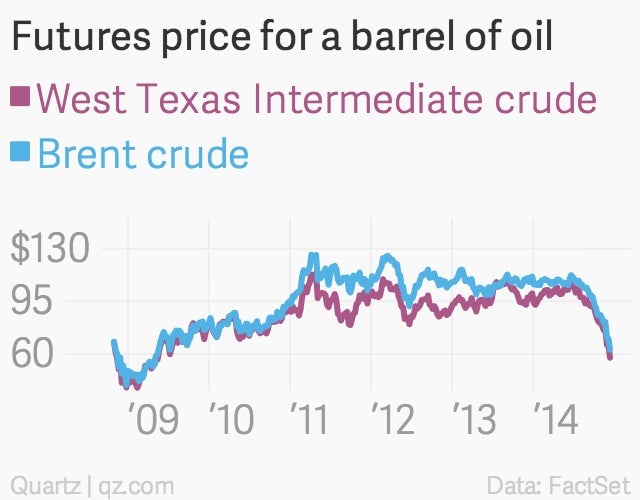

The markets were clearly focused on one particular fossil fuel this week

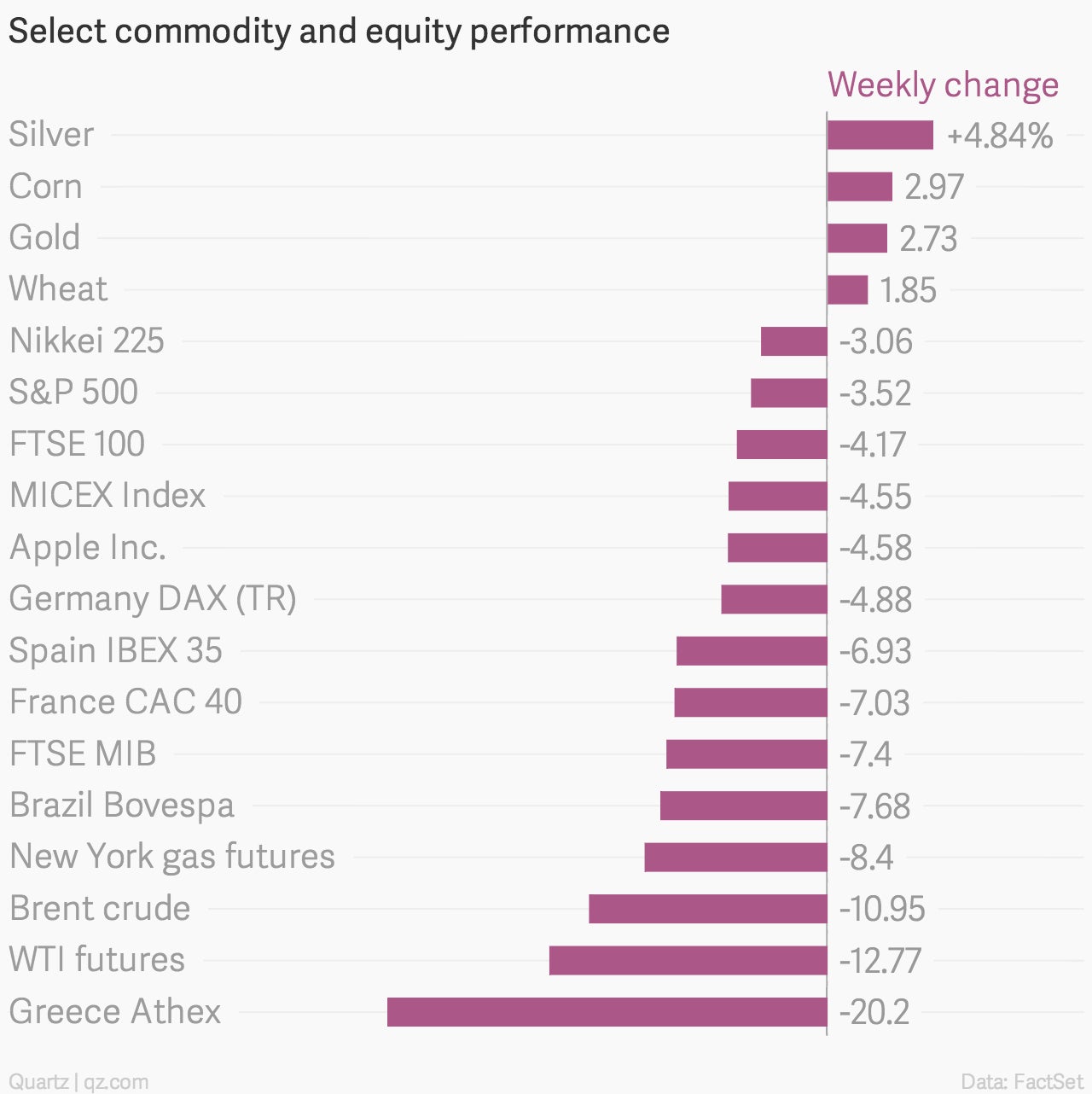

Yes, Greek stocks dropped like a rock. The Bank of Canada seemed to suggest housing prices there might collapse. And US Treasury yields continued to fall from already low levels.

Yes, Greek stocks dropped like a rock. The Bank of Canada seemed to suggest housing prices there might collapse. And US Treasury yields continued to fall from already low levels.

But the biggest story in markets this week was oil.

The world is already producing way too much and demand is clearly in decline. The US crude oil futures fell nearly 13% in the last week alone, and they’re taking down everything from Norwegian krone to junk bonds with it. In short, an energy bust, a much cherished American tradition, has myriad and far-reaching economic consequences.

Will Venezuela default? Will junk bond investors continue to suffer? Will US consumers cheer? Will US investment, which has been bolstered by energy investment in recent years, slump? All will be answered, in time, by gyrations in the global oil markets.