Mario Draghi won’t let anything stop him—from delaying big decisions

What did the markets make of the European Central Bank’s actions today? See if you can spot the moment when the ECB’s latest policy announcement came out:

What did the markets make of the European Central Bank’s actions today? See if you can spot the moment when the ECB’s latest policy announcement came out:

Traders evidently were hoping that ECB president Mario Draghi would drop hints that he was willing—eager, even—to stop messing around with cheap bank loans and asset-backed securities and just do what other major central banks have done: buy government bonds. Many believe that full-blown quantitative easing (QE) of this kind is the last, best hope for the euro zone to break itself out of the economic doldrums, regardless of whether a narrow reading of the EU’s founding treaty outlaws the practice.

Draghi disappointed traders hoping for the ECB to unleash a flood of euros to boost stocks and bonds, and push down the value of the common currency. Only if the ECB saw the risks of “too prolonged a period of low inflation,” Draghi said, the bank would go about ”altering early next year the size, pace, and composition of our measures.” Would those alterations include buying government bonds? The governing council discussed the possibility of purchasing ”all assets but gold,” Draghi said.

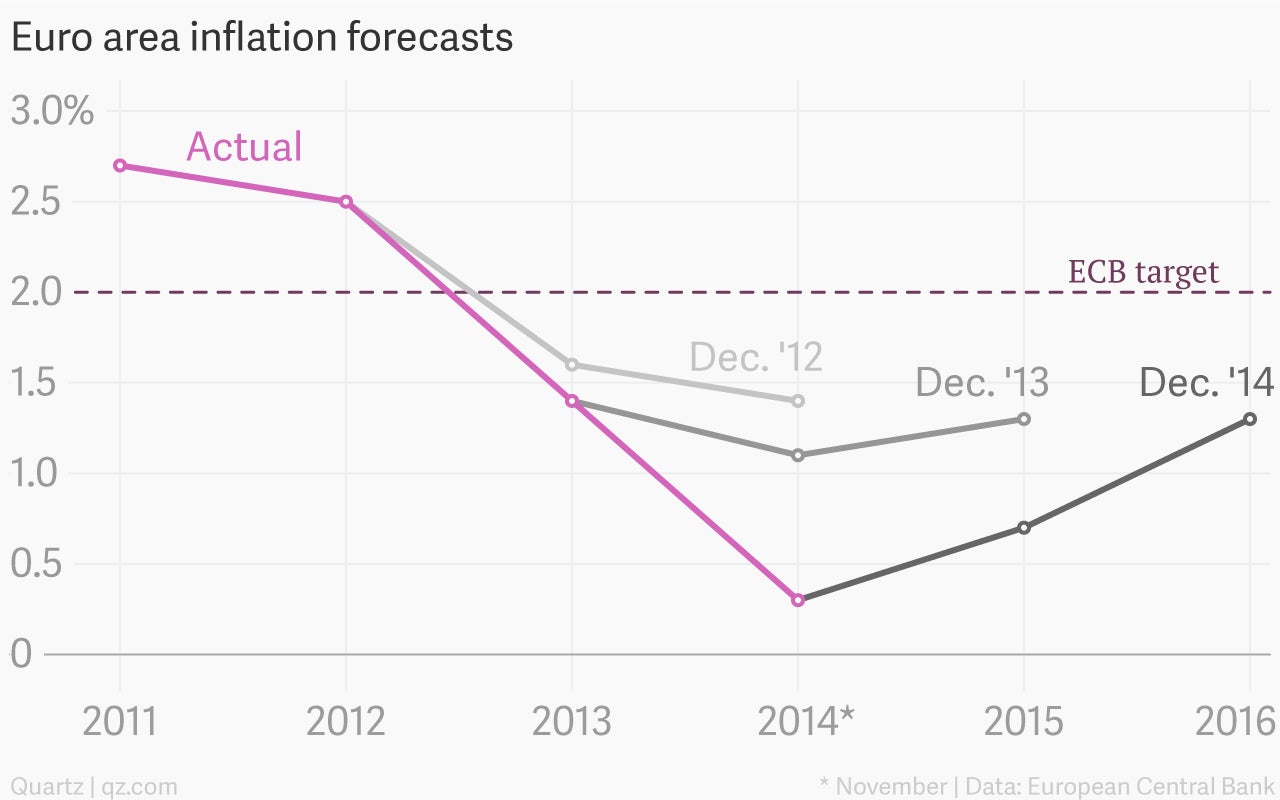

The bank’s economic projections, updated today, show inflation firmly entrenched in the “danger zone” (Draghi’s words) of below 1%. Amid weak economic growth and tumbling oil prices, the risks of low inflation tipping over into outright deflation seem as high as ever:

Still, like so many times before, Draghi has offered words instead of actions. And even his words proved contentious among his colleagues. Last month, the central bank said that it “expected” to expand its balance sheet by €1 trillion ($1.24 trillion). Today, it strengthened this pledge somewhat, saying in a statement that it “intended” to boost its balance sheet by that amount. The change of wording was not unanimously agreed, Draghi said, with hawkish German members of the board the likeliest dissenters.

If the ECB can’t even agree on verb choices, what chance does it have of taking the unprecedented step of launching bona fide QE? After he departed from his prepared remarks, Draghi offered some hope for people keen to see him rev up the printing presses. In the back and forth with journalists, the president stressed that the ECB’s sole mandate is to maintain inflation of close to 2%. “It would be illegal not to pursue our mandate,” he said.

It is not illegal, he stressed, to come up with a QE program that involves buying government bonds. It it is also not necessary for the board to be unanimous on launching such a program, Draghi said. This was his way of saying that he’s comfortable steering the ECB into uncharted waters even if all of his colleagues aren’t on board. These are “meaningful words,” he said. But talk is cheap—€1 trillion takes action.