Okay, the market is freaking out a little about the Syriza win in Greece

At first the market was pretty sanguine about Greece’s election results, which saw the anti-austerity Syriza party take control of the government. But now it’s getting real. Newly installed prime minister Alexis Tsipras already has started laying the groundwork for Greece to stop paying down its debt, and he appointed a cabinet that is well-aligned with his goals.

At first the market was pretty sanguine about Greece’s election results, which saw the anti-austerity Syriza party take control of the government. But now it’s getting real. Newly installed prime minister Alexis Tsipras already has started laying the groundwork for Greece to stop paying down its debt, and he appointed a cabinet that is well-aligned with his goals.

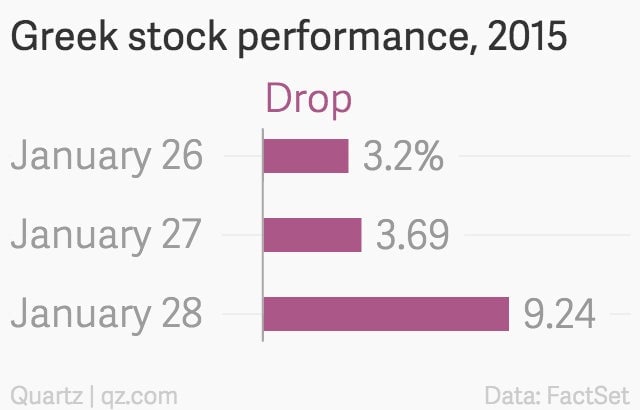

The Athex composite index, which began losing strength in December when the prospect of a Syriza win became a real possibility, plunged more than 9% today (Jan. 28); and the yield on 10-year Greek debt, which might soon get restructured, jumped more than a whole percentage point.

As the yield on safe-haven German debt continues to fall, the spread between Greek and German bonds is wider than it’s been since late 2012.

Th euro was fairly steady, though—suggesting the fear of a full-blown “Grexit” remains pretty muted.