The Fed stress tested 31 big banks and everyone passed. Don’t you feel better now?

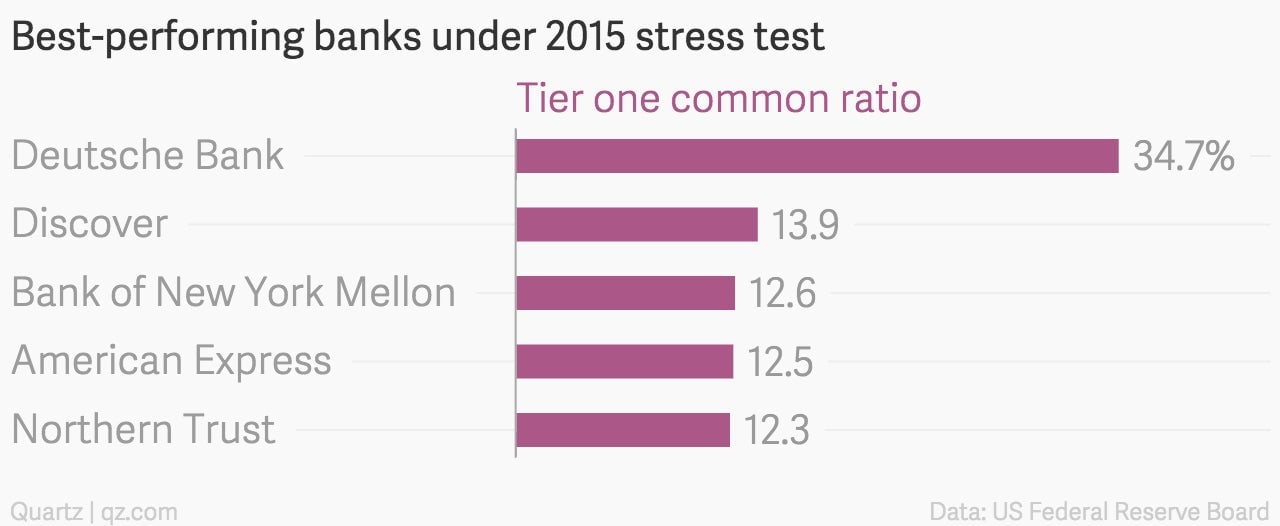

The US Federal Reserve issued its latest round of results measuring the strength of the country’s largest banks and it looks pretty good: All 31 institutions the Fed tested passed this go-around, meaning after running through a host of Armageddon-like scenarios, the Fed determined the banks would have enough of a capital cushion to stay afloat.

The US Federal Reserve issued its latest round of results measuring the strength of the country’s largest banks and it looks pretty good: All 31 institutions the Fed tested passed this go-around, meaning after running through a host of Armageddon-like scenarios, the Fed determined the banks would have enough of a capital cushion to stay afloat.

It’s not a completely clean bill of health. The banks face another test next week, when the Fed releases its opinions on proposals banks submitted for increasing dividends or buying back stock. If they clear that hurdle it likely means certain executives whose banks failed this portion last year will be able to keep their jobs.

So we should all breath a sigh of relief that the financial system is in good hands, right?

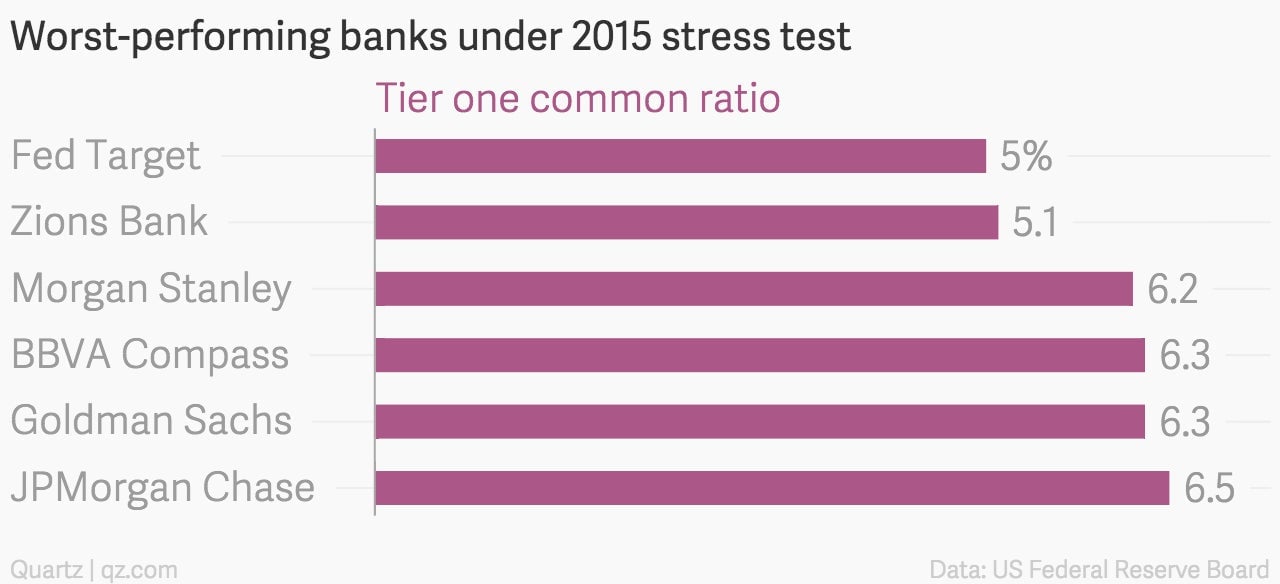

Maybe not. While the Fed says the results are evidence of a financial system significantly strengthened in the years since the financial crisis, skepticism abounds. Stanford finance professor Anat Admati tells Quartz the annual exam, which the Fed began administering in 2009 in hopes of avoiding another global financial meltdown, creates ”a false sense of security about the safety of banks.” The exercise, she says, is “a big charade.”

The hypothetical situations the Fed uses to test the banks’ mettle “don’t really account for what would happen in actual market scenarios in a still-fragile financial system,” Admati says, where asset values could swing wildly from their assumed book values and typically uncorrelated assets could suddenly act in lockstep with one another—making for scenarios that are impossible to predict, test, and prepare against.

Even the US Treasury’s office of financial research came out against the stress tests this week with a timely paper claiming the results have become too predictable to be informative and effective at protecting against actual shocks to the financial system. The paper further argues that banks could be “gaming” the system (they’re experienced at that, after all) to get past regulatory hurdles, creating “new, harder to detect risks in doing so.”

Admati, a tenured critic of the current banking system, also says the tests fail to miss the bigger picture: That banks shouldn’t be paying out dividends and issuing buybacks in the first place, because doing so, she argues, creates an incentive for the banks to borrow more, which in turn creates more risk.