Markets fail to be stunned as US Treasury declines to label China a currency manipulator

Like Beetlejuice and Voldemort, some things just must not be said aloud.

Like Beetlejuice and Voldemort, some things just must not be said aloud.

For the US Treasury Department, the key phrase is “currency manipulator.”

The US financial ministry declined to call China a currency manipulator today in its latest report on the topic, surprising absolutely nobody.

Every so often—usually because of politics—a drumbeat builds to pin this label on China. Republican candidate Mitt Romney made the promise to do so on his first day in office a constant refrain from the stump during this year’s presidential campaign.

It’s important to remember that this amounts to more than just name-calling. Under a US trade law passed in 1988, the Treasury has to analyze exchange-rate policies of foreign countries and assess whether these policies give them an unfair trade advantage over US companies, i.e, by making their exports to the US unnaturally cheap or their imports from the US unfairly expensive. (There was no way, therefore, that Romney could have labelled China a manipulator himself, and even if he had found a Treasury secretary malleable enough to do it for him regardless of what Treasury officials said, it certainly wouldn’t have happened on his first day in office.) If the Treasury does indeed find that a country is a manipulator, it must enter into negotiations with economic officials from the country in question “on an expedited basis.” The prospect of such forced, very public talks opening various cans of worms between giant economies such as the US and China is an unsettling thought for policy-makers on both sides of the Pacific.

Here’s a useful bit of background on the topic from the Peterson Institute for International Economics:

The US Treasury named several Asian economies as “manipulators” in the 1988-94 period (including China in 1992-94) but no country has been cited since 1994—including in 2003 and 2004 when, as indicated earlier, there was strong evidence of manipulation by China and several others economies.

But, you may ask: Don’t governments meddle in the markets to move the value of their currencies all the time?

Yes, they do. Brazil. Switzerland. Japan. They’ve all done it relatively recently. Some would even argue that the US Federal Reserve’s practice of creating new money and using it to buy bonds in the financial markets—the famous quantitative easing—has the effect, intended or otherwise, of keeping the US dollar weak.

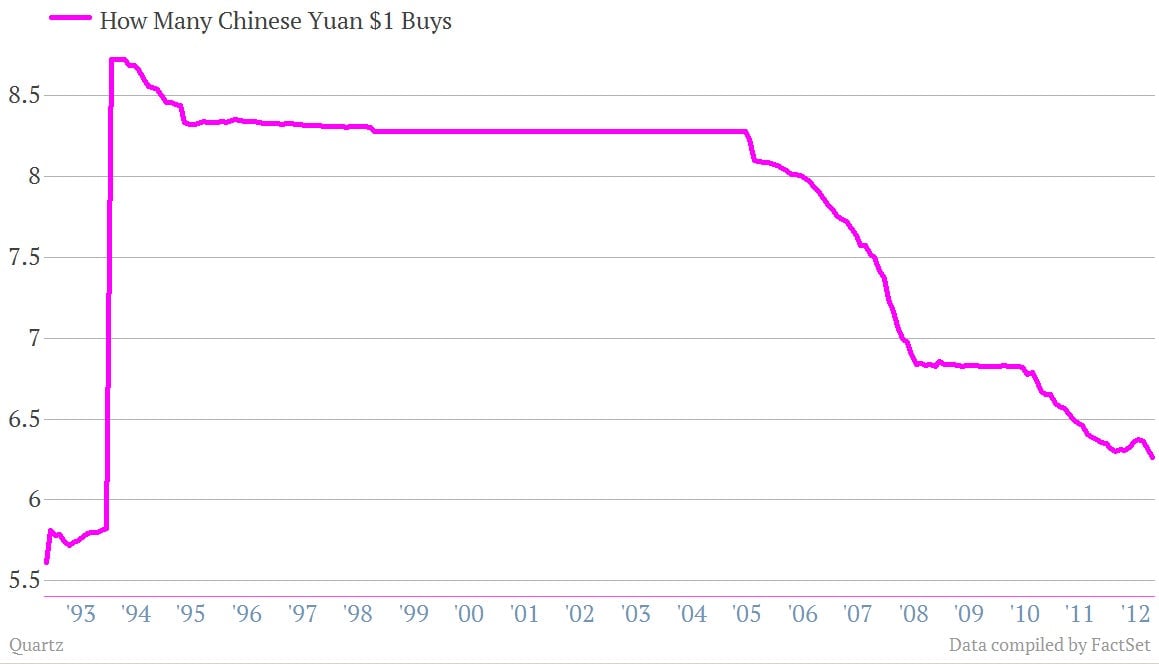

At any rate, it would have been a very strange time to label China a currency manipulator. Especially since the Chinese government has seemed to make a pronounced turn towards letting the yuan gain strength against the US dollar, which is exactly what American policymakers want. There was speculation that the Chinese were doing this to help Barack Obama get elected, but now that he is back in office it has kept on strengthening, and is currently the strongest against the dollar that it has been since the yuan devaluation of 1994.