It’s getting better to be the little guy in US banking

Coming out of the financial crisis, it seemed pretty clear that banks needed size to survive. But now the little guys are catching up.

Coming out of the financial crisis, it seemed pretty clear that banks needed size to survive. But now the little guys are catching up.

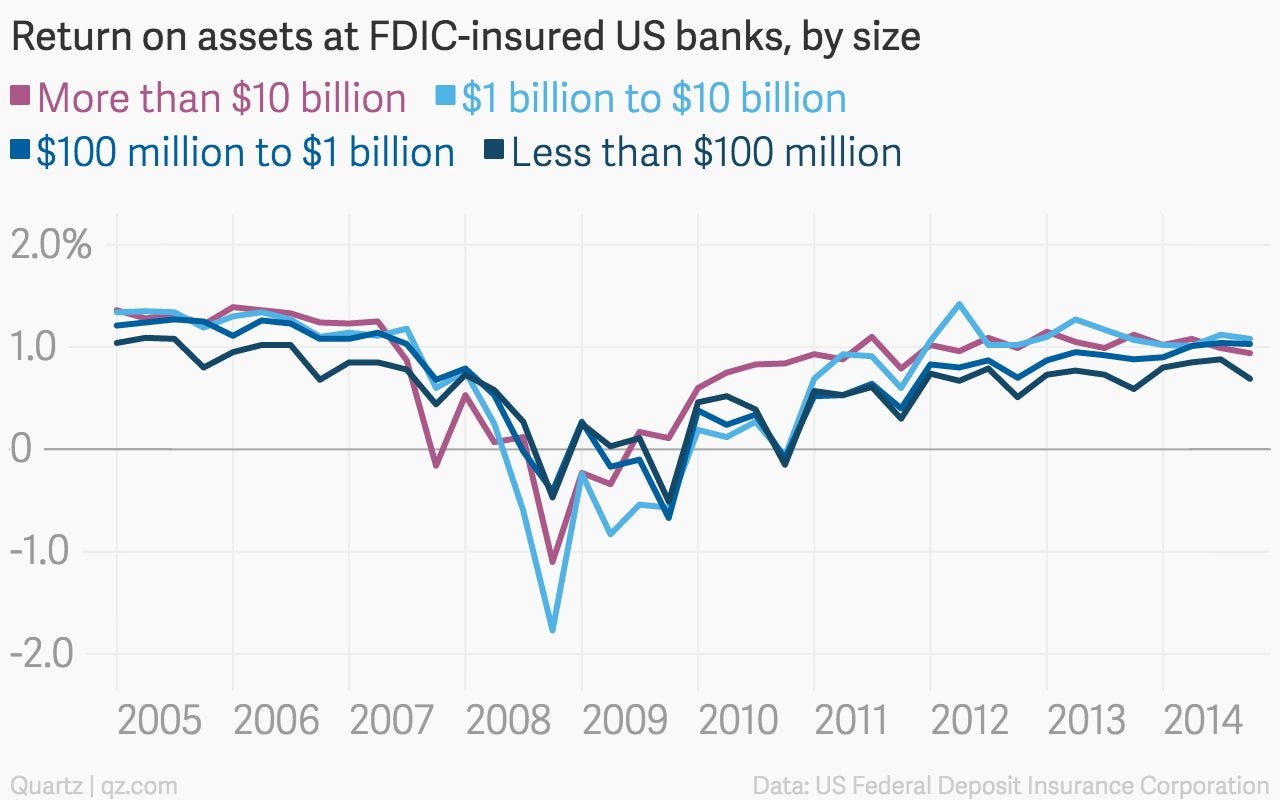

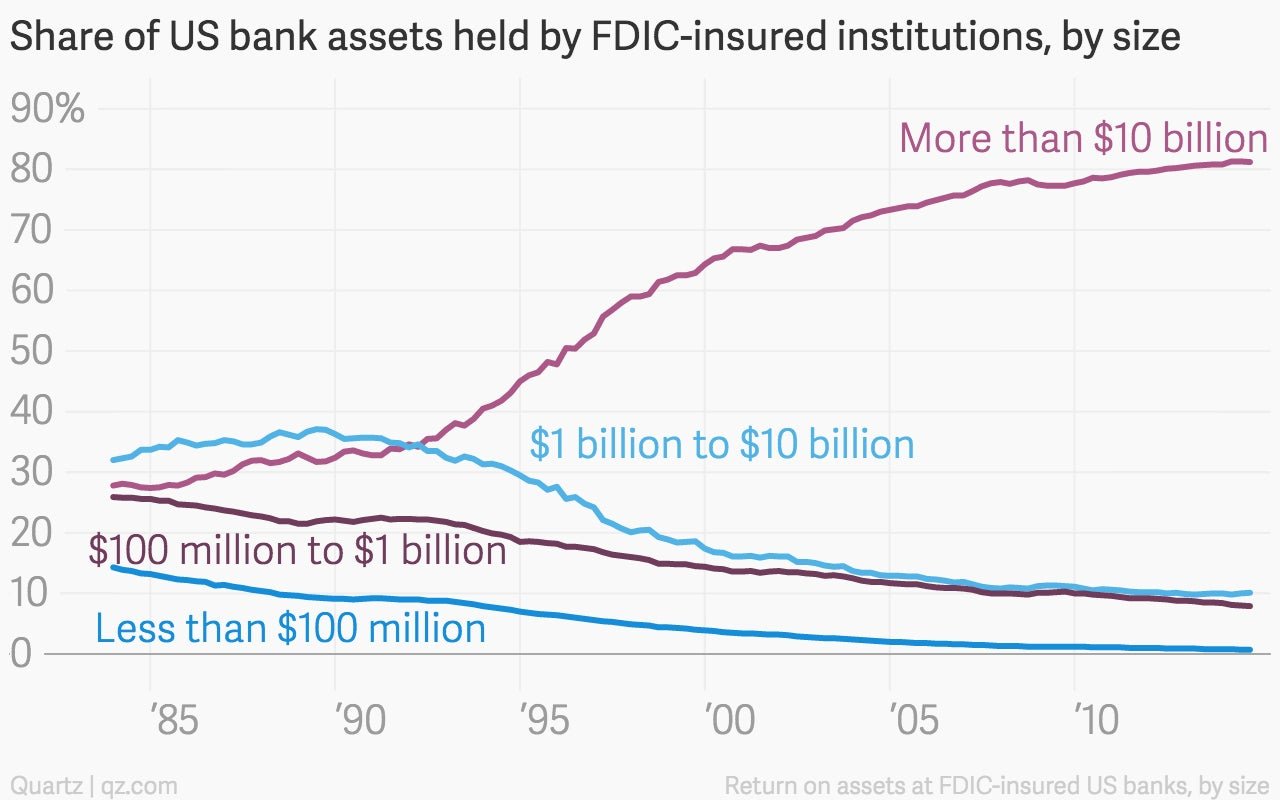

A big chunk of the statement accompanying the Federal Deposit Insurance Corp.’s latest quarterly banking report was dedicated to the improving fortunes of community banks. Loosely defined as banks with fewer than $10 billion in assets, these were the kinds of institutions that have more largely avoided the costly legal settlements that have dogged their megabank counterparts. And with less money going to lawyers and the feds, they’ve been reaping the benefits of the improving economy without much distraction, illustrated by the better returns they’re wringing from the assets on their balance sheets.

To be sure, the tiniest banks—those with fewer than $100 million in assets—are still having a harder time than most, and small banks overall have a lot less market share than they used to.

But everyone likes to root for the little guy.

Indeed, things are looking up for the $370 million-asset Industrial Bank in Washington D.C. In 2014, its return on assets was 0.69%. That’s weak by industry standards but it was Industrial’s best showing in a decade, as the bank moved foreclosures off its books and made more loans.

“The economy is getting better and we’ve put a lot of our problems behind us for now,” CEO B. Doyle Mitchell tells Quartz.

At the moment, that latter claim is one which very few big banks can credibly make.