After Japan’s election, the market thinks the Bank of Japan is about to join the money-printing party

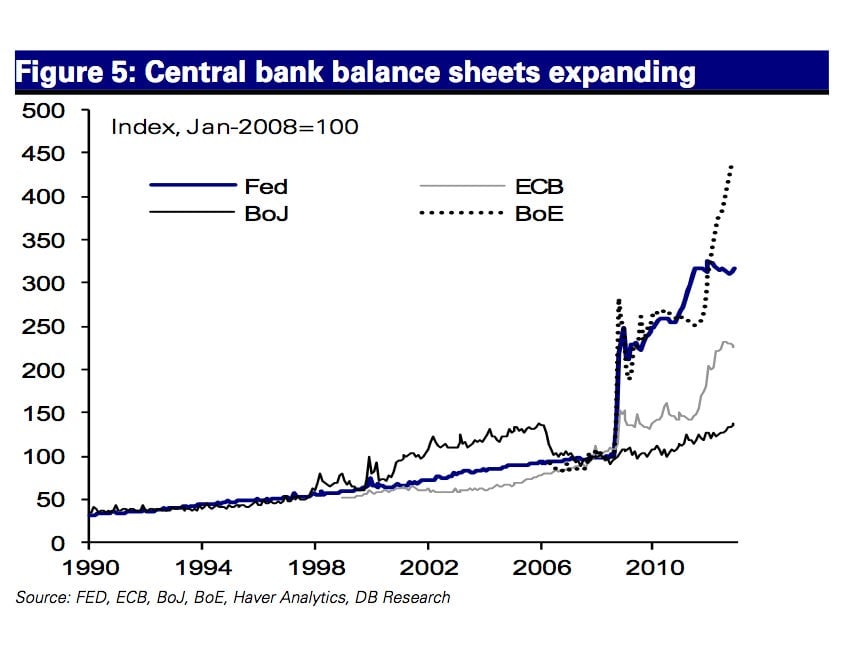

Here’s an intriguing little bit of monetary-policy history. The chart below shows how various central banks have been reacting to the global financial crisis. It tracks the growth of central bank balance sheets (essentially the creation of new money, as the US Federal Reserve is doing with its “quantitative easing”, for example.) Two things about it are notable. See if you can spot them both.

Here’s an intriguing little bit of monetary-policy history. The chart below shows how various central banks have been reacting to the global financial crisis. It tracks the growth of central bank balance sheets (essentially the creation of new money, as the US Federal Reserve is doing with its “quantitative easing”, for example.) Two things about it are notable. See if you can spot them both.

Ready? The first notable thing is that the central banks of the US, the EU and the UK have been much more forceful in their response to the global financial crisis than Japan’s, which looks, essentially, like nothing in comparison. That’s kinda obvious from this chart.

And the second is that it shows how much more forceful the Fed in particular is being now than the Bank of Japan was in reacting to the very similar Japanese real estate bust/financial crisis/recession that started in the early 1990s.

This disparity is pretty key to understanding the implications of last weekend’s Japanese election, in which the Liberal Democratic Party won a landslide victory.

The markets were pleased. (The Nikkei jumped a bit less than 1% to an eight-month high.) You’d think after a decades-long battle with deflation folks might be less than enthusiastic about the prospects for a new government (which is actually the old government that got Japan into this mess) to reinvigorate economic growth. So what’s everybody excited about?

Well, for one thing Shinzo Abe, who is set to be Japan’s new premier, turned this election into nearly an outright referendum on the Bank of Japan, and whether it is doing enough to jolt the economy back to life. Departing from the somewhat genteel detente that exists globally between elected officials and central bankers, Abe promised to bring pressure to bear on the Bank of Japan in hopes of forcing it to adopt a more aggressive asset-purchase program. On Monday, Abe said that the Bank of Japan should take the results of the election into account when it holds its monetary policy meeting on Wednesday.

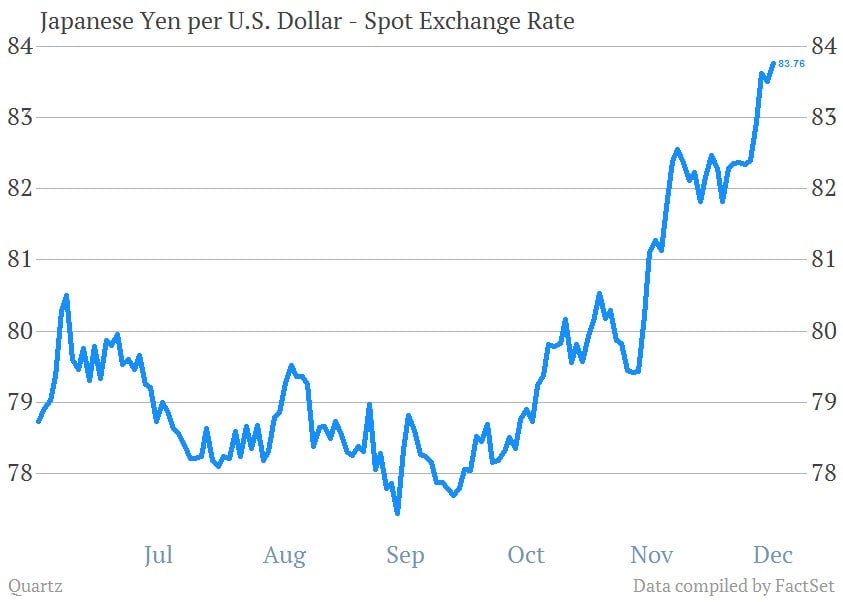

As Abe’s campaign appeared to gather steam, the yen weakened considerably, suggesting that the markets expect that the Bank of Japan will indeed ramp up its money creation. The LDP victory hammered the yen down further this weekend. This chart shows the US dollar exchange rate versus the yen, as the dollar gets stronger the yen gets weaker.

A weak yen is of course a good thing for Japan’s export driven economy. But more to the point, it shows that the markets think there is indeed quite a lot more that the Bank of Japan could do. It’ll be interesting to see how hard Abe pushes it.