Americans love their ATMs more than online banking

Americans still like to get their banking done the old fashioned way—at banks.

Americans still like to get their banking done the old fashioned way—at banks.

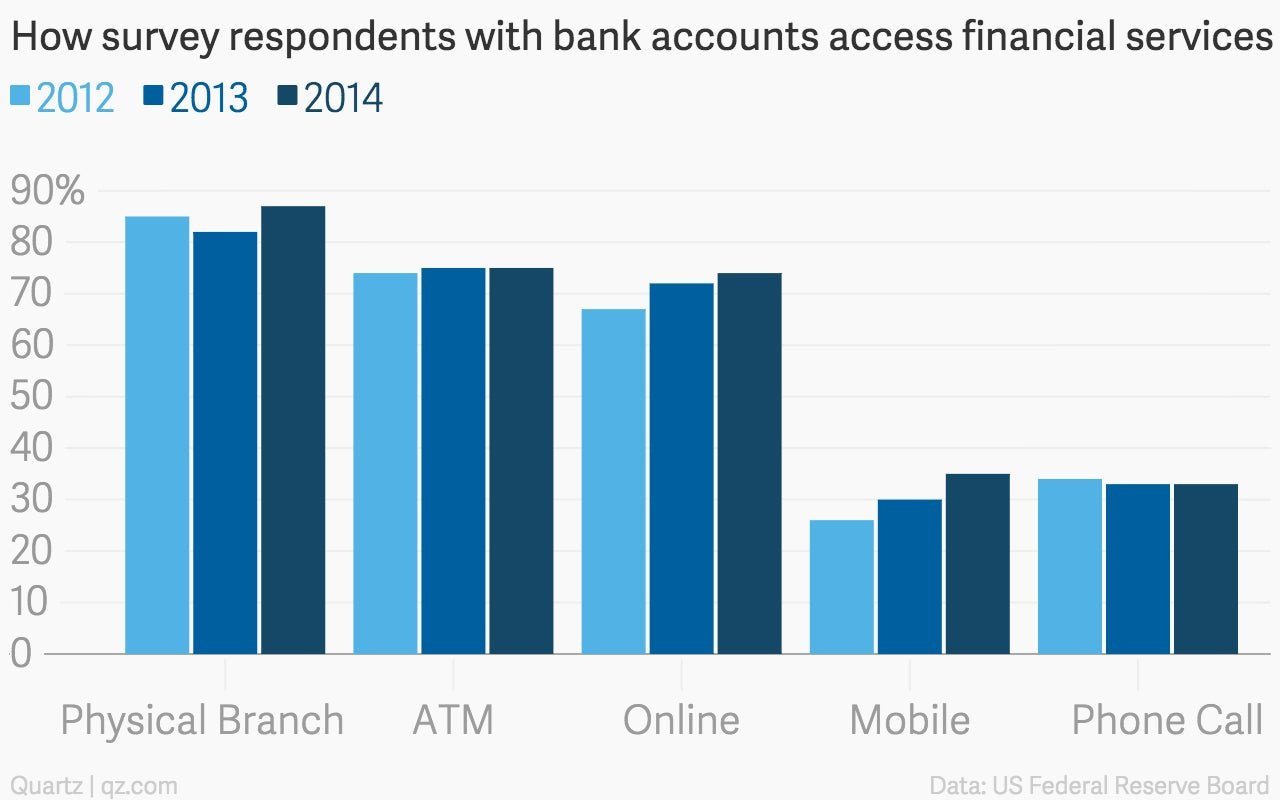

More of them prefer using a physical ATM than banking online. And the kind of phone banking that relies on apps and text messages is only now becoming more popular than the kind that uses actual phone calls.

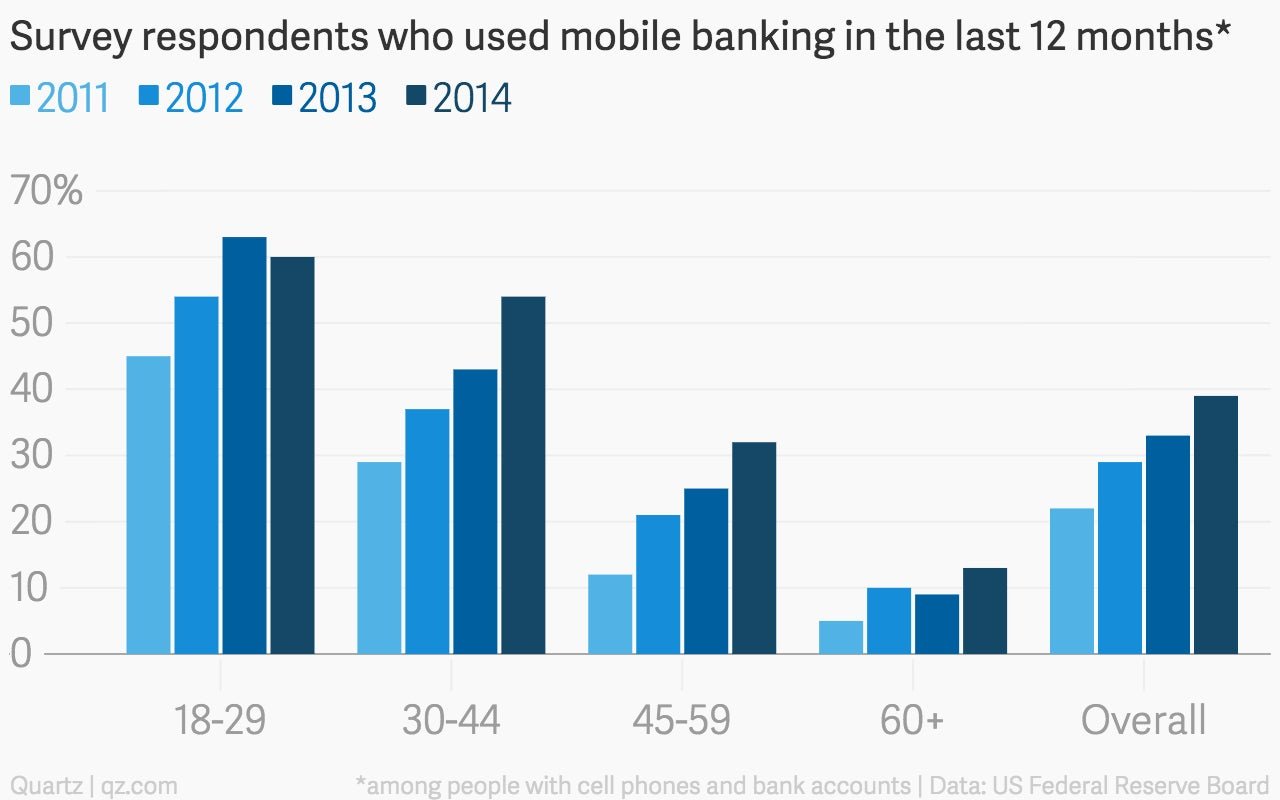

The Federal Reserve just released the latest edition of its annual survey on banking habits, and the report is chock full of interesting nuggets about the way Americans interact with their money. Like this: The age group that saw the biggest growth in its use of mobile payments was 30- to 44-year-olds, not their venmoji-using younger peers. And though the younger group is still the mostly likely to use mobile devices to manage payments, the gap between them is shrinking rapidly.

Curiously, that same youngest age group was the only one to see a decline in its use of mobile banking in general in 2014. The survey doesn’t give a reason for the dip.

Mobile banking may be growing, but it’s still not a very popular way for Americans to interact with their bank accounts.