The market isn’t freaking out too much about the Syriza win in Greece

Greece has a new, far-left government, and the markets outside the country don’t seem too perturbed. For a few weeks the financial press has been chattering again about a possible Greek exit from the euro. Now that the austerity-bashing Syriza party is actually in power, the initial reaction has been pretty muted.

Greece has a new, far-left government, and the markets outside the country don’t seem too perturbed. For a few weeks the financial press has been chattering again about a possible Greek exit from the euro. Now that the austerity-bashing Syriza party is actually in power, the initial reaction has been pretty muted.

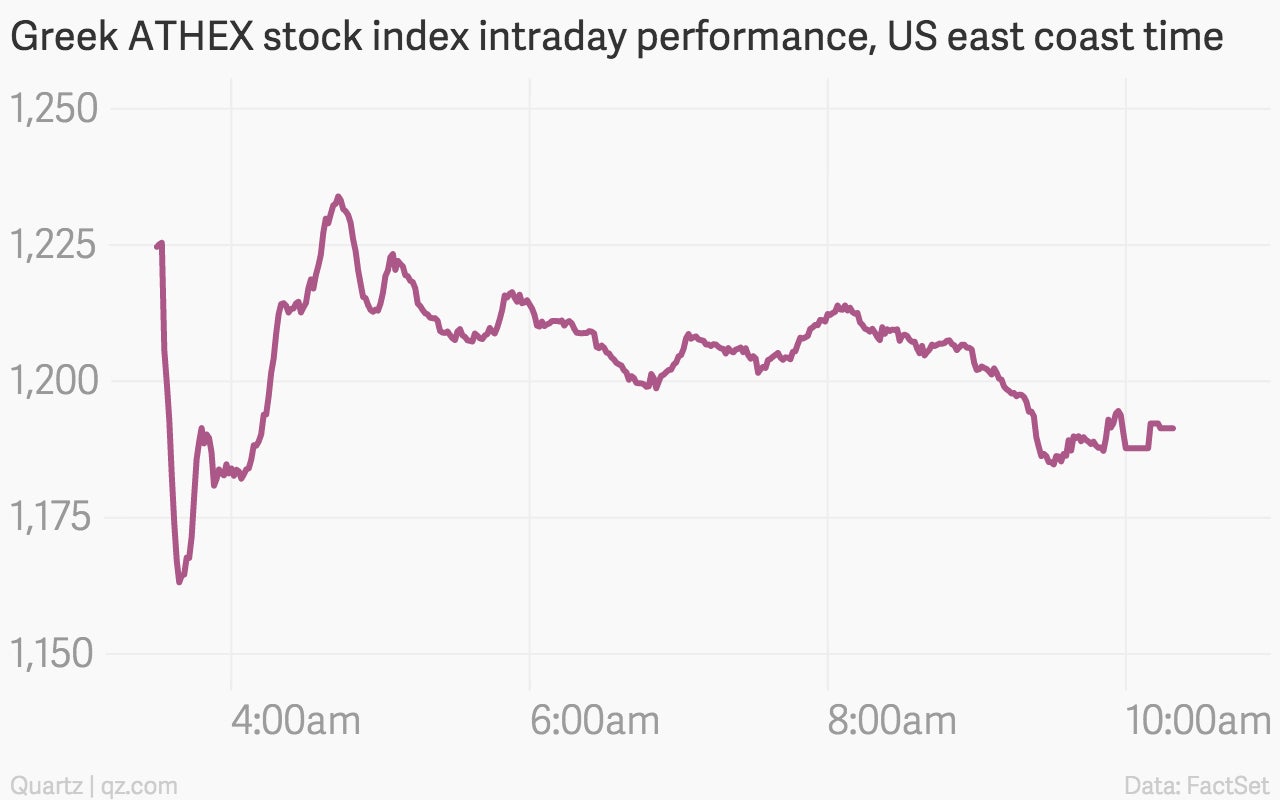

The Greek stock index initially nosedived, but then recovered before sliding again to close above the day’s lows.

Greek bond yields have been rising, and they went higher again today.

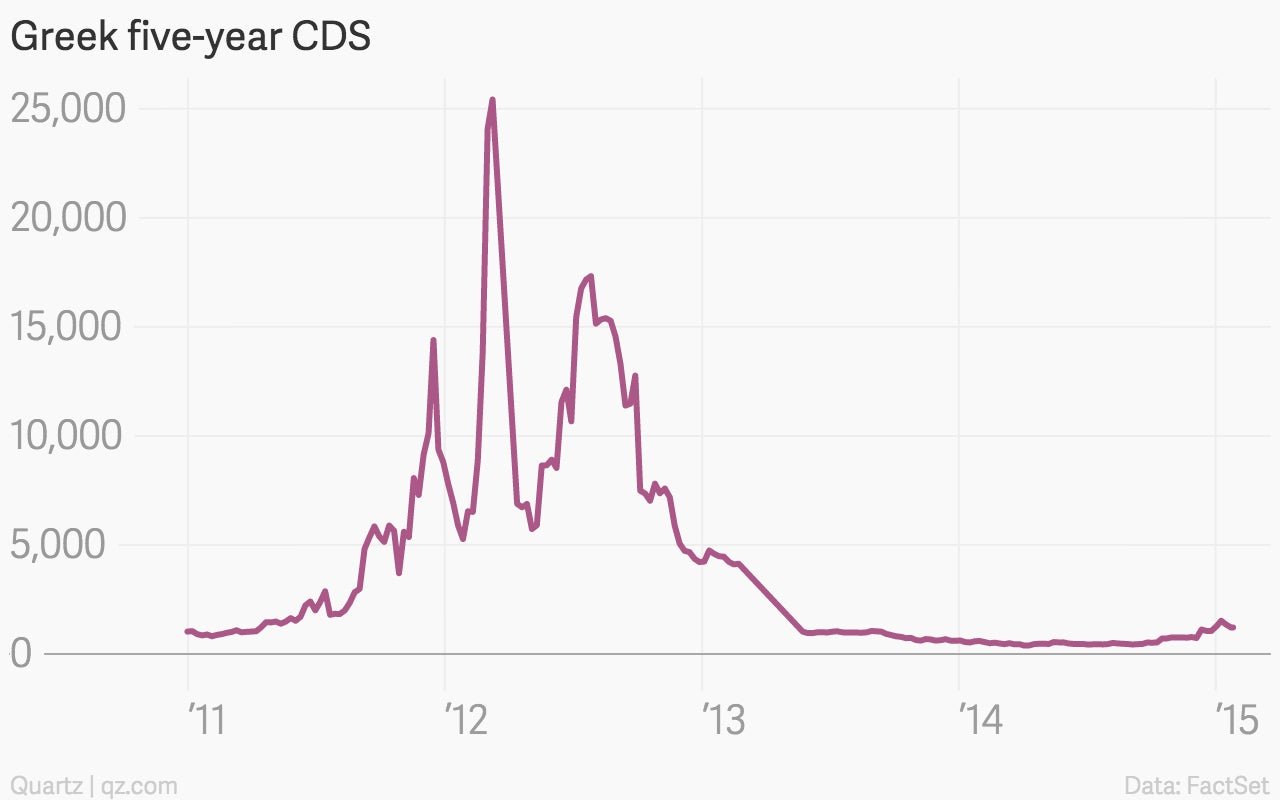

Credit default swap contracts—a gauge of the market’s odds of a Greek default—didn’t move, though it’s still higher than it was a few months back.

In contrast, the CDS price soared at the height of the debt crisis a couple years back.

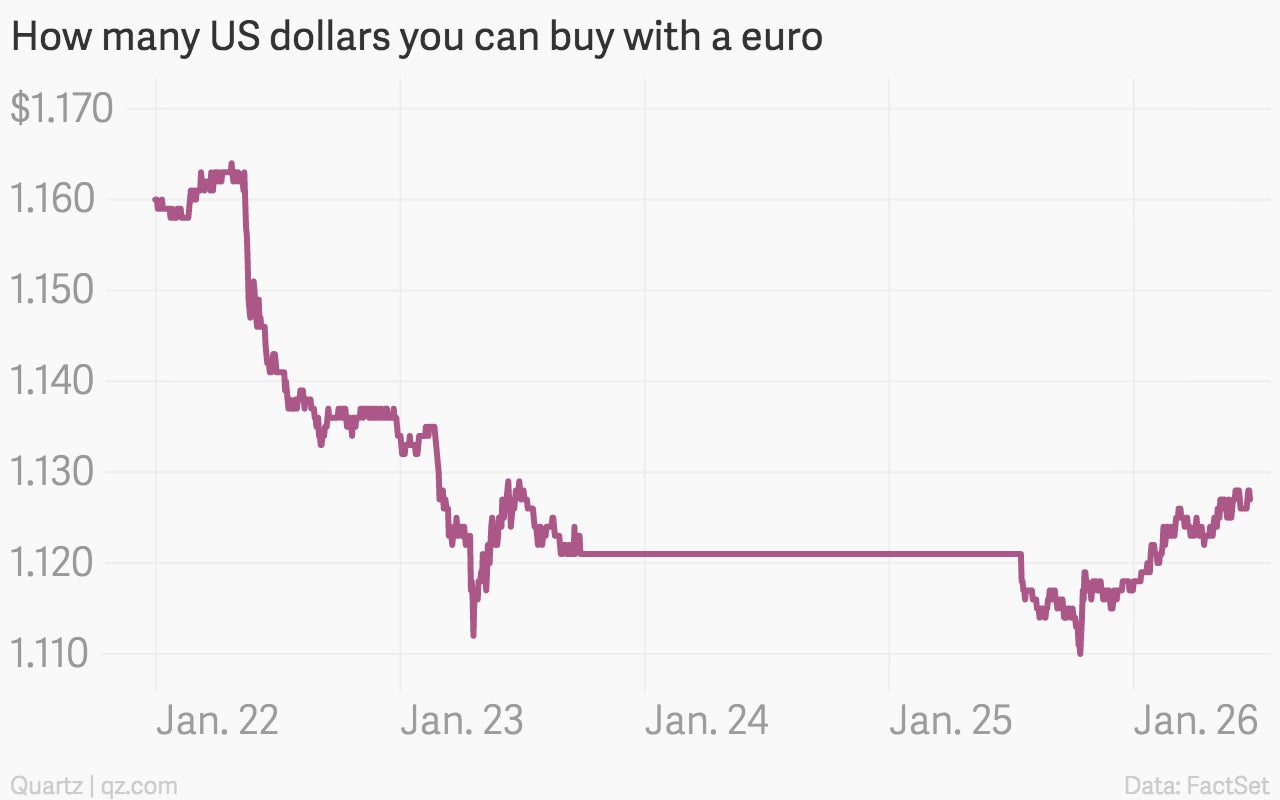

Elsewhere on the continent the euro strengthened a bit, as opposed to what happened a few weeks ago when Grexit fears were more pronounced.

All this suggests that investors are hopeful Greece’s new government won’t storm out of the euro just yet.