Europe faces a huge industrial problem as the internet expands

A recent Bain & Co survey paints Europe’s digital future as squeezed between the explosive demand of emerging countries and the dominance of US-based internet giants.

A recent Bain & Co survey paints Europe’s digital future as squeezed between the explosive demand of emerging countries and the dominance of US-based internet giants.

“The Next Billion,” a phrase coined and propagated by the Quartz team, refers to the explosive internet growth in emerging countries—almost entirely fueled by mobile usage. The new phrase got its own conference (last week in NYC, next May 19th in London) and a dedicated section on the Quartz site.

For Europe, the Next Billion will be hard: Last week, the global consulting firm Bain & Co published a survey that exposes what’s at stake. The report, titled Generation #hashtag (pdf here), was commissioned by The Forum d’Avignon, a yearly gathering of intellectuals and business people that explores cultural changes; the survey was conducted by Bain’s staff in Paris and Los Angeles and had over 7,000 respondents in 10 countries with the following internet status:

Source : Internet World Stats

Here are Bain’s key findings:

The next period is going to be dominated by digital natives, i.e. audiences that won’t have even known other forms of media (video, communication, news or entertainment.) In emerging countries, powerful forces are now in motion (emphasis mine):

Across the BRICS countries, the percentage of consumers 25 and younger—who are, on average, 40% more prevalent than in developed economies, according to Euromonitor—suggests the rapid rise of Generation #hashtag in emerging markets. (…) Over the past year, smartphone ownership rose significantly in emerging markets: from 45% to 50% in China, 14% to 21% in India, 45% to 54% in Brazil and 45% to 63% in Russia.

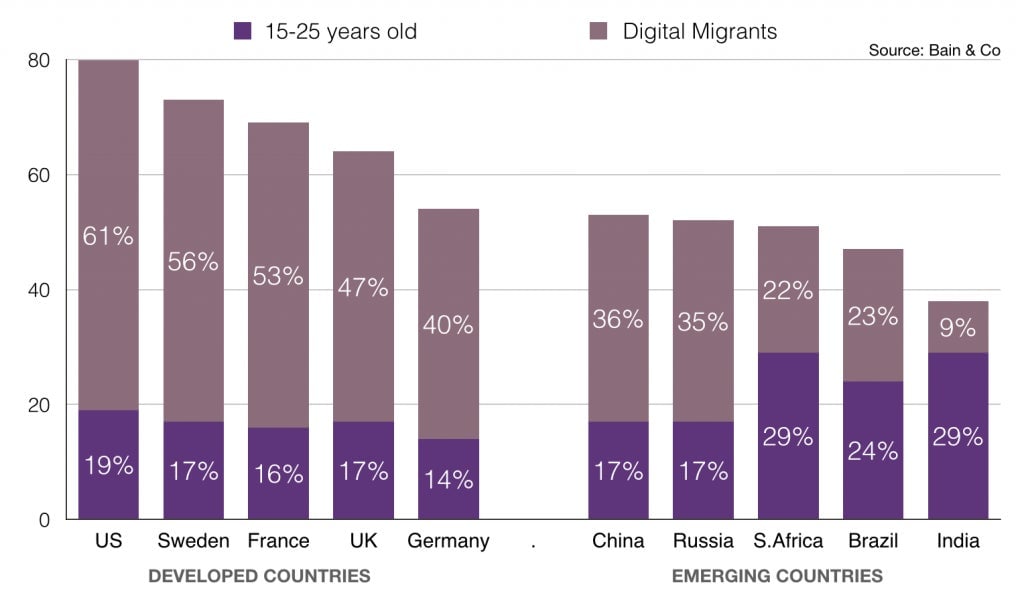

The chart below shows two important elements. One is the importance of Generation #hashtag. The second, and even more interesting, is the demographic distribution which, for emerging countries, clearly states the potential:

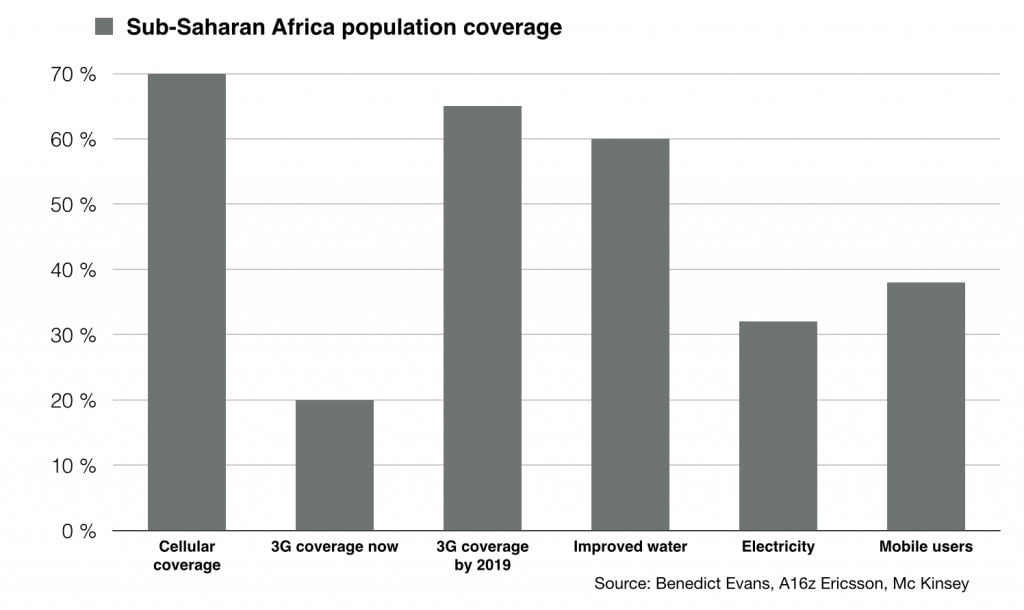

These demographics show two major gaps: disposable income and networking infrastructure. Taking the long view, the first one could be overcome by strong growth in key areas. For the second, in many countries of Asia or Sub-Saharan Africa, landline equipment is staying flat—and sometimes decreasing—while cellular networks are growing like weeds. A couple of weeks ago, Benedict Evans, from the Andreessen Horowitz venture firm, released his Mobile is Eating the World slide deck–from which I extracted these two charts :

These figures might prove to be conservative as heated competition for the Next Billion has already started between tech giants. Google’s Project Loon, Facebook’s future drone network, both aimed at delivering broadband internet in developing countries, are to be joined by Elon Musk’s reported plan to deploy 700 micro-satellites at a cost of $1 billion to serve the same purpose. If we factor in Mark Zuckerberg’s idea to get a 100x improvement on internet delivery (10x reduction in cost of serving data multiplied by 10x improvement in compression and caching technologies), we can project the internet’s global availability challenge as solved within the next five years or so.

In this picture, Europe faces a huge industrial problem. The players who will benefit from the exploding demand in emerging markets are everywhere but in Europe, except maybe for Nokia Networks (not the handset division, now owned by Microsoft, but the remaining independent infrastructure business), and Sweden-based telecom maker Ericsson. Other are mostly Chinese, Taiwanese, and Korean (Samsung and many others), they cover the entire field from networking infrastructure to mobile terminals. Symmetrically, most of the engineering brainpower and very large investment capabilities are concentrated in the US, with immensely rich companies such as Google or Facebook (or Musk’s SpaceX) that are focused on capturing this Next Billion.

Europe’s options are limited. It has no common language and no political leadership. It is encumbered by a gigantic bureaucracy, and scattered and uneven access to capital (compared to the Keiretsu-like American venture capital system.) Europe could choke, squeezed between Asian hardware markers and US-based software giants. Unfortunately, instead of organizing itself to favor the emergence of tech leaders—through decisive education programs and smarter immigration policies, for instance—Europe’s main contribution to technologies has been the creation of tax havens. A textbook example of a missed opportunity.

You can read more of Monday Note’s coverage of technology and media here.