Barclays is doing pretty well—if you ignore the billions in legal fees

As its domestic rivals reel from scandal and overreach, Barclays dropped an unexpectedly strong set of results (pdf) on the markets this morning. The bank recorded an annual profit of £2.8 billion ($4.3 billion) last year, up from £2.2 billion in 2013.

As its domestic rivals reel from scandal and overreach, Barclays dropped an unexpectedly strong set of results (pdf) on the markets this morning. The bank recorded an annual profit of £2.8 billion ($4.3 billion) last year, up from £2.2 billion in 2013.

Nevertheless, Barclays’ shares are sinking—like just about everything in banking these days, there is less than meets the eye in its latest results. After stripping out various adjustments from its “core” operations, the group in fact registered a net loss of £174 million for the year, down from a profit of £540 million the year before.

You can probably guess the inconvenient adjustments that the bank chooses to exclude from its headline results. Most notably, in the fourth quarter Barclays added a £750 million provision to cover the potential costs of a legal settlement on foreign-exchange manipulation, bringing the total set aside during the year to £1.25 billion. The bank put another £1.1 billion into its kitty last year to repay customers wrongfully sold dud insurance and hedging products.

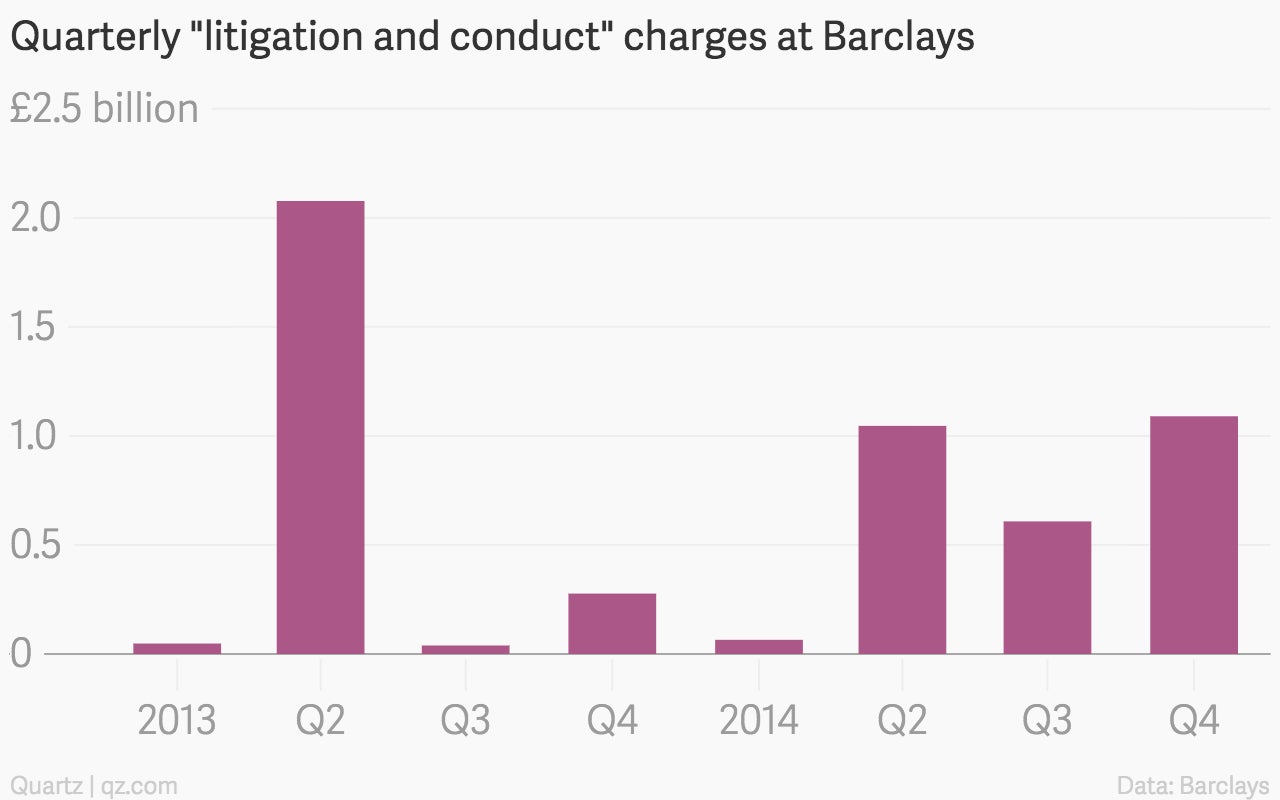

Altogether, last year “litigation and conduct” charges amounted to £2.8 billion, up from £2.4 billion in 2013:

“I share the frustration of colleagues and shareholders that matters like these continue to cast a shadow over our business,” chief executive Antony Jenkins said, repeating the mantra of so many bank bosses before him. Barclays has paid out more than £6 billion in fines, settlements, and other charges since 2011, and could face another £5 billion or so in penalties over the next few years.

Indeed, the “Legal, competition and regulatory matters” section of Barclays’ annual report runs to nine pages of tiny, single-spaced text. To appreciate the full scope of the bank’s legal entanglements, download this PDF and scroll down to page 306. Get comfortable, because it could be a while.