The BRICs stock bloc has never been a good idea, and this year especially

Back in 2001, then-Goldman Sachs economist Jim O’Neill created the BRICs acronym to collectively describe Brazil, Russia, India, and China—a bunch of big emerging-market economies that were going to power global growth. Since then, the countries themselves have banded together (and roped in South Africa) to form a trade bloc and a development bank.

Back in 2001, then-Goldman Sachs economist Jim O’Neill created the BRICs acronym to collectively describe Brazil, Russia, India, and China—a bunch of big emerging-market economies that were going to power global growth. Since then, the countries themselves have banded together (and roped in South Africa) to form a trade bloc and a development bank.

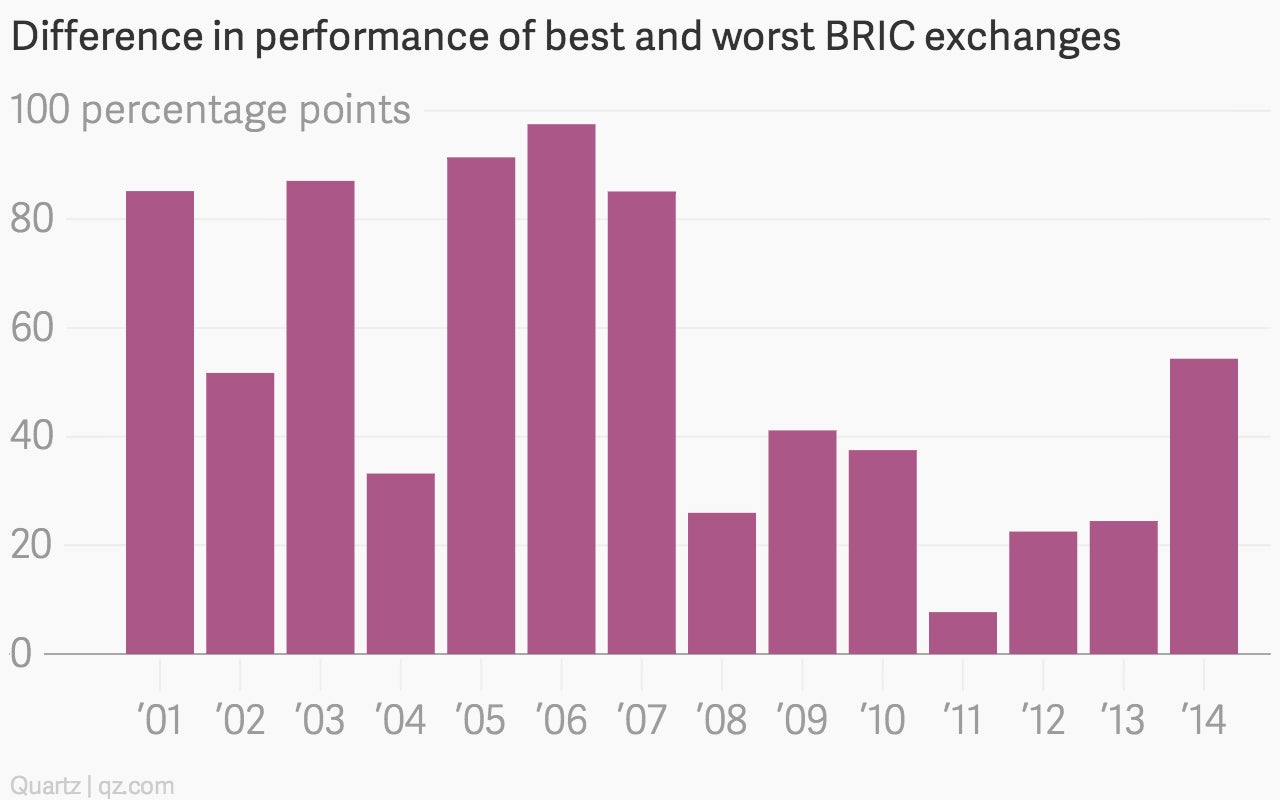

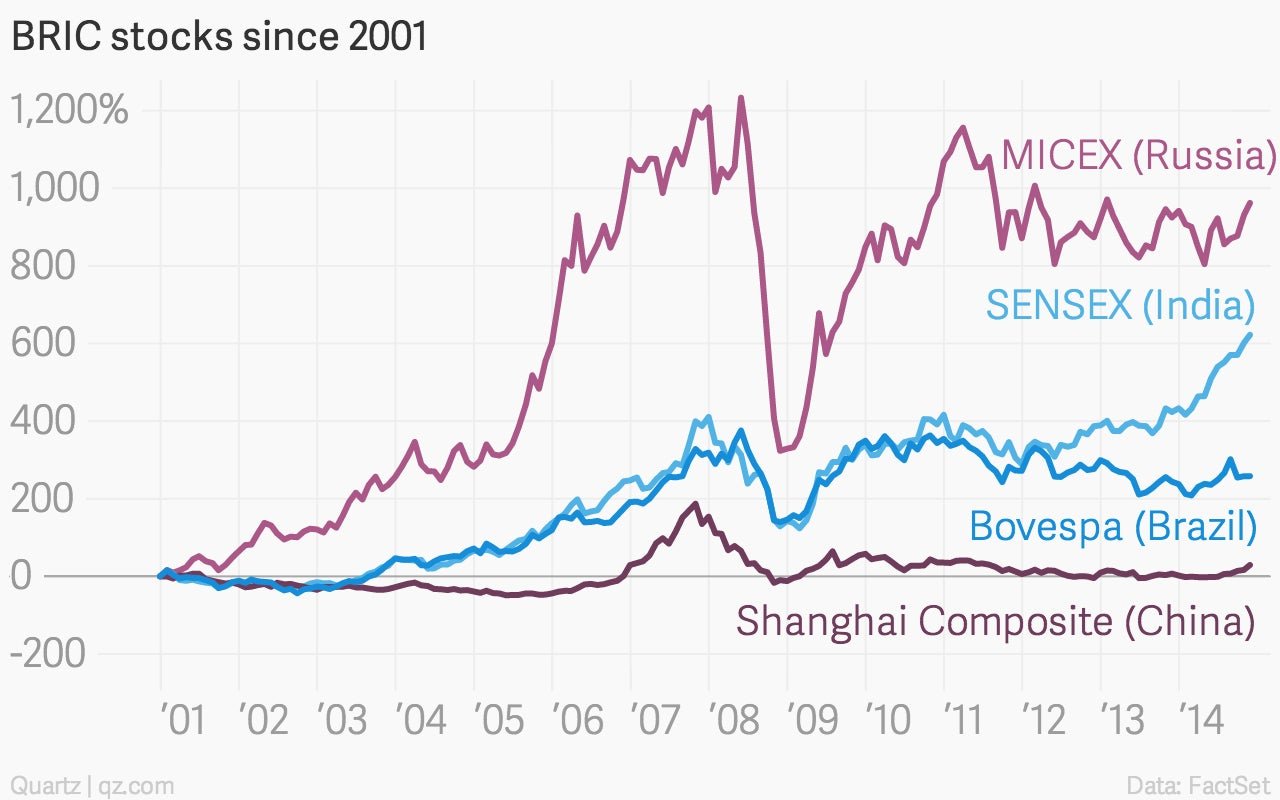

More visibly to most US investors, the acronym became a marketing tool, with everything from stock indices to mutual funds launched in its name. But the four economies have never really performed that coherently (paywall). Since the year that birthed BRICs, the stock indexes behind them have had minds of their own.

In fact, it took a decade for their annual performances to even approach matching up. And as this year’s performance has shown, that feat may be short-lived.