Enders Game: The EADS CEO escapes European politicians after his first attempt failed

EADS, the European aerospace and defense champion, has announced an equity restructuring that would stop the governments of France and Germany, which both hold stakes in it, from meddling in business decisions.

EADS, the European aerospace and defense champion, has announced an equity restructuring that would stop the governments of France and Germany, which both hold stakes in it, from meddling in business decisions.

The company was formed in 2000 with the merger of the two countries’ largest defense firms. But while its Airbus passenger planes and Eurofighter jets found buyers, executives felt hobbled by conflicting demands from the company’s public stakeholders. The talks that EADS chief executive Tom Enders began earlier this year with BAE, the UK’s main aerospace and defense firm, were an effort to find business synergy but, more importantly, to dilute the power of investment blocs controlled by Paris and Berlin (as well as a smaller share controlled by Spain). The wheels fell off the merger talks after just a few weeks, when it became clear that the concerns of the various governments—largely the location of EADS/BAE facilities and the jobs that came with them—could not be reconciled.

It’s clearly difficult to run an international business like EADS with a global staff speaking multiple languages, but it gets all the harder when multiple sets of politicians second-guess every decision, and your ownership structure can be described as “a complex pact between the French state, French media firm Lagardère and German car firm Daimler.”

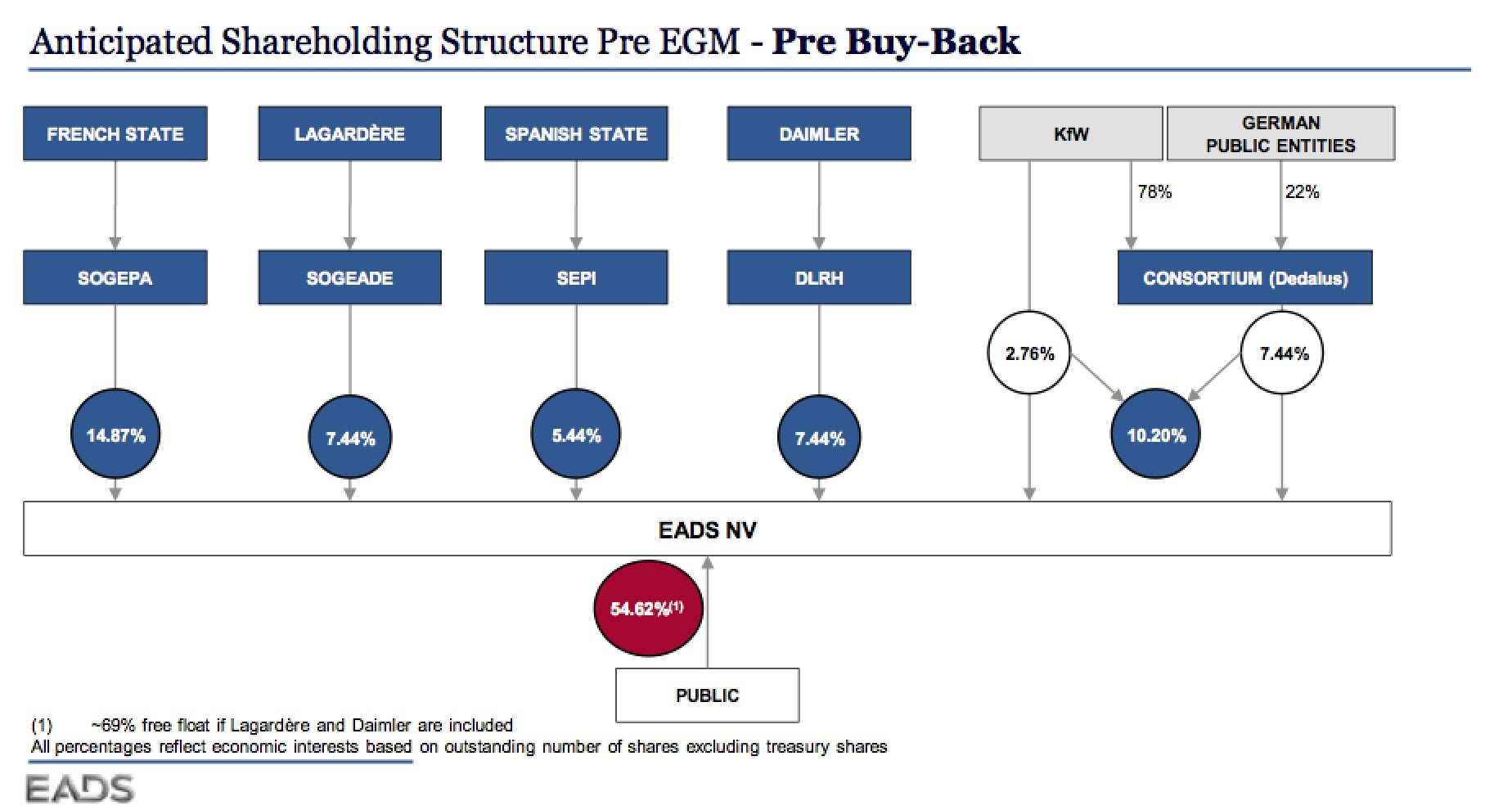

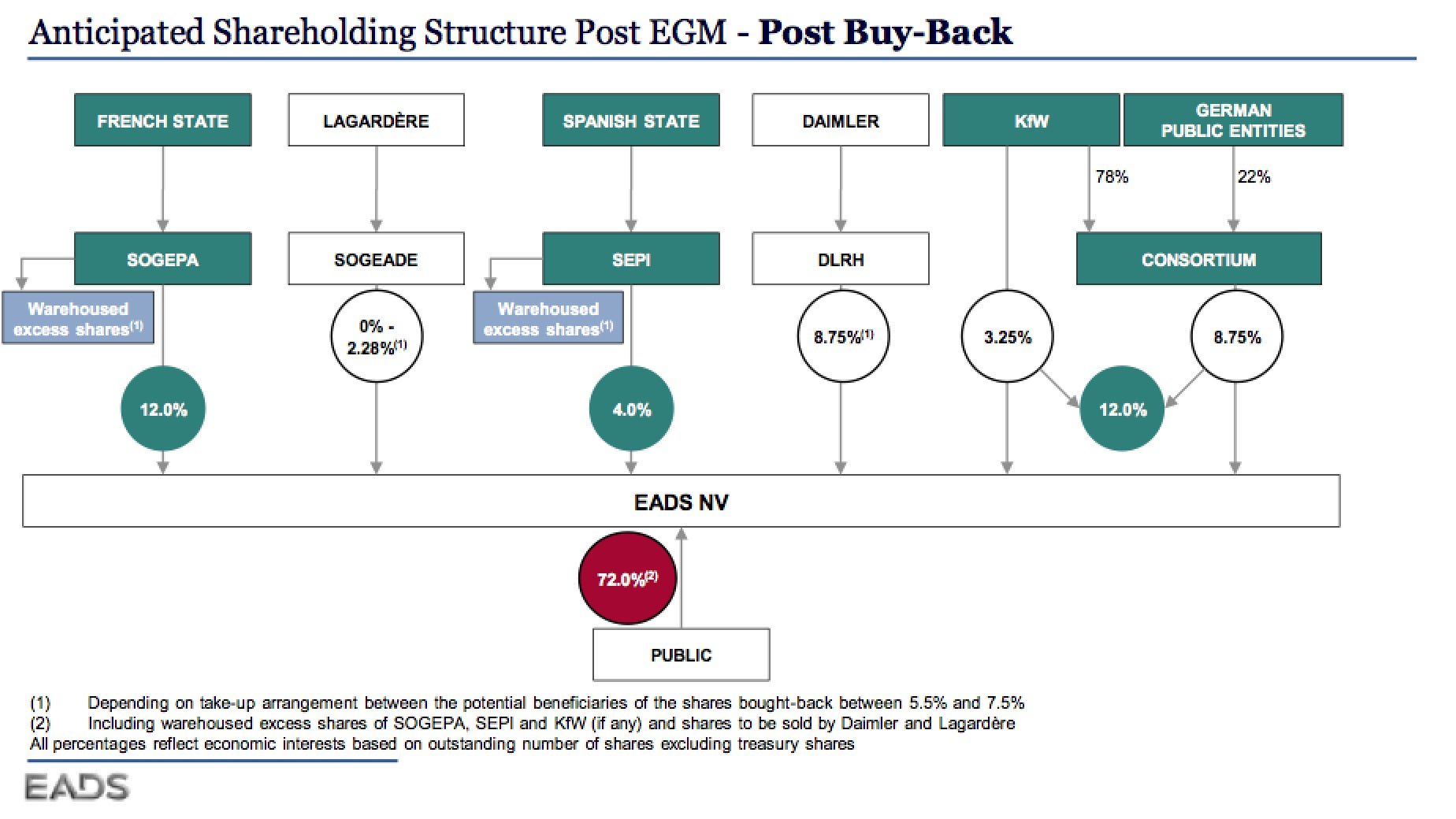

The diagrams from EADS of the old and new ownership structures are somewhat confusing:

But the key point is that Lagardère and Daimler will sell off parts of their shareholdings (cushioned by a company stock buy-back program) and will eventually be free to sell off the rest—which they probably will, since both have been wanting to move their investments to areas related to their core businesses. Private sector investors will eventually trade more than 70% of the firm’s value, up from a current level around 55%. And these diagrams don’t explain the biggest difference, which is that the French and German governments’ shareholdings will come with restrictions on their influence.

EADS stock is trading higher this week. That’s in in anticipation, analysts say, of a more nimble firm emerging to compete with its transatlantic arch-rival, Boeing. ”We are making a big leap forward in terms of governance, actually the most important change since the creation of our company more than 12 years ago,” Enders said in his statement.

The failure of the merger with BAE offered an object lesson in how political interference can tarnish an otherwise lucrative business deal. Defense contracting is a tricky enough business as it is, without having to balance the interests of many countries; EADS’s effective board of directors are some of the same people who are so deftly navigating the euro crisis.

But Enders’ determination to unseat his public minders clearly wasn’t dented in the messy link-up attempt. Assuming the plan is approved by shareholders early next year, as expected, it will only have taken him a few months longer than he hoped.