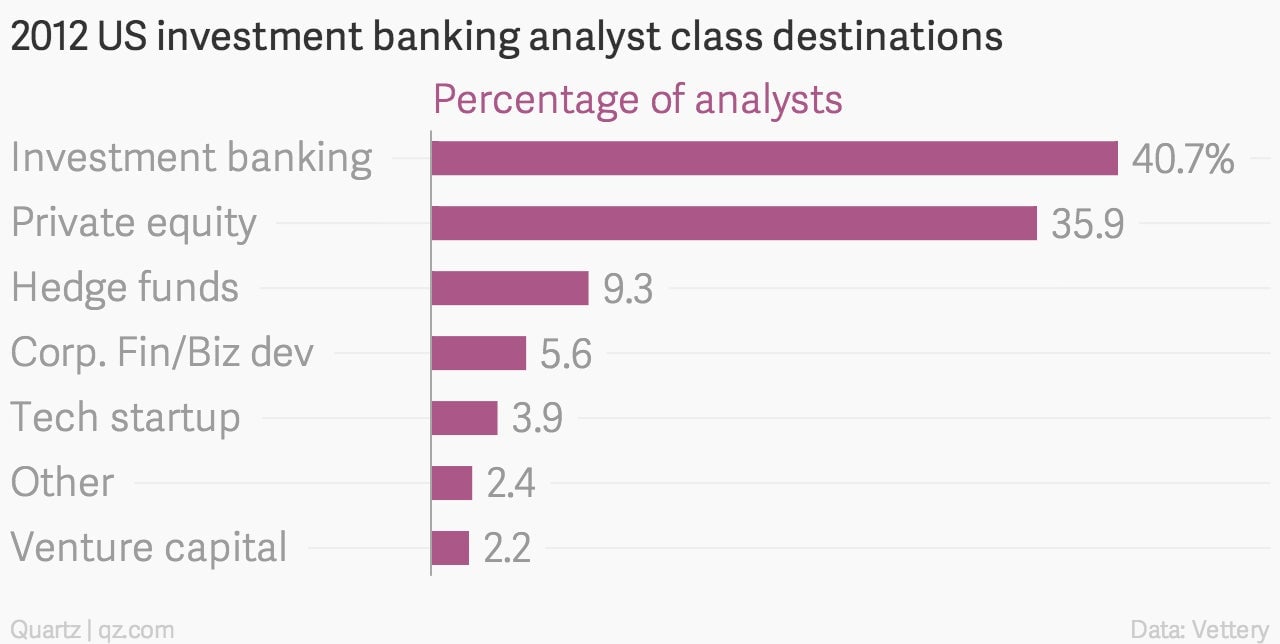

Less than 4 percent of Wall Street’s analyst class joined startups

There’s been a great deal of attention paid to the supposed growing talent rivalry between Silicon Valley and Wall Street. Silicon Valley started booming just as Wall Street tried to recover from the financial crisis, which created a new post-graduate destination for young over-achievers. Now many MBAs at top US schools are picking tech over finance, and several US banks have upped analyst salaries to stay attractive.

There’s been a great deal of attention paid to the supposed growing talent rivalry between Silicon Valley and Wall Street. Silicon Valley started booming just as Wall Street tried to recover from the financial crisis, which created a new post-graduate destination for young over-achievers. Now many MBAs at top US schools are picking tech over finance, and several US banks have upped analyst salaries to stay attractive.

But there hasn’t been a mass exodus from Wall Street to Silicon Valley, at least not yet. Few graduates who go into two-year US investment banking analyst programs (the prestigious entry point into Wall Street) make a jump to Silicon Valley, according to analysis by recruiting startup Vettery. The company says its dataset–mined from regulatory filings, social media, and its site users—nearly covers the 2012 analyst class.

Many move from investment banking to lucrative posts in private equity. Out of the 1,400 analysts that Vettery has tracked, 55 went to startups, 31 to venture capital, and 500 to private equity. Even more two-year investment bankers stuck with investment banking, but of those the majority switched to another group within the bank, or another bank altogether (27.5% stuck with the same bank or group within the bank).

The two-year analyst program is supposed to offer a taste of banking to those uncertain about the profession. But the short time window gives way to another recruiting frenzy just months after the analysts start their jobs.

Private equity firms recruit banking analysts who’ve been primed in valuing companies and building deals; these skills are less useful in Silicon Valley, which has limited need for internal dealmaking.

Many former bank analysts migrate to private equity simply because it offers more jobs than, say, hedge funds, which manage money for long periods with fewer people. By contrast, private equity requires broad networks to constantly source shorter-term deals. Venture capital firms are even smaller than hedge funds and have their own hiring stream; they tend to hire more experienced finance people and proven entrepreneurs, not investment banking analysts.

Orn thinks Silicon Valley is more likely to be plucking recent college and business school graduates, because as far as he can tell, it isn’t knocking on Wall Street’s door.