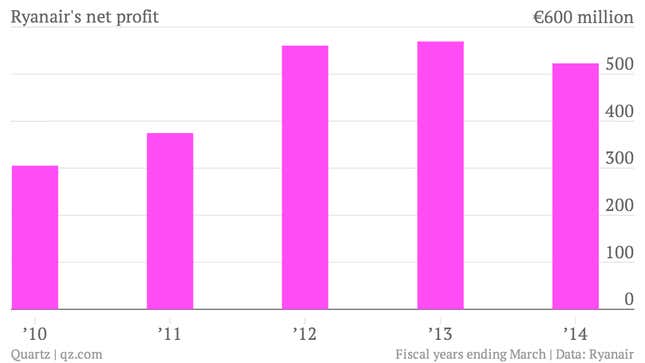

The numbers: Not great, at first glance. Low-cost airline Ryanair reported its first fall in profit for five years, as lower fares, currency movements, and fuel costs weighed on earnings in its latest fiscal year (ending in March).

The takeaway: Although chief executive Michael O’Leary called the results “disappointing,” traders saw method behind the company’s recent stumble, namely its leading role in a European short-haul price war. Thanks in part to a 4% fall in fares, the carrier’s traffic rose by 3%, to 81.7 million passengers, with forward summer bookings “significantly ahead” of last year. Ryanair’s share price is up by nearly 10% at the time of writing.

What’s interesting: The airline continues its charm offensive, highlighting the more user-friendly booking and boarding procedures it has introduced in recent months. And although it has cut many of the extra ticketing and baggage fees that angered travelers the most, its push to lure more passengers with lower headline fares has nonetheless boosted its “ancillary” revenue significantly. These fees and charges jumped by 17% in its latest fiscal year, accounting for 25% of overall sales. On a per-passenger basis, these fees have never been higher: