China’s next stock market bubble may be upon us

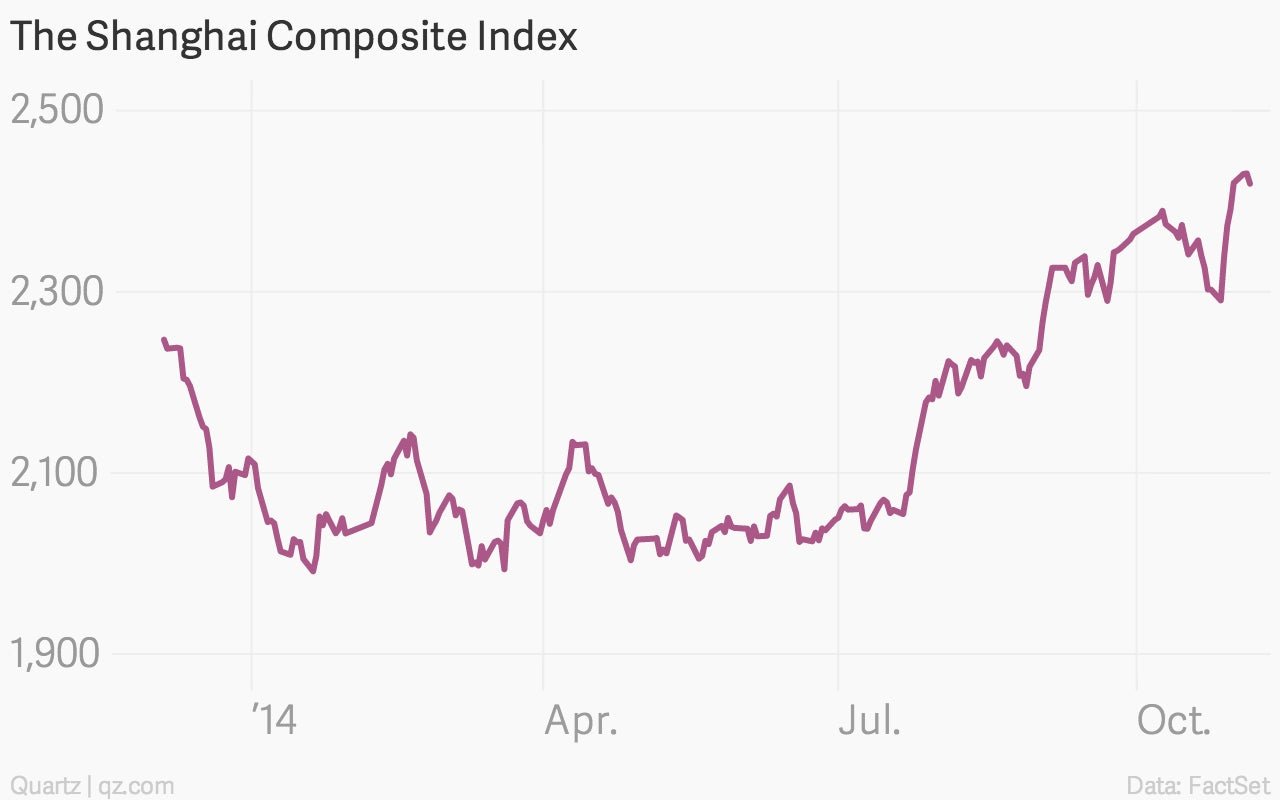

There are two ways to look at the remarkable performance of the Shanghai stock market, which has climbed nearly 40% this year, and about 10% in the last week alone:

There are two ways to look at the remarkable performance of the Shanghai stock market, which has climbed nearly 40% this year, and about 10% in the last week alone:

1. This is just the beginning of an even stronger bull market. Cao Fengqi, director of finance at Peking University, believes China’s stock markets are ready for a big leap (link in Chinese). The weak housing market may have driven money into stocks, but market reforms have made a bubble unlikely, other like-minded bulls say. One Morgan Stanley strategist even called the beginning of an “ultra-bull” market, predicting stocks could double in 18 months.

2. China is in the middle of another stock market bubble. Analysts say that bull-market enthusiasm “has become self-reinforcing.” (paywall) Just as happened in 2007, when the index climbed to nearly 6,100, the flood of money into “A-shares,” as Shanghai and Shenzhen-traded stocks are known, can’t last. The following year, many retail Chinese investors were wiped out, losing their lives savings (paywall) after the market fell 65%. “Every spike in the A share market was a bubble,” former World Bank economist Andy Xie told Bloomberg. “Why should this one be any different?”

With China’s economy showing continued signs of a slowdown, huge doubts about the quality of trillions of dollars in loans outstanding to companies, and leverage driving much of the stock-buying, it is pretty tough to side with the bulls.