Scandinavia provides a least bad option for investors

Bloomberg reported today that bond and currency investors remain keen on Scandinavia, despite contractions in the economies of Denmark and Finland, and stalled growth in Sweden. Analysts Bloomberg interviewed said investors weren’t enamored of the Nordics—it’s just that major markets elsewhere, like the US, Japan, and some euro zone countries, looked worse.

Bloomberg reported today that bond and currency investors remain keen on Scandinavia, despite contractions in the economies of Denmark and Finland, and stalled growth in Sweden. Analysts Bloomberg interviewed said investors weren’t enamored of the Nordics—it’s just that major markets elsewhere, like the US, Japan, and some euro zone countries, looked worse.

Some surprising statistics from the region:

Foreign holdings of Swedish bonds and money market instruments rose to 3.23 trillion kronor ($483 billion) as of June, from 2.09 trillion at the end of 2007, central bank data show.

Foreign investors bought 163 billion kroner of Norwegian securities in the first half, double the total amount purchased through all of 2011, the Oslo-based statistics office estimates.

Purchases of Danish krone denominated bonds jumped almost five-fold in September to 21.4 billion kroner, from a year earlier, according to central bank data.

Even though recent data show all four Nordic economies are faltering, they each retain AAA debt ratings and have debt loads half the euro zone average, making them more appealing safe haven destinations.

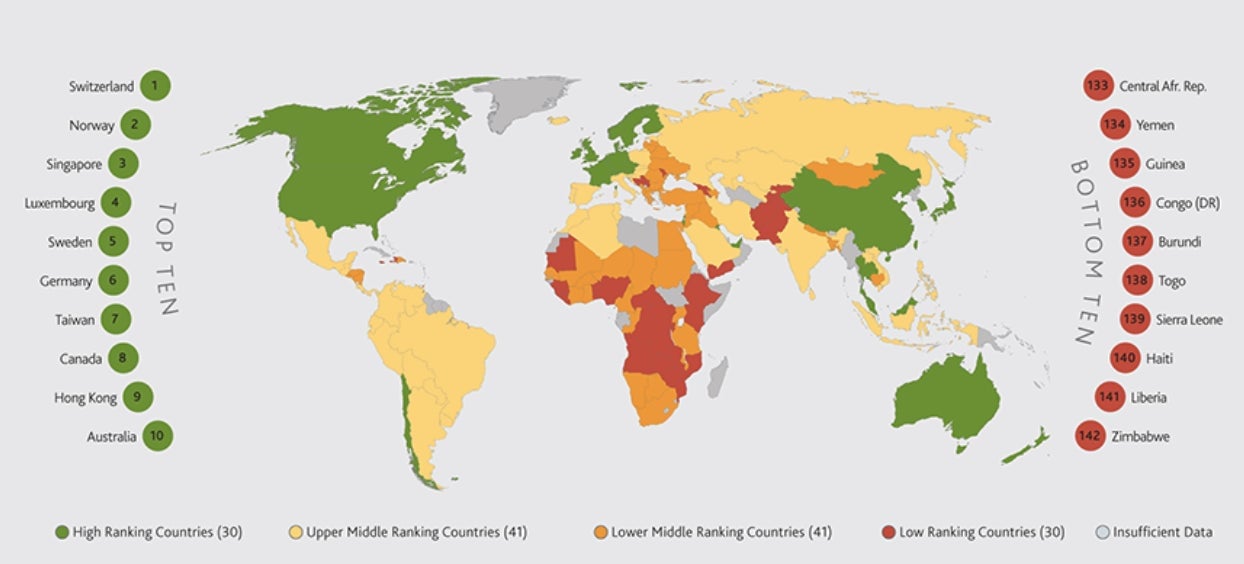

Last month, the annual Legatum Prosperity Index published in London ranked Norway, Denmark and Sweden as the three most prosperous nations in the world for wealth and well-being. The ranking measures economic strength, along with other indicators including health, education, and entrepreneurship.The US fell out of the top 10 spot for the first time ever to number 12, while Finland ranked seventh. A separate ranking, based solely on economic factors such as macroeconomic policies and financial sector efficiency, also placed Norway and Sweden in the top five.

Economic Strength