QE4 announced, Chinese stocks surge. Coincidence?

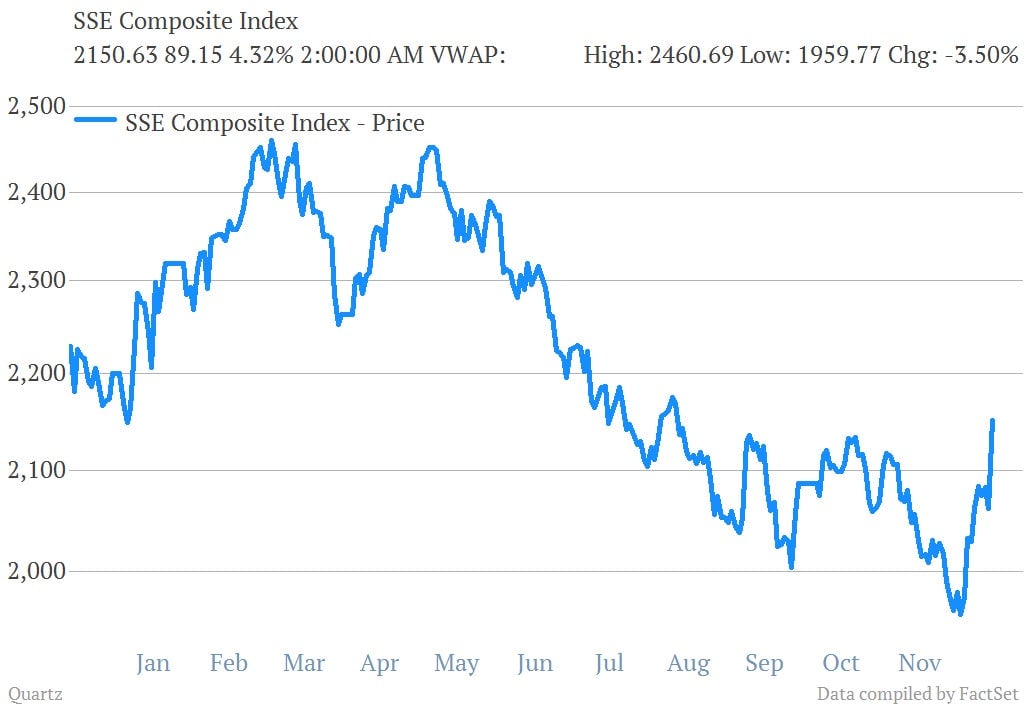

Mainland Chinese stocks surged today, thanks to data that suggested the all-important manufacturing sector may be rebounding slightly in December. The Shanghai Composite posted its biggest one-day jump in three years. The gain in the Shanghai Composite was the biggest single-day move since Oct. 9, 2009. The recent upturn in the market looks pretty stark, no?

Mainland Chinese stocks surged today, thanks to data that suggested the all-important manufacturing sector may be rebounding slightly in December. The Shanghai Composite posted its biggest one-day jump in three years. The gain in the Shanghai Composite was the biggest single-day move since Oct. 9, 2009. The recent upturn in the market looks pretty stark, no?

Hong Kong stocks also hit a 16-month high. So, is the market front-running a pronounced pickup in the Chinese economy? There are reasons to be skeptical. For one thing, the Shanghai Composite has had several blips that were bigger during its long downtrend over the last few years.

In fact, we can’t help but wonder whether the sharp move higher for Chinese stocks in recent days might have less to do with Chinese manufacturing data than with the Fed’s unveiling of QE4 earlier this week. As part of its latest decision the Fed said it would end its Operation Twist policy program—in which it swapped out its holdings of short term US government bonds for longer term bonds, but created no new net money—as previously planned. But it also said it would replace that program with a more traditional quantitative easing effort, in which it increases the quantity of money—i.e., prints it—and uses it to buy bonds.

In the Fed’s recent experiments with such policies, such outright money creation has been more likely to spill over into other markets, such as commodities and emerging market stocks, than its Twist effort, which wasn’t accompanied by as pronounced a spike in commodity prices. All those freshly created dollars that the Federal Reserve is pushing into financial markets have to go somewhere, and many of them have flowed to higher-yielding investments: emerging-market debt, currencies, and commodities.

The attraction of capital to those markets has the effect of strengthening the currencies of many emerging market nations. That’s something they don’t like, since it makes the exports on which their economies rely on more expensive to foreign buyers. Indeed, the Hong Kong Monetary Authority has recently stepped into the market to push back against a flow of capital rushing to buy Hong Kong dollars—yet another skirmish in such so-called currency wars.