Traders are pushing oil prices back up, but they are getting the market wrong

Oil prices are surging today on a report that the suffering of oil-producing nations may be coming to an end. But the report—from the International Energy Agency—is more notable for what it says about US shale oil, which is that it will remain remarkably resilient against the breathtaking six-month plunge in oil prices.

Oil prices are surging today on a report that the suffering of oil-producing nations may be coming to an end. But the report—from the International Energy Agency—is more notable for what it says about US shale oil, which is that it will remain remarkably resilient against the breathtaking six-month plunge in oil prices.

In short, traders—desperate for any glimmer of a market bottom—today grasped at a straw. Look for prices to resume their plummet.

The slowing of the bonanza is real—note the 9,000 layoffs at Schlumberger, which does the drilling for many big oil companies, while oil producers including BP and ConocoPhillips have announced job cuts for roughly 800 workers in the North Sea.

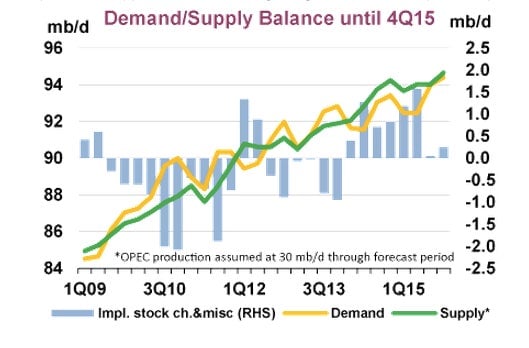

As you see in this chart, the IEA thinks such cutbacks will result in supply more or less meeting demand by the end of this year. But is the IEA’s picture actually sufficient to soak up the global surplus? Perhaps in the North Sea and elsewhere—though even there the data are thin. But on the US shale patch, drillers aren’t stopping their work—and haven’t stopped growing, either.

The IEA report forecasts that US supply growth will erode by a minuscule 80,000 barrels a day this year—not production mind you, but growth. This cut amounts to a scant 0.8% of current US production of 9.19 million barrels a day.

In fact, the US Energy Information Administration forecast on Jan. 15 that US production will rise to 9.31 million barrels a day by the end of the year, and to 9.53 million barrels in 2016.

One reason is inertia. Another is that the energy companies need to service their debt. Yet a third is that the most capable drillers, emphasizing the sweet spots on the patch, can still make money at these prices. In a note today, industry research group WoodMacKenzie forecast that shale oil drilling costs will plunge overall by 15%, and that some operators will save 40% on their costs. In just one field—the Eagle Ford in south Texas—drillers can carry out “economic drilling [at] well below $50 a barrel,” WoodMacKenzie said. US-traded oil is at $46.99 as of this writing.

In all, the IEA forecasts a drop of 380,000 barrels in non-OPEC supply growth this year. Almost all of the projected cuts will come from other countries—175,000 barrels from Colombia, 95,000 from Canada, and 30,000 from Russia. That still leaves a considerable 2015 global supply surge of 900,000 barrels a day overall.