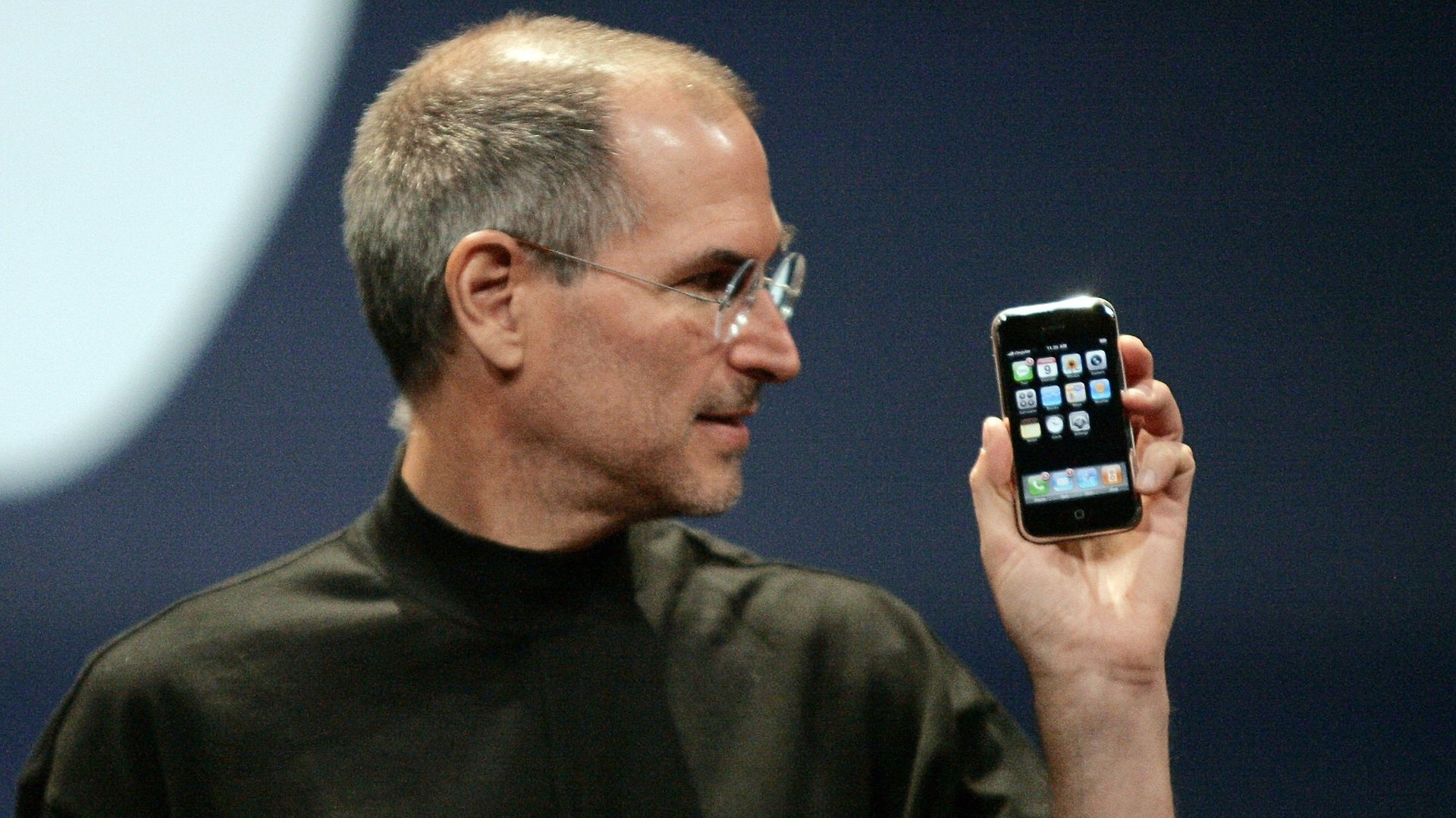

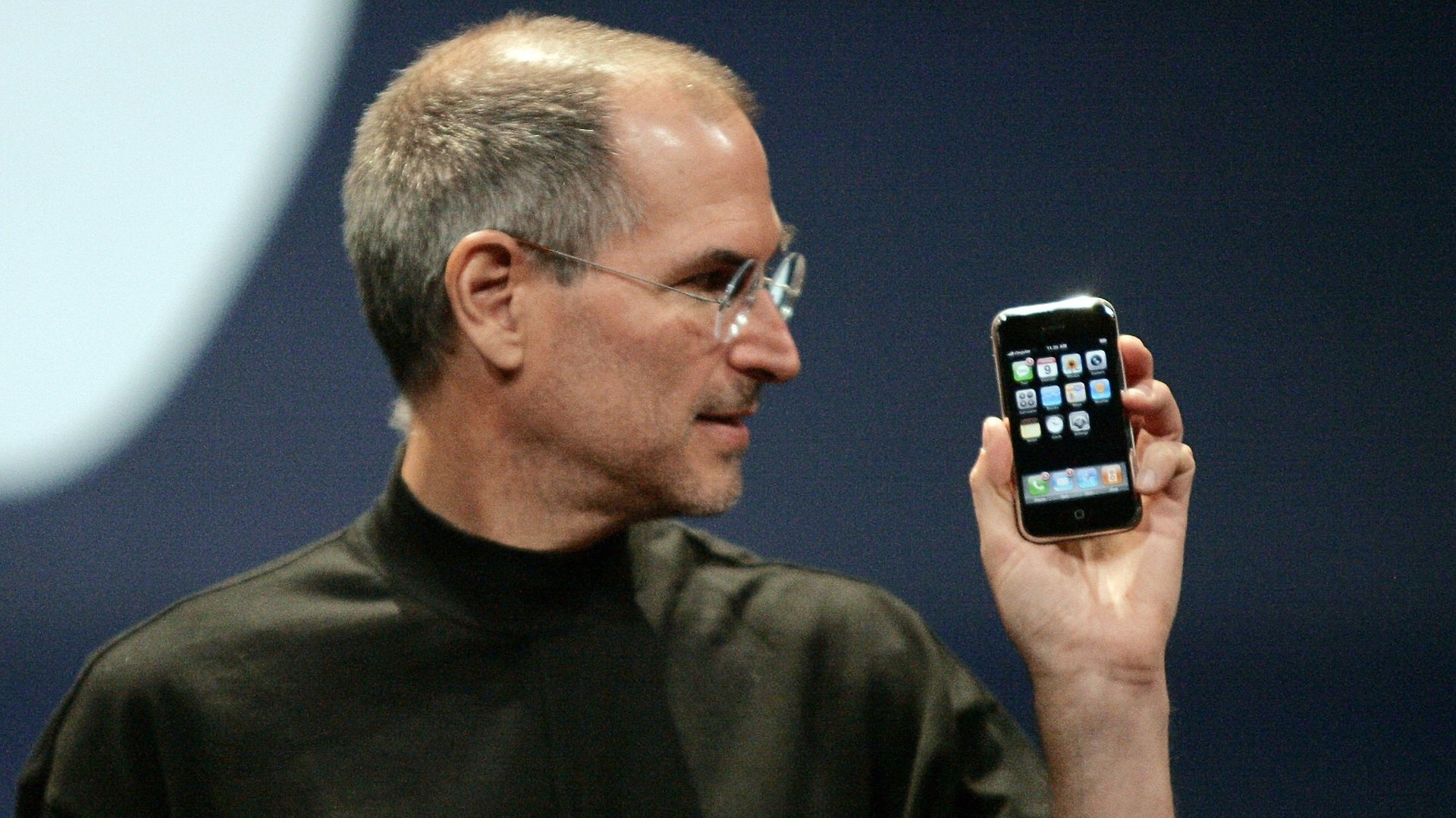

The remarkable eight years since Steve Jobs introduced the iPhone

Smartphones existed before Steve Jobs introduced the iPhone on Jan. 9, 2007. But by upending existing technology platforms, application distribution, and carrier business models, he kickstarted a new era of computing whose impact is yet to be fully understood.

Smartphones existed before Steve Jobs introduced the iPhone on Jan. 9, 2007. But by upending existing technology platforms, application distribution, and carrier business models, he kickstarted a new era of computing whose impact is yet to be fully understood.

I knew one of the victims of the Charlie Hebdo massacre: Bernard Maris. We weren’t friends, just pleasantly casual acquaintances through the in-law side of my family. Typical Parisian dinner conversations “rearranging the world” led to a Palo Alto visit and an interview for a small Charlie Hebdo piece, complete with the requisite risqué drawing.

After several false starts writing about the events in Paris, I’ve come to the conclusion that I’m too angry at too many targets, starting with certain cowards in the media who don’t understand that the fear of antagonizing oppressors perpetuates their power, that no good culture can exist without a dose of bad taste, that the demand to never be offended is inhumane. As cardinal André Vingt-Trois, archbishop of Paris puts it: “A caricature, even in bad taste, criticism, even extremely unfair, cannot be put on the same plane as murder.”

(Lovers of ironic detail will note that cardinal Vingt-Trois was once the titular bishop of Thibilis, Algeria. In partibus infidelium.)

—

Instead, I will turn to a more positive train of thought: The beginning of the Smartphone 2.0 era.

Eight years ago, Jobs walked onto the stage at MacWorld San Francisco and gave a masterful performance. His presentation is worth revisiting from time to time, a benchmark against which to evaluate a PowerPoint-addled CEO pitch or a product-intro-cum-dance-number.

In his talk, Jobs tells us that the iPhone is one of these products that, like the Mac and the iPod before, “changes everything.” He was right, of course, but one wonders…even with his enormous ambition, did Jobs envision that the iPhone would not only transform Apple and an entire industry, but that it would affect the world well beyond the boundaries of the tech ecosystem?

If the last sentence sounds a bit grand, let’s look at the transformation of the smartphone industry, starting with Apple.

In 2006, the year before the iPhone, Apple revenue was $19 billion (for the fiscal year ending in September.) That year, iPod revenue exceeded the Mac, $7.7 billionto $7.3 billion…but no one claimed that Apple had become an iPod company.

In 2007, revenue climbed to $24 billion, a nice 26% progression. Mac sales retook the lead ($10.3 billion vs. $8.3 billion for the iPod), and iPhone sales didn’t register ($123 million) as shipments started late in the fiscal year and accounting’s treatment of revenue blurred the picture.

In 2008, revenue increased to $32.5 billion, up 35%. IPhone revenue began to weigh in at $1.8 billion, far behind $9 billion for the iPod and $14.3 billion for the Mac (a nice 39% uptick.)

In 2009, revenue rose by a more modest 12%, to $36.5 billion—this was the financial crisis. iPod declined to $8 billion (- 11%) as its functionality was increasingly absorbed by the iPhone, and the Mac declined a bit to $13.8 billion(- 3%.) But these shortfalls were more than compensated for by iPhone revenue of $6.8 billion (+266%), allowing the company to post a $4 billion increase for the year. This was just the beginning. (And even the beginning was bigger than originally thought: Due to a change in revenue recognition esoterica, 2009 iPhone revenue would be recalculated at $13.3 billion.)

In 2010, iPhone revenue shot up to $25 billion, pushing Apple’s overall revenue up by a phenomenal 52% to $65 billion. The iPhone now represented more than one-third of total revenue.

In 2011, growth accelerates, revenue reaches $108 billion(+66%), more than five times the pre-iPhone 2006 number. iPhone reaches $47 billion (+87%), now almost half of the company’s total.

For 2012, sales shoot up to $156.5 billion (+45%), and the iPhone reaches $80.5 billion (+71%.) At such massive absolute numbers, 45% and 71% growth look almost unnatural as they appear to violate the Law of Large Numbers. As this happens, the iPhone crosses the 50% of total revenue threshold, and accounts for probably two-thirds of Apple’s total profit.

Apple’s growth slowed in 2013 to a modest +9%, with $171 billion overall revenue. The iPhone, weighing in at $91.3 billion (+16%), provides most ($12.6 billion) of the modest ($14 billion) overall revenue increase and 53% of total sales.

Last year, growth slows just a bit more: $182.8 billion (+7%) with the iPhone reaching $102 billion (+12%.) Once again, the iPhone contributes most of the total revenue growth ($10.7 billion of $11.9 billion) and fetches 56% of the company’s sales. Notably, the iPad shows a 5% decrease and, at $2.3 billion, the iPod is becoming less and less relevant. (Although, how many companies would kill for $2.3 billion in music-player revenue?)

The excellent Statista portal gives us picture of the iPhone’s emergence as Apple’s key product:

While the company is about 10 times larger than it was before the iPhone came out, the smartphone industry has become a nearly trillion-dollar business. Depending on how we count units and dollars, if we peg Apple at 12% market share, that means the worldwide number across the smartphone industry reaches $800 billion. If we grant Apple just a 10% share, we have our $1 trillion number.

For reference, still according to Statista, the two largest auto companies, Toyota and the Volkswagen Group, accounted for $485billion in revenue in 2013:

However we calculate its size, whether we place it at $800 billion or $1 trillion, what we mustn’t do is think that the smartphone industry merely grew to this number. Today’s smartphone business has little in common with what it was in 2006.

Consider that Motorola “invented” the cell phone. Now Motorola is (essentially) gone: Acquired by Google, pawned off to Lenovo, likely to do well in its new owner’s Chinese line.

Nokia: The Finnish company stole the crown from Motorola when cell phones became digital and once shipped more than 100 million phones per quarter. Since then, Nokia was Osborned by its new CEO, Stephen Elop, an ex-Microsoft exec, and is now owned by Elop’s former employer. With 5% or less market share, Nokia is waste of Microsoft resources and credibility…unless it switches to making Android phones as a vehicle for the company’s “Cloud-First, Mobile-First” apps.

Palm, a company that made a credible smartphone by building on its PDA expertise, was sold to HP and destroyed by it. It’s worse than dead, with anecrophiliac owner (TCL), and LG humping other parts of the corpse for their WebOS TVs and a WebOS smartwatch.

And then there’s the BlackBerry. Once the most capable of all the smartphones with a Personal Information Manager that was ahead of its time, it was rightly nicknamed CrackBerry by its devoted users. Now BlackBerry Limited is worth less than a 1/100th of Apple, and is trying to find a niche–or a seeker of body parts.

The change in the industry is, of course, far from being solely Apple’s “fault.” In many ways, Google destroyed more incumbents than Apple. Google acquired Android in 2005, well before the iPhone appeared. According to Tomi Ahonen, China now sports more than 2,000 (!) phone brands, all based on some Android derivative. And let’s not forget the voraciousness of Apple’s giant Korean frenemy Samsung, which acts as both a supplier of key iPhone components and a competitor.

But is the industry now settled? Are any of the current incumbents, including Apple, unassailable? Market-leading Samsung appears to be challenged by both Apple at the high end and Xiaomi from below, and has announced more recent troubles. Our friend Ahonen argues that Xiaomi isn’t the new Apple but that Lenovo and Huawei are the ones to watch. And, of course, Apple is seen as a “hits” company, a business that lives and dies by its next box-office numbers—and the numbers for the new iPhone 6 aren’t in, yet they’re likely be very strong.

Regardless of any individual company’s business case, the overall of impact of the smartphone on the world is what counts the most. In a blog post titled “Tech’s Most Disruptive Impact Over the Next Five Years,” Tim Bajarin argues that the real Next Big Thing isn’t the internet of things, virtual reality, or bitcoin. These are all important advances, but nothing compared to the impact of smartphones [emphasis mine]:

“Another way to think of this is that smartphones or pocket computers connecting the next two billion people to the internet is similar to what the Gutenberg Press and the Bible were to the masses in the Middle Ages.”

As Horace Dediu notes, we’re on track to 75% US smartphone penetration by the end of 2014. The big impact to come will be getting the entire world to reach and exceed this degree of connectivity, especially in areas where there’s little or no wired connectivity.

This is what Jobs started eight years ago by upending established players and carrier relationships.

You can read more of Monday Note’s coverage of technology and media here.