Private equity, Walmart, Dick’s Sporting Goods flee from taint of rifle used in Newtown

The American firearms industry is suddenly in crisis as private equity firm Cerberus Capital Management, the subject of a Quartz profile on Monday, said it would sell its market-leading portfolio of gun firms. Who wants to own the company that made the gun used in the Newtown, Connecticut, massacre?

The American firearms industry is suddenly in crisis as private equity firm Cerberus Capital Management, the subject of a Quartz profile on Monday, said it would sell its market-leading portfolio of gun firms. Who wants to own the company that made the gun used in the Newtown, Connecticut, massacre?

Perhaps no one.

Walmart, the largest gun seller in the United States, on Monday removed the Bushmaster Patrolman’s Carbine M4A3 from its website, though it continued to sell the gun in store. And on Tuesday morning, Dick’s Sporting Goods said it would no longer sell that gun and similar semiautomatic assault weapons at all. Those moves came as support appeared to swell for a renewal for the assault weapons ban that prevailed in the US between 1994 and 2004.

Cerberus said it was exiting the gun and ammunition business to avoid the burgeoning debate over gun regulation in the United States. “We are investors, not statesmen or policy makers,” the publicity-shy Cerberus said in a statement. “It is not our role to take positions, or attempt to shape or influence the gun control policy debate.”

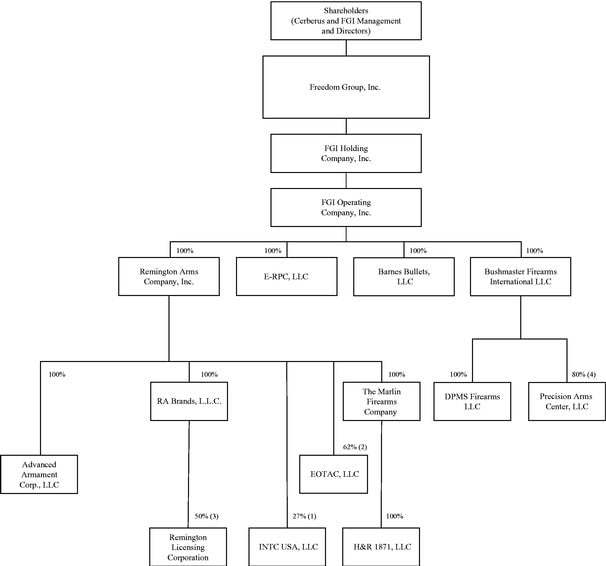

As we detailed on Monday, Cerberus owns a holding company called Freedom Group that dominates the US firearms industry, selling 1.2 million long guns and 2.6 billion bullets in the 12 months between April 2009 and March 2010, the most recent year for which data is available. It leads the American market for semiautomatic weapons, traditional rifles, handguns, and bullets.

By its own account, Freedom Group’s Bushmaster brand sells 48% of the country’s “modern sporting rifles,” the kind of assault weapon used in Newtown and other recent mass shootings, which are popular among young men and have been a rare source of growth for a struggling industry.

Freedom Group reported its firearms sales were up 23% in the quarter that ended on Sept. 30. “These increases were primarily the result of strong market demand for modern sporting products,” the company said.

Its biggest customer was Walmart, accounting for 13% of sales. Walmart has almost singlehandedly popularized the AR-15 style rifles produced by Bushmaster. Dick’s is also a major player in the gun industry, and reports have suggested that it sold the weapon used in Newtown. Dick’s said it was suspending sales of such rifles “during this time of national mourning.”

Private equity—and Cerberus, in particular—have a long history of investing in “sin” companies, like tobacco and alcohol firms, that others are unwilling to touch. But if manufacturing guns and ammunition is too scandalous even for Cerberus, the whole industry could be facing an inflection point.

Cerberus had faced mounting pressure on Monday night to address its stake in the gun companies. California Public Employees’ Retirement System, an investor in Cerberus funds, said it was reevaluating its stake. And Bloomberg reports that the father of Cerberus CEO Stephen Feinberg is a resident of Newtown.

Cerberus may be able to find buyers for some of its firms—like Remington, the nation’s oldest and best-known gun company—that produce handguns and traditional rifles, which may not be further regulated in the wake of the Newtown shooting. Ammunition firms may also prove to be an attractive synergy to companies that currently only produce guns, like Smith & Wesson. Other private equity firms are heavily invested in the gun industry and may seek to pick up properties in a fire sale.

But it’s far from clear that anyone would be willing to pick up Bushmaster in the current climate. In fact, a likely outcome is that Cerberus is unable to find a buyer for Bushmaster and holds onto the firm while ducking some of the immediate public scrutiny.

When Cerberus attempted to take Freedom Group public, only to pull the offering in April 2011, it detailed the holding company’s structure in a filing with the US Securities and Exchange Commission: