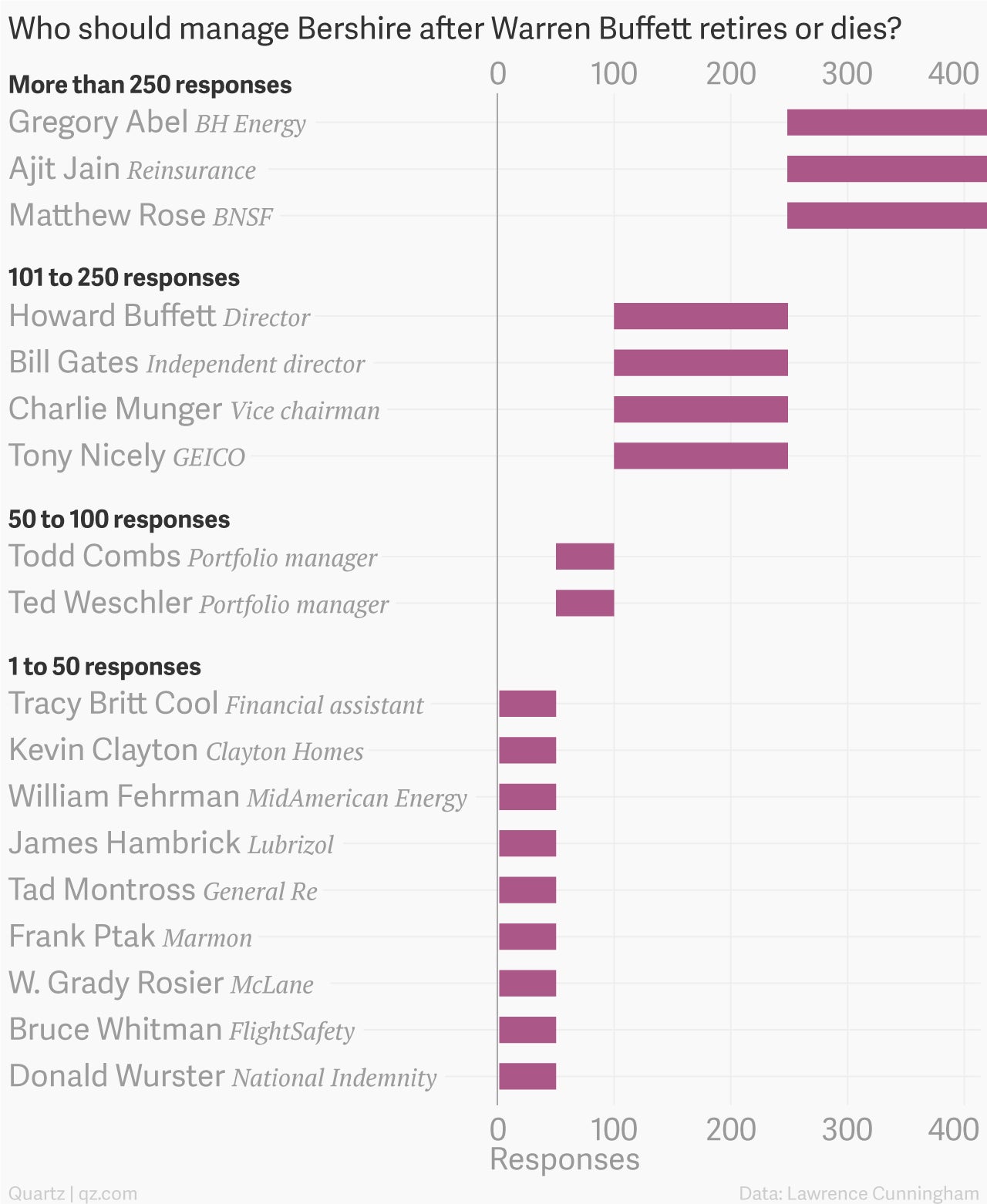

Cunningham surveyed more than 400 Berkshire Hathaway shareholders as part of the research for his new book, Berkshire Beyond Buffett: The Enduring Value of Values. One of the questions he asked: “After Buffett’s retirement or passing, who among current Berkshire executives would you say should be in the senior management group?” Respondents were asked to provide three names. Cunningham shared the results with us, grouped according to the range of mentions each person received. (Cunningham, a Berkshire stockholder himself, emphasizes that there is no out-and-out frontrunner.) Here’s what Berkshire’s investors said.

None of this is to say that the markets will placidly accept Buffett’s departure from the stage—which isn’t imminent by the way. Some have argued that Berkshire Hathaway shareholders have long benefitted from the so-called Buffett premium, essentially an extra layer of valuation owing to Buffett’s reputation as a brilliant investor. So it’s probably pretty likely that shares would at least wobble a bit without Buffett at the helm.

But Buffett has long counseled investors to ignore the day-to-day mood swings of the market and concentrate on the underlying earnings power of companies. Cunningham argues that Berkshire has the people it needs to keep its subsidiary companies running smoothly.

“It would be a big job,” Cunningham tells Quartz. “But there’s a lot of people who could do it.”