Some of America’s richest people are about to get even richer thanks to the fiscal cliff

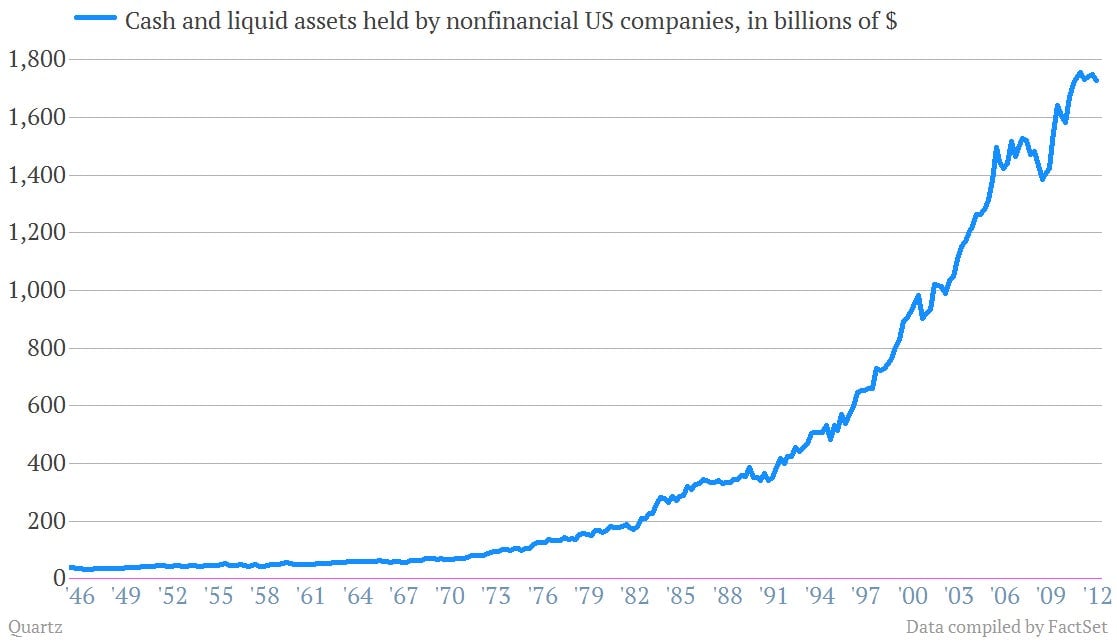

The risk that the US government could raise taxes on dividends as part of a deal on the forthcoming “fiscal cliff” has finally forced corporate America to do something with its massive pile of cash. Here’s a look a the Smaug-worthy* hoard companies have been accumulating:

The risk that the US government could raise taxes on dividends as part of a deal on the forthcoming “fiscal cliff” has finally forced corporate America to do something with its massive pile of cash. Here’s a look a the Smaug-worthy* hoard companies have been accumulating:

And what will they do with this haul? Spend it on investment? Hah! They’re rushing to give some of it to shareholders. Both the Wall Street Journal and the Financial Times have taken note of the trend in recent days. The Journal writes:

The moves would send hundreds of millions of dollars back to shareholders before tax hikes that could kick in next year either automatically or as a result of negotiations between the White House and Congress.

And the FT reports that since the beginning of the fourth quarter, “a record 103 companies have announced they will pay special dividends before the end of the year, according to Markit. The data firm is forecasting that 123 companies will announce special fourth-quarter dividends, compared to the previous average of just 31.” This is similar to what happened during the fourth quarter of 2010 the last time that the so-called Bush tax cuts were about to expire.

With a ton of cash, there’s no reason companies shouldn’t be giving at least some of it back to shareholders. Especially if those shareholders are well, the controlling ones. The Journal rightly notes that some rich Americans stand to gain quite a bit from getting their cash now, thanks very much. For instance, Las Vegas Sands CEO—and well-known backer of Republican political candidates—Sheldon Adelson could collect about $1.2 billion from the $2.75 a share special dividend on his 52% ownership interest in the casino company, which said it would pay a new one-time dividend next month.

*For those who are not avid fans of the writings of J.R.R. Tolkien, Smaug was the dragon in The Hobbit who slept atop a pile of gold and gems for centuries, so that his stomach became encrusted with jewels.