Australia’s miracle economy is losing altitude

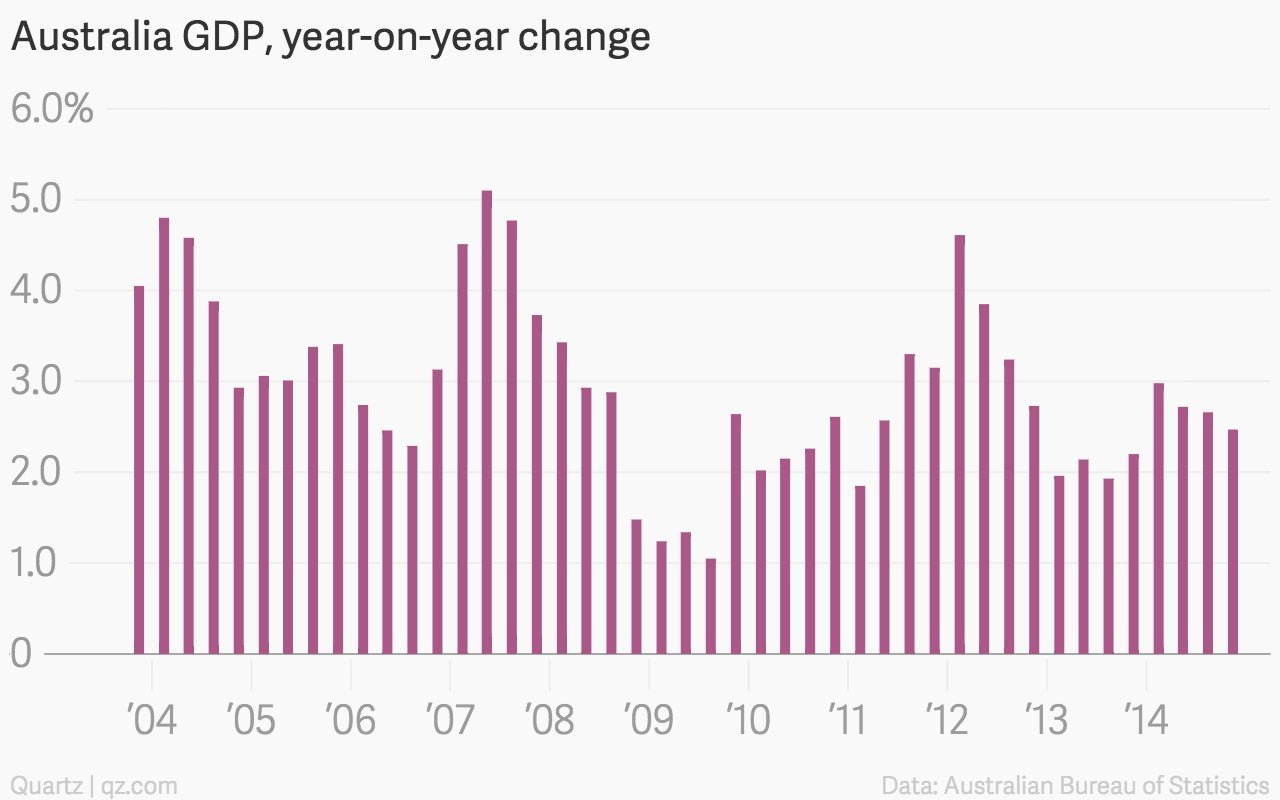

Australia’s business model of digging up stuff and selling it to China is in need of some tweaks, amid a growth slowdown in the People’s Republic. Fourth quarter GDP was up a slightly better-than-expected 2.5%, compared to the fourth quarter of 2013.

Australia’s business model of digging up stuff and selling it to China is in need of some tweaks, amid a growth slowdown in the People’s Republic. Fourth quarter GDP was up a slightly better-than-expected 2.5%, compared to the fourth quarter of 2013.

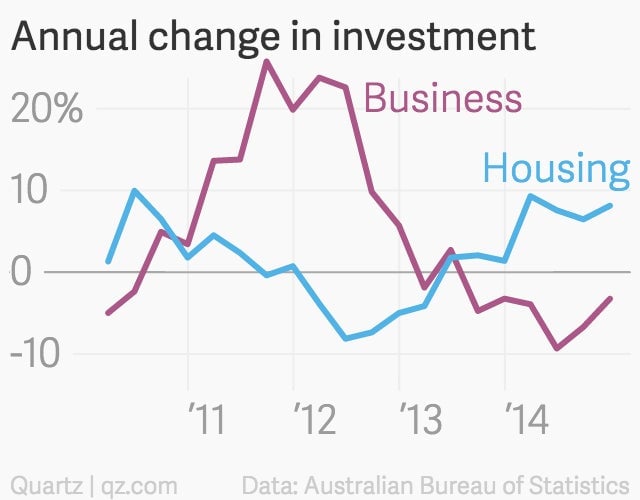

But, digging into the weeds of the report from the Australian Bureau of Statistics you can see the Australian economy shifting gears in mid-air. Investment in housing is taking over, after a huge boom in business investment petered out amid a collapse in commodities prices.

But is housing growth sustainable? After all, Australia by some measures has a housing bubble on its hands. This puts the Reserve Bank of Australia in a tough spot. All else being equal, the slowing Aussie economy would seem to require rate cuts to shore up growth. But those rate cuts risk inflating a bubble that’s already causing consternation about financial stability.