The US government holds more than $875 billion in student loan debt

This post has been corrected.

This post has been corrected.

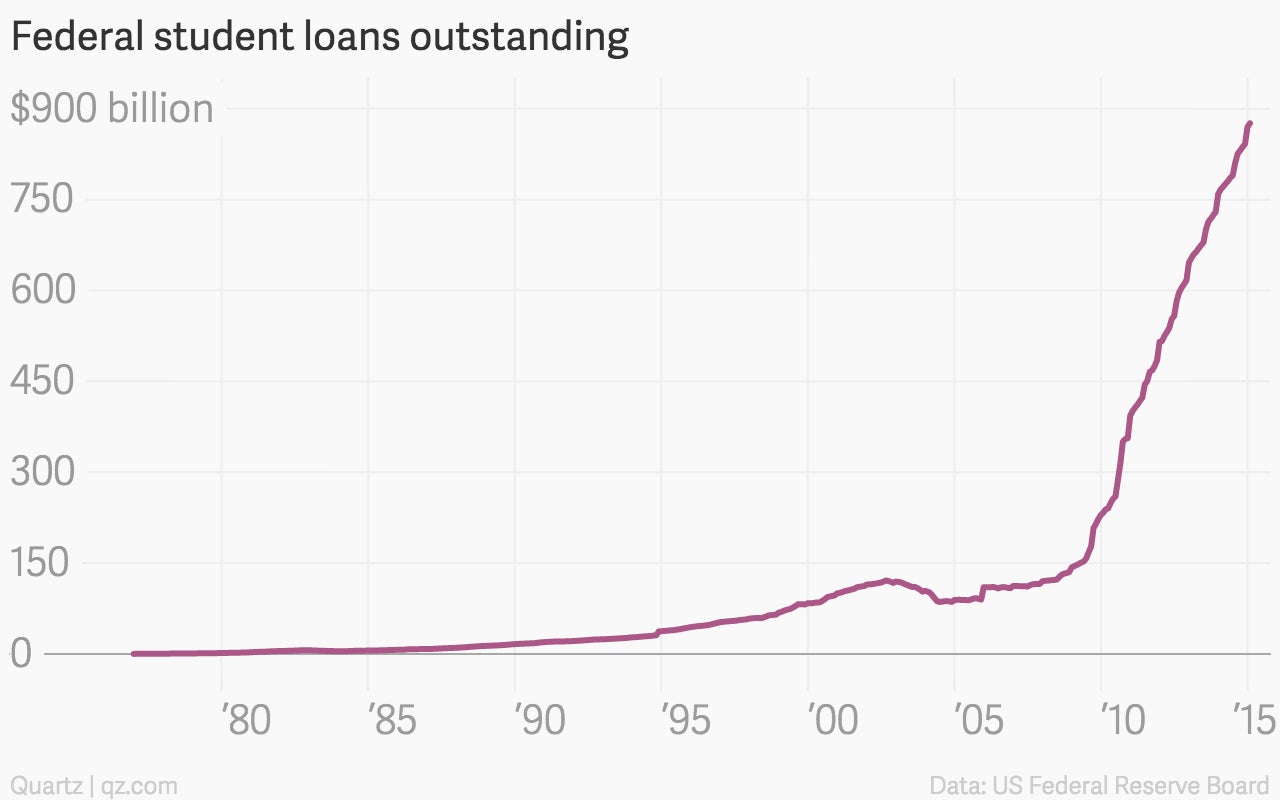

Americans are taking on new debt at a strong pace—7% more than last year, according to the Federal Reserve. But one statistic that sticks out, particularly in chart form, is the student debt held by the US government. In February it clocked in at $876.1 billion, the most ever recorded by the Fed.

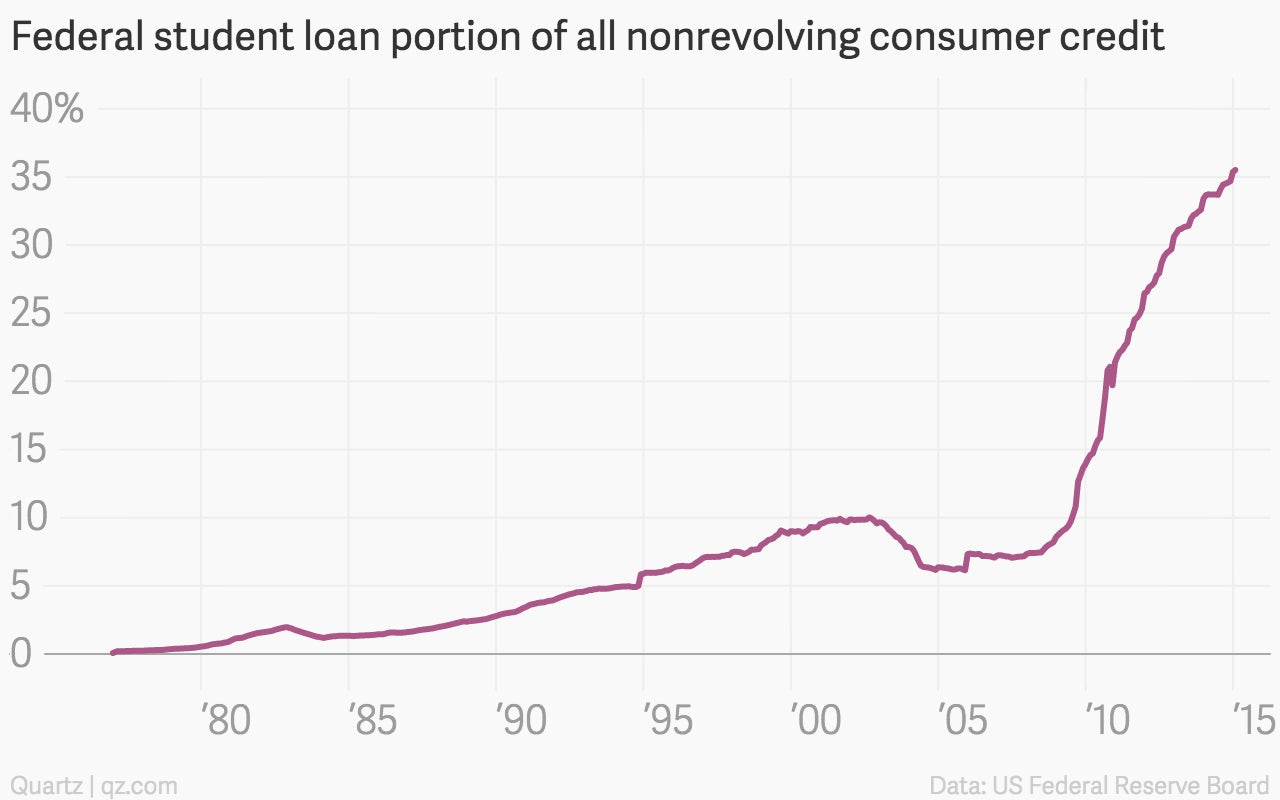

The huge spike over the last five years or so can be explained by all the people who went back to school during the recession. Around the same time, the government decided to play a biger role in the student loan business, lending to students directly instead of guaranteeing loans made by private lenders. Another record? The portion of all nonrevolving consumer credit (think auto loans and personal loans), made up by those federal student loans, which stands at 35.5%.

The default rate on federal student loans stands at about 14%, a figure that’s skewed by for-profit schools, where higher-than-average percentages of students take out higher-than-average loan amounts to fund their education. But as the job market improves and the economy continues to grow slowly but surely, that number should fall—and these charts should look a lot less scary.

An earlier version of this post incorrectly reported that the government held $875 million, rather than $875 billion, in student loan debt.