As profit warnings go, it was a pretty mild one. Ryanair, Europe’s largest budget airline, issued a statement that profits in its current fiscal year (ending in March) would fall near the bottom of its previous forecast range. Given that range, €570 million to €600 million ($753 million to $792 million), this implies that the carrier’s profit will be flat; it made €569 million in its previous fiscal year.

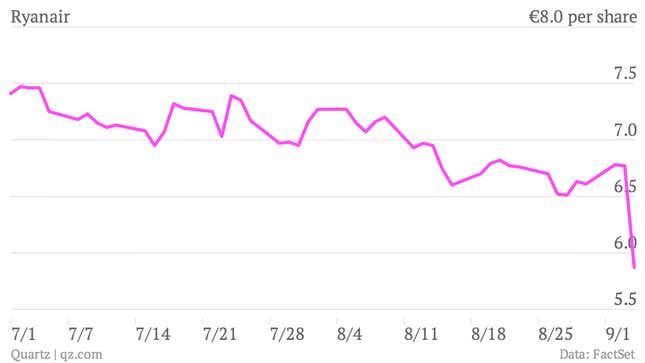

“We’re not talking about some kind of a collapse or catastrophe,” chief executive Michael O’Leary (pictured above) said on a conference call, “but it is weaker than we had expected it to be.” Investors were less sanguine, pushing Ryanair’s shares in Dublin down by more than 13%. In fact, airlines across Europe took a hit.

Ryanair carries more passengers per year than any other in Europe, so anything it says about business conditions warrants attention. In its case, unfavorable exchange rates and unseasonably warm weather in northern Europe cut into its summer trade. The pricier last-minute fares that rain-soaked Brits book to Spain when they can no longer take the weather didn’t materialize this year.

In response to a disappointing July and signs of weakness in forward bookings for the fall, O’Leary will respond in typically brash style, with what the company statement described as “a range of lower fares and aggressive seat sales.” Ryanair will also cut some of its capacity later this year, aiming for an annual traffic target of 81 million passengers, 500,000 less than previous guidance. O’Leary described the strategy to fills these seats as, “to hell with the yields, let’s maintain the load factors, let’s maximize the ancillary revenues and let’s continue to push on aggressively.” Ancillary revenue, of course, is the euphemism for a welter of fees, levies and egregiously expensive food on Ryanair flights.

Full-service carriers, and even most other low-cost carriers, are often openly dismissive of Ryanair, which operates on a brazenly bare-bones business model that is fanatical in its focus. But however much they scoff in public, they cannot afford to ignore the warning that Ryanair expressed. For his part, O’Leary is certain that the skies over Europe are about to get a lot choppier:

I have no doubt that the market is going to be weaker generally than the industry is expecting over the next couple of months, and we’re going to respond to that by being out there first and being aggressive with the pricing and the fare response. Would that have an impact on the market generally? You bloody bet it will.