Wall Street bankers have been getting short shrift in Silicon Valley lately.

Tech titans are relying far less on highly-compensated bankers to engineer mergers and acquisitions, and opting to follow their gut rather than relying purely on deal data, the New York Times reports. For example, in 2012, when Facebook bought Instagram for a $1 billion, CEO Mark Zuckerberg didn’t use a banker to identify the deal, a departure from the typical protocol in the realm of corporate mergers and acquisitions.

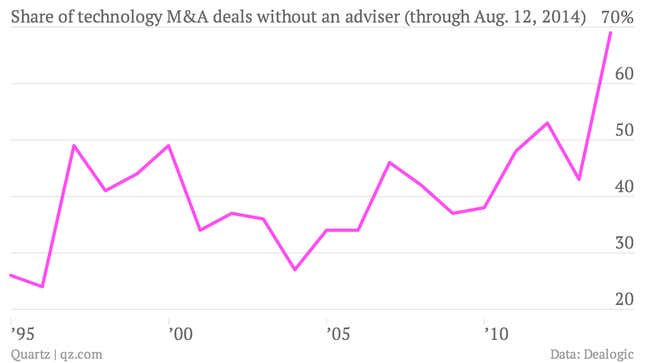

That approach has become far less anomalous. Indeed, approximately 70% of the tech deals completed in early August have been sealed without a Wall Street bank consultant helping the buyer identify the transaction, according to data from Dealogic.

And over the past two years, the trend has been growing, with more than half the tech deals in 2012 occurring without a banker working on behalf of the buyer. The figure was 43% last year, still higher than the average of 40% for the past 9 years, according to Dealogic.

This M&A consulting shift highlights a subtle but growing divide between fee-eager bankers and the tech giants of today. A boom in M&A activity across sectors means bankers are still making a lucrative living. Still, if tech executives are making deals without a horde of bankers weighing in, perhaps that’s a deeper rejection of Wall Street: Indeed, much of the fresh-out-of-college talent that was once drawn to finance is now ending up in Silicon Valley.