Here’s the best investment you could have made over the last two years

Just because something has surged in price, doesn’t mean it was necessarily a good investment.

Just because something has surged in price, doesn’t mean it was necessarily a good investment.

A cornerstone of modern portfolio theory of investing is that returns must be measured against the amount of risk investors took to achieve them. But how do you measure that?

Well, the conventional metric to use is the Sharpe ratio. It is based on the work of financial economist and Nobel laureate William F. Sharpe, who pioneered ways of measuring the appropriateness of investment returns when measured against market risks. Essentially it gauges whether an investment was worth it, in terms of the amount of anxiety involved. In short, the higher the Sharpe ratio, the better the investment returns look in relation to the risks that were taken. In this his context risk is measured as volatility, or how much an asset’s price whipsaws. And as logic might dictate, high returns tend to go with high risk.

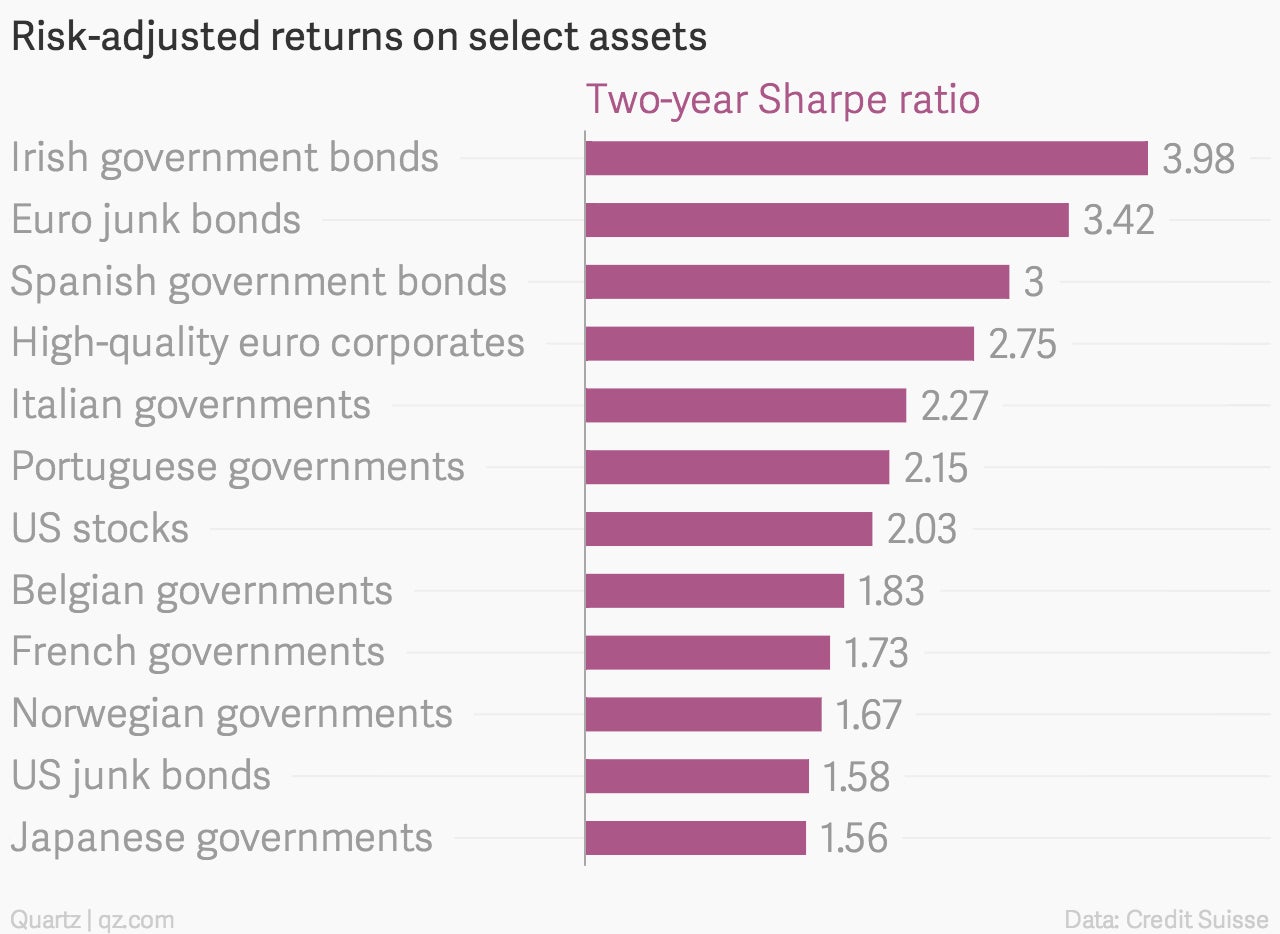

But not always. Sometimes there are amazingly great investments that enjoy a relatively smooth ride to outsized returns. And that’s been then case for European bonds over the last few years. According to numbers crunched by Credit Suisse researchers, bonds from Ireland, Spain, and Italy have been some of the best possible risk-adjusted investments in recent years. (Investors in government bonds from Ireland, Spain, and Italy have enjoyed total returns of 26%, 27%, and 23% respectively over the last two years, according to Credit Suisse analysts. Portuguese bonds faired even better, returning 31%.)

Basically, this the investor’s recent experience of the remarkable steady collapse in the bond yields of troubled European countries. As we’ve said many times, this is not because the economic prospects of these countries have improved so much. In fact, some have worsened. Italian unemployment has just touched a new record of more than 13%. And these countries have made little if any progress in bringing their heavy debt-to-GDP ratios down. So why are investors piling into these bonds?

Because the ECB, under the leadership of Mario Draghi, has convinced the markets that it eventually will be there to buy up large amounts of European government debt if that becomes necessary to save the currency union. Remarkably, this has been achieved with almost zero action on the part of the bank, which instead has opted to use its bully pulpit to nudge markets in the direction it prefers. But the hour of action may be drawing near. With the appearance of outright deflation in the euro zone recently, expectations are that the central bank will launch a Federal Reserve-style bond-buying program at its meeting in late January. Will it come to pass?

Well, it’s the ECB. So likely it will disappoint the markets somewhat. But if Draghi shows signs of backpedaling on his promise to do whatever it takes to guarantee the future of the euro zone, the smooth ride to remarkably high returns in the European bond markets may just disappear.