Here’s the perfect portfolio for 2012 you failed to create

It’s that time of year again, when traders tended to square up their positions and await the imminent implosion of the US financial system. We figured it was worth showing you how you could have constructed a world-beating portfolio that would have destroyed the competition in 2012.

It’s that time of year again, when traders tended to square up their positions and await the imminent implosion of the US financial system. We figured it was worth showing you how you could have constructed a world-beating portfolio that would have destroyed the competition in 2012.

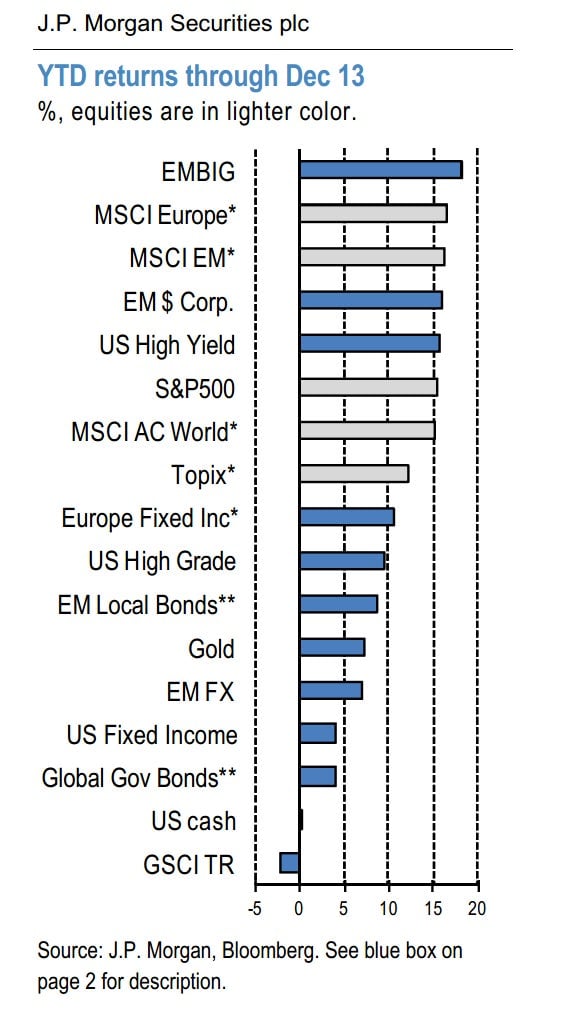

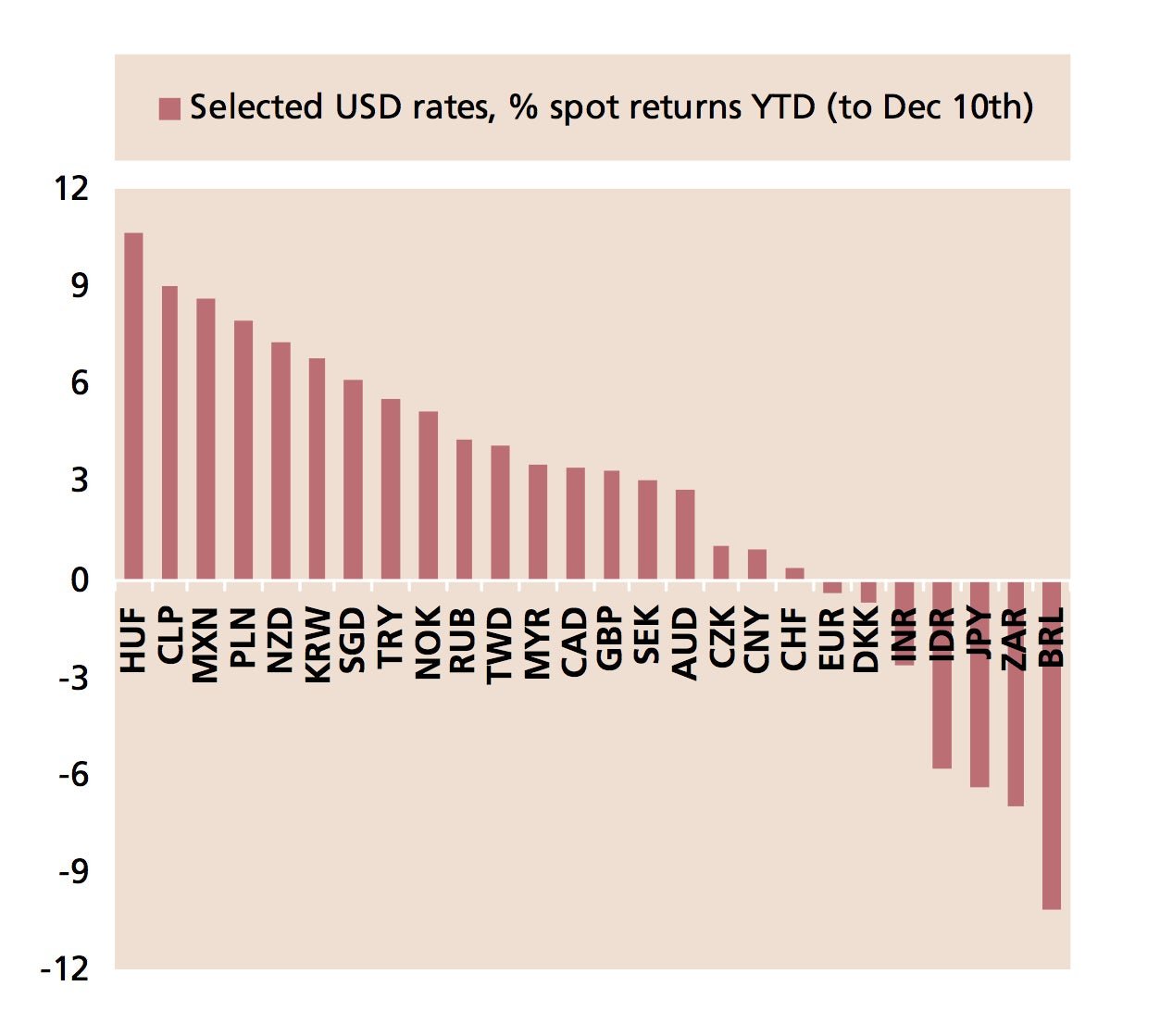

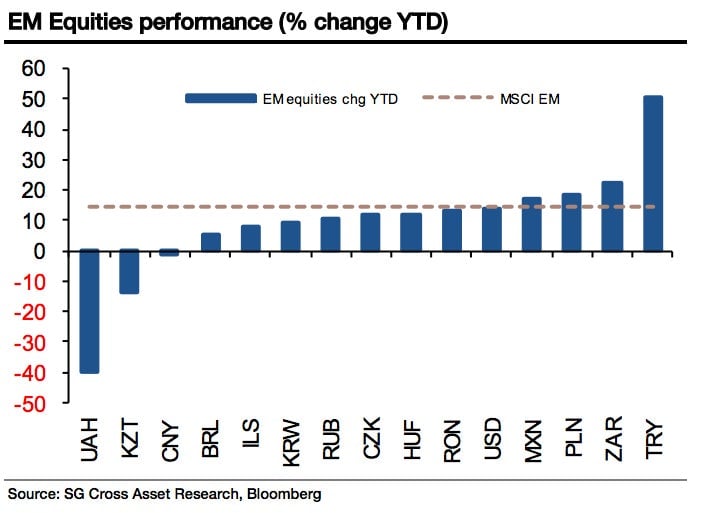

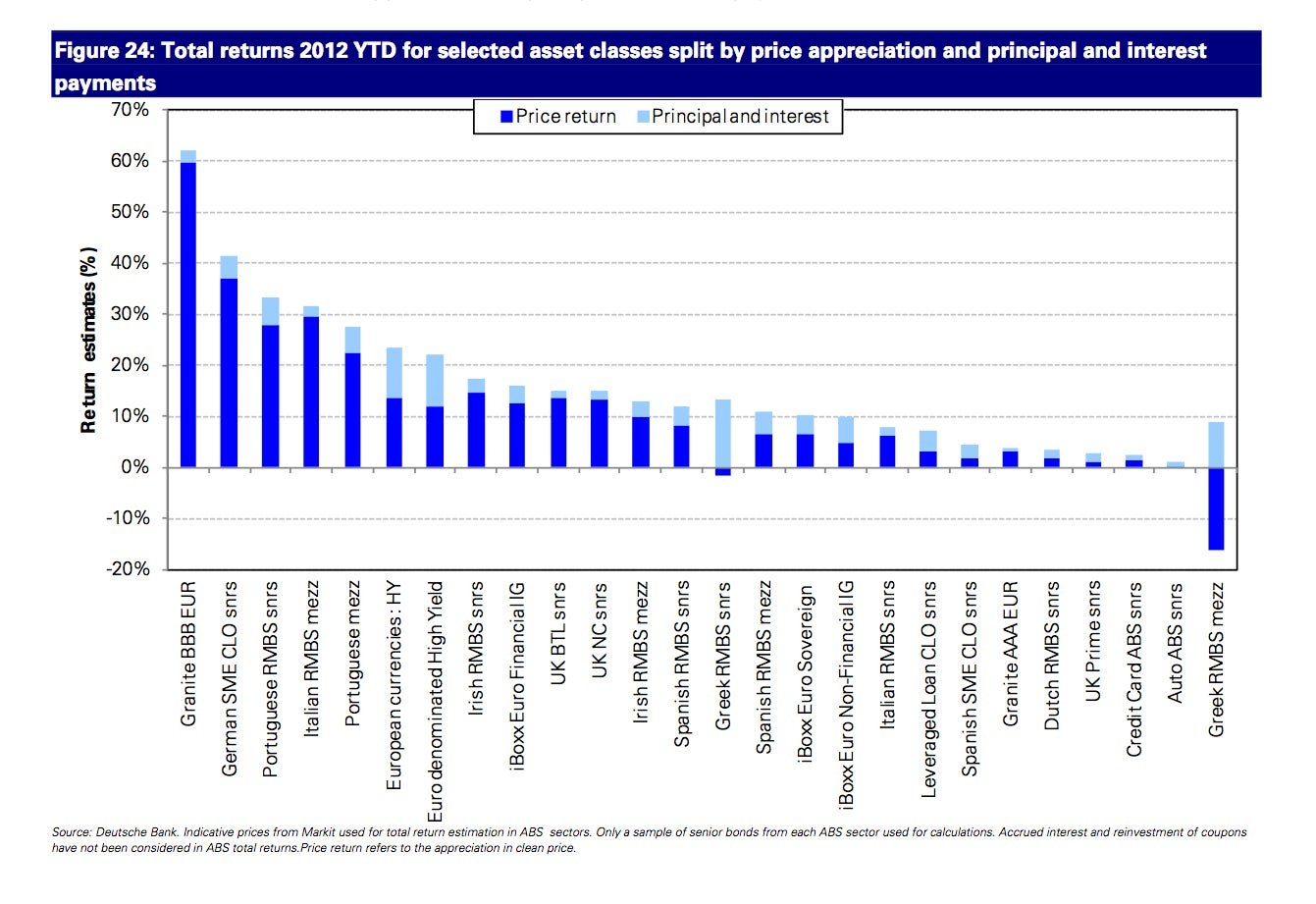

Looking back, it seems painfully obvious that one only needed to:

– dive into risky government bonds of countries such as Italy and Greece

– buy European stocks at the peak of the crisis

– carefully select assets denominated in Hungarian forints

– toss some money into risky European asset-backed securities

– go all-in on soybeans and Turkish stocks

It was, let’s face it, a no brainer. Here are some charts that tell the story: