Ryanair is back on track, and in the mood for a price war

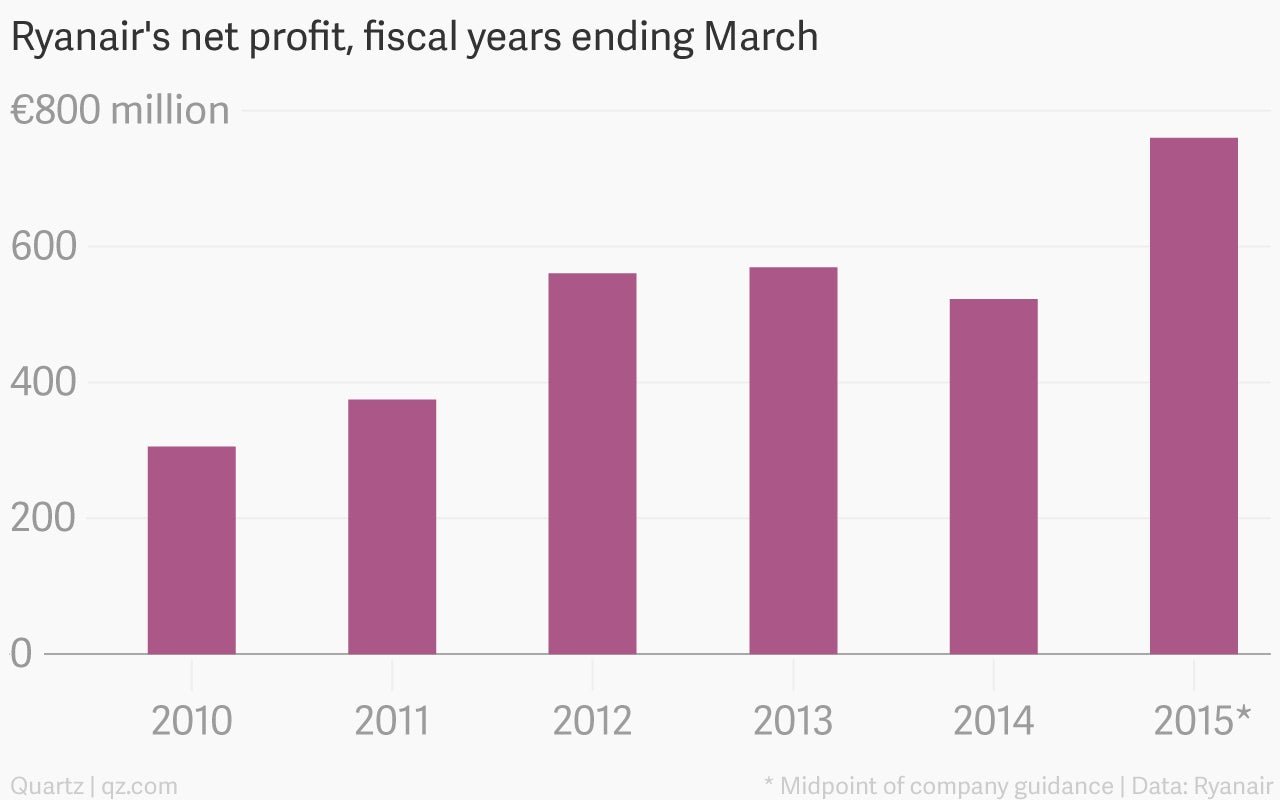

The numbers: Lofty. Ryanair reported a 32% rise in its fiscal first-half profit, and boosted its full-year guidance by some €100 million ($125 million)—it now expects to make €750-770 million in the year to March.

The numbers: Lofty. Ryanair reported a 32% rise in its fiscal first-half profit, and boosted its full-year guidance by some €100 million ($125 million)—it now expects to make €750-770 million in the year to March.

The hefty upgrade sent the budget carrier’s shares soaring by around 9%, and lifted airline stocks across Europe.

The takeaway: Ryanair has retooled its services since its profit dropped last fiscal year. It is now reaping the rewards of CEO Michael O’Leary’s charm offensive, “from mobile booking, online check-in, a smoother boarding process, and a friendlier on-board service.” Like rival low-cost carrier EasyJet, Ryanair is also winning short-haul market share from the likes of Lufthansa and Air France, which have been hit by worker strikes.

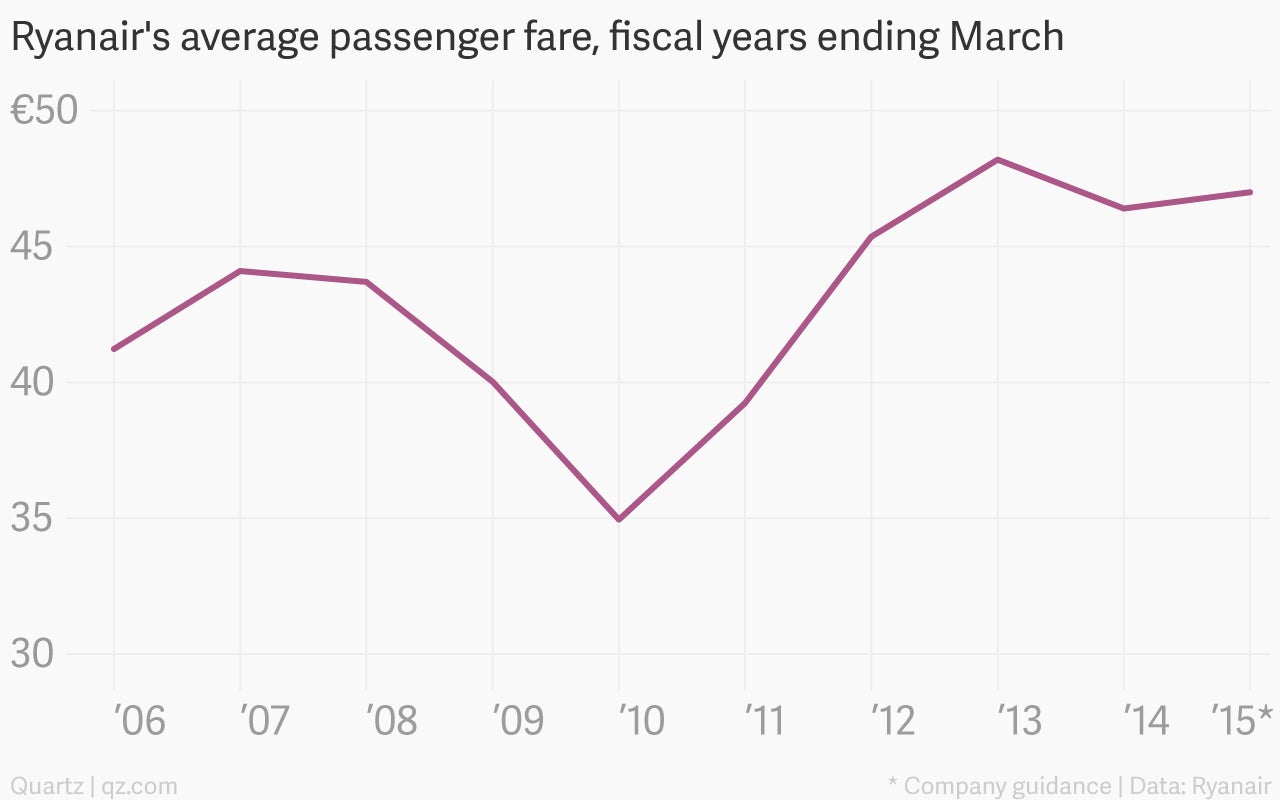

What’s interesting: Lower oil prices led Ryanair to forecast a 4% fall in its full-year unit costs. Europe’s largest carrier won’t just sit on these savings—instead, it will slash prices, targeting a 9% rise in passengers, to 89 million, this fiscal year.

The airline’s average fare was €54 in its fiscal first half (5% higher than the same period last year), but big discounts over the next six months will push its projected full-year average fare down to just €47. Although airline investors are cheering a sunnier outlook for the industry, the players who can’t keep up with relentless cost-cutting at a revitalized Ryanair are in for some significant turbulence.