Why did mainland Chinese investors suddenly go on a Hong Kong buying spree?

Last November, when China allowed mainland residents to trade shares in Hong Kong and Hong Kong investors to access previously closed off Chinese companies, there was widespread speculation that tidal waves of money would start to flow between mainland China and Hong Kong. Those expectations fell flat—until now.

Last November, when China allowed mainland residents to trade shares in Hong Kong and Hong Kong investors to access previously closed off Chinese companies, there was widespread speculation that tidal waves of money would start to flow between mainland China and Hong Kong. Those expectations fell flat—until now.

In recent weeks, and particularly the past few days, the “southbound” trading in Hong Kong stocks by mainland investors has suddenly surged:

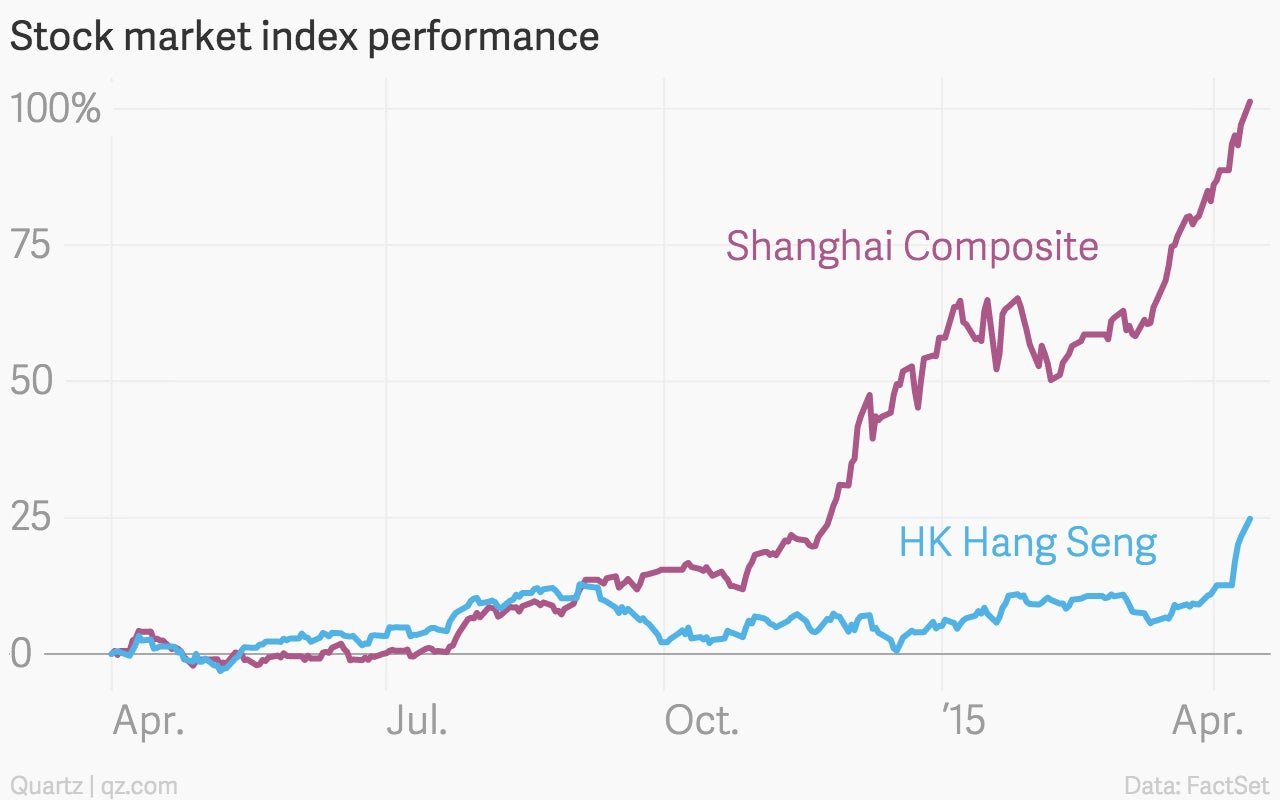

What gives? The move could be tied to Chinese regulators recently allowing local mutual funds to invest in Hong Kong stocks, opening up the market to a broader group of mainland savers, who have limited options for investing their cash at home. And the mainland market’s heady rise this year—which is almost totally divorced from the country’s slowing economy—has encouraged lots of people to open brokerage accounts, few of whom are very well versed in the world of finance. Stocks are going up, so more people sign up to buy stocks, which pushes stocks up, at least for a while:

Even after the recent rally, Hong Kong shares seem like a bargain compared with their counterparts on the mainland. Shares that trade in both markets are still worth 20% more on the mainland than in Hong Kong, on average. In theory, an open market for trading between the two markets will narrow this gap—which implies a further rise in Hong Kong stocks.

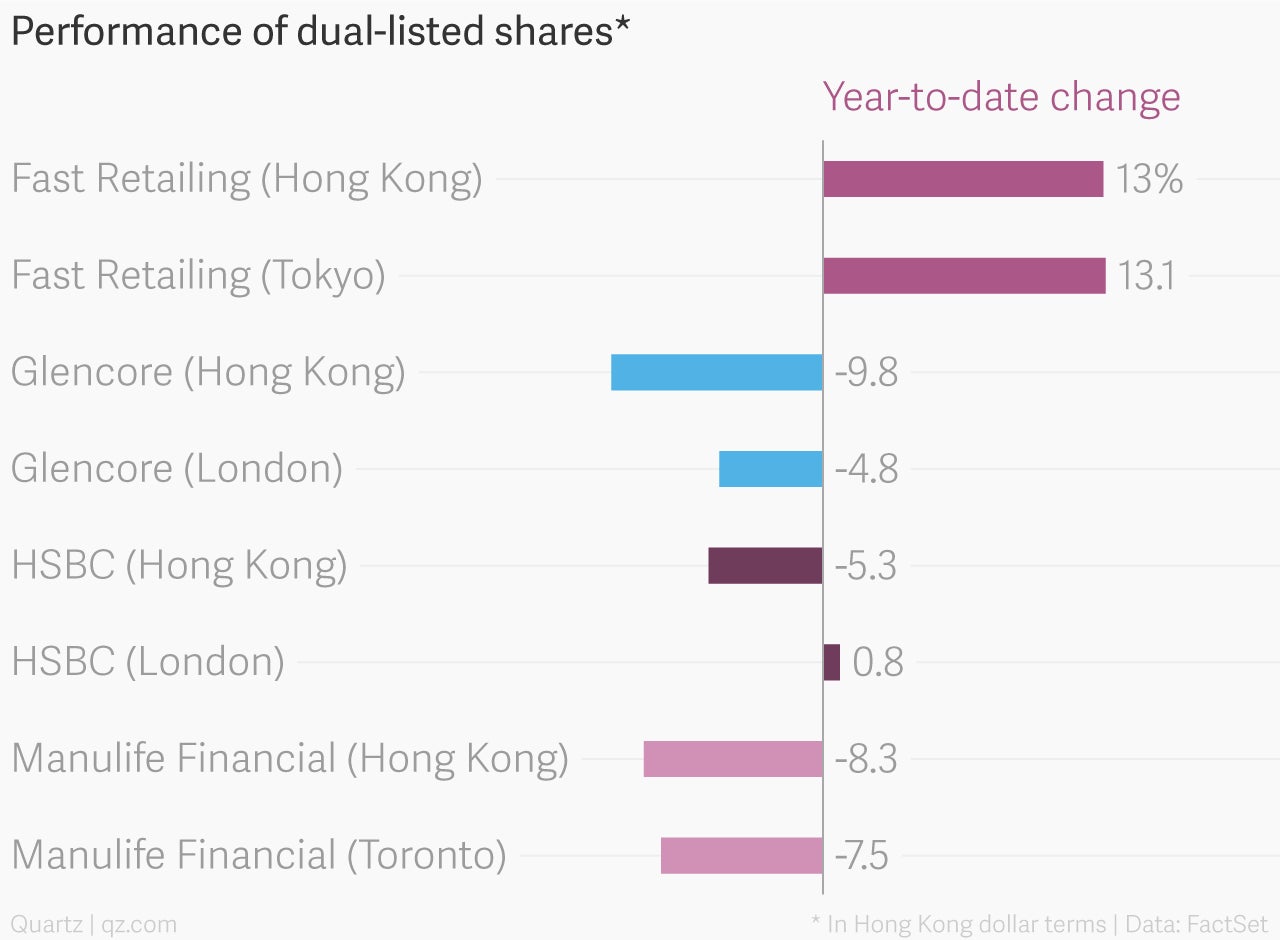

Some of the best performing dual-listed shares in recent days were those that traded at the biggest premiums on the mainland relative to Hong Kong, suggesting that investors have developed a rather simple (and predictable) system for screening shares.

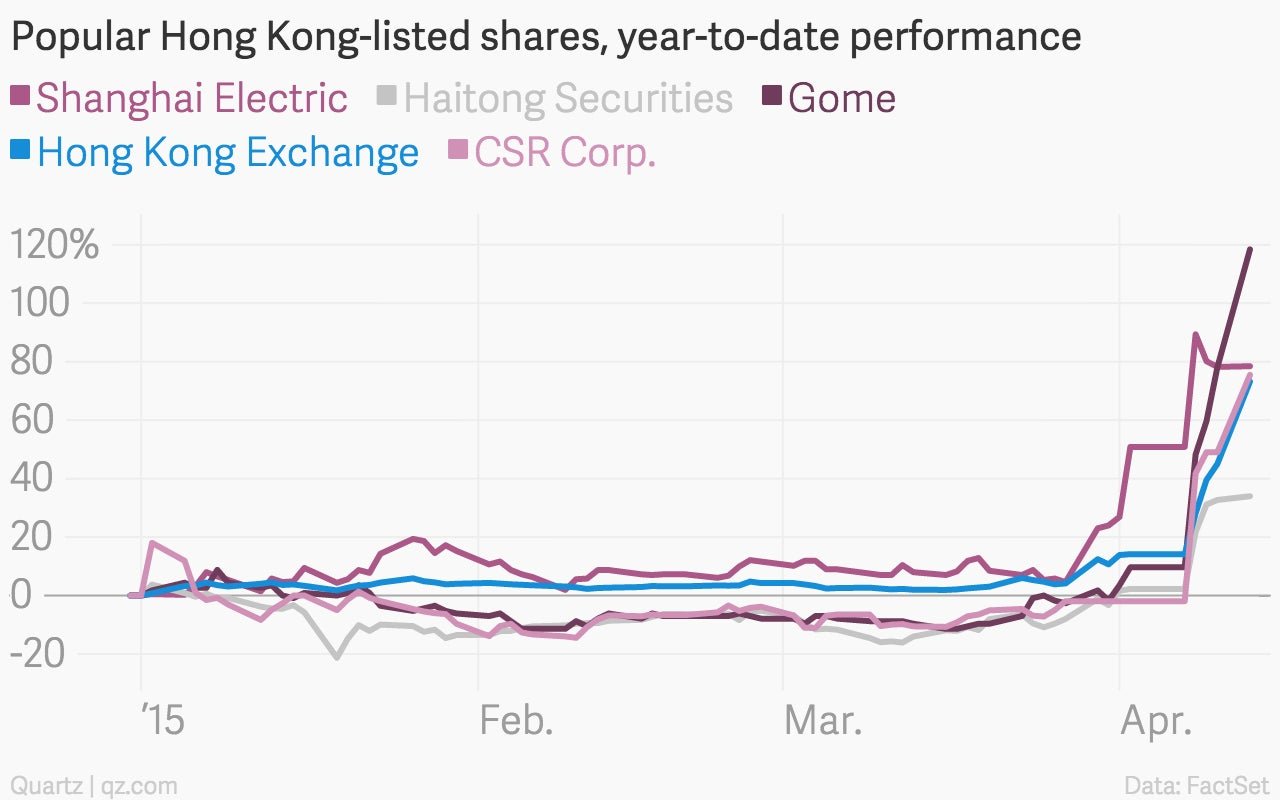

But a look at the most popular Hong Kong shares also shows a basic preference for companies already known to mainland investors. For example, the share price of electronics retailer Gome—which does most of its business on the mainland but is listed solely in Hong Kong—has more than doubled in just the past two weeks.

The market rally also seems to be self-fulfilling. For example, shares of brokers like Haitong Securities have risen as investors bet that the investment boom will boost the shares of investing-related companies. Indeed, the most heavily traded shares today were in the operator of the Hong Kong stock market itself, which gained nearly 20%, making it the most valuable exchange operator in the world (paywall).

Plenty of foreign firms have Hong Kong listings—the city-state is one of the world’s most important financial centers, after all—which might suggest that the market euphoria would boost their shares as well. However, so far the party hasn’t spread to the big multinational names whose shares trade in Hong Kong. For example, so far this month, the shares of luggage maker Samsonite have risen by a modest 3% and luxury group Prada have fallen by 4%. Companies with multiple listings also haven’t seen much uplift in Hong Kong relative to other exchanges:

For now, to many foreign companies’ chagrin, China’s market madness is largely a local affair.