Japan, the economy the world forgot, might be coming back

Japan just hit two milestones it hasn’t seen in a while.

Japan just hit two milestones it hasn’t seen in a while.

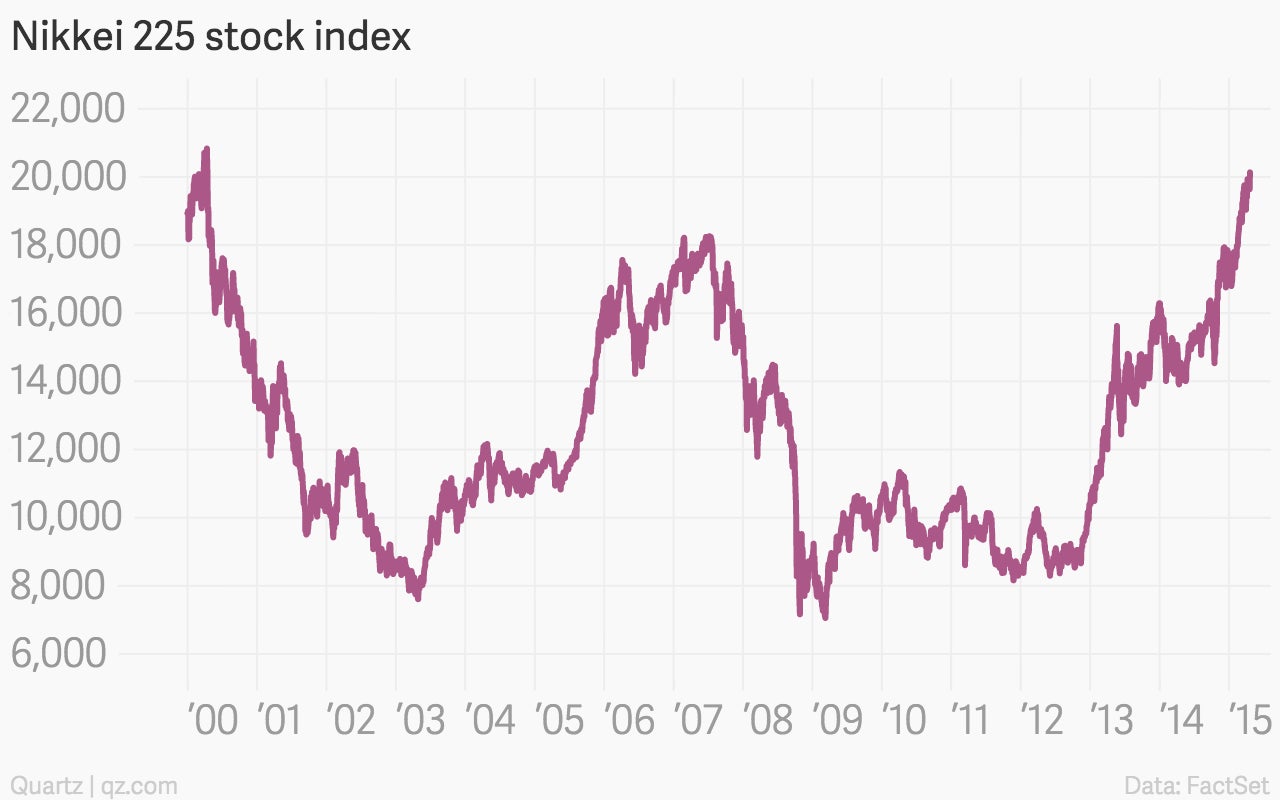

Most visibily, the Nikkei 225 index closed above the 20,000 level for the first time this century and is up more than 15% this year.

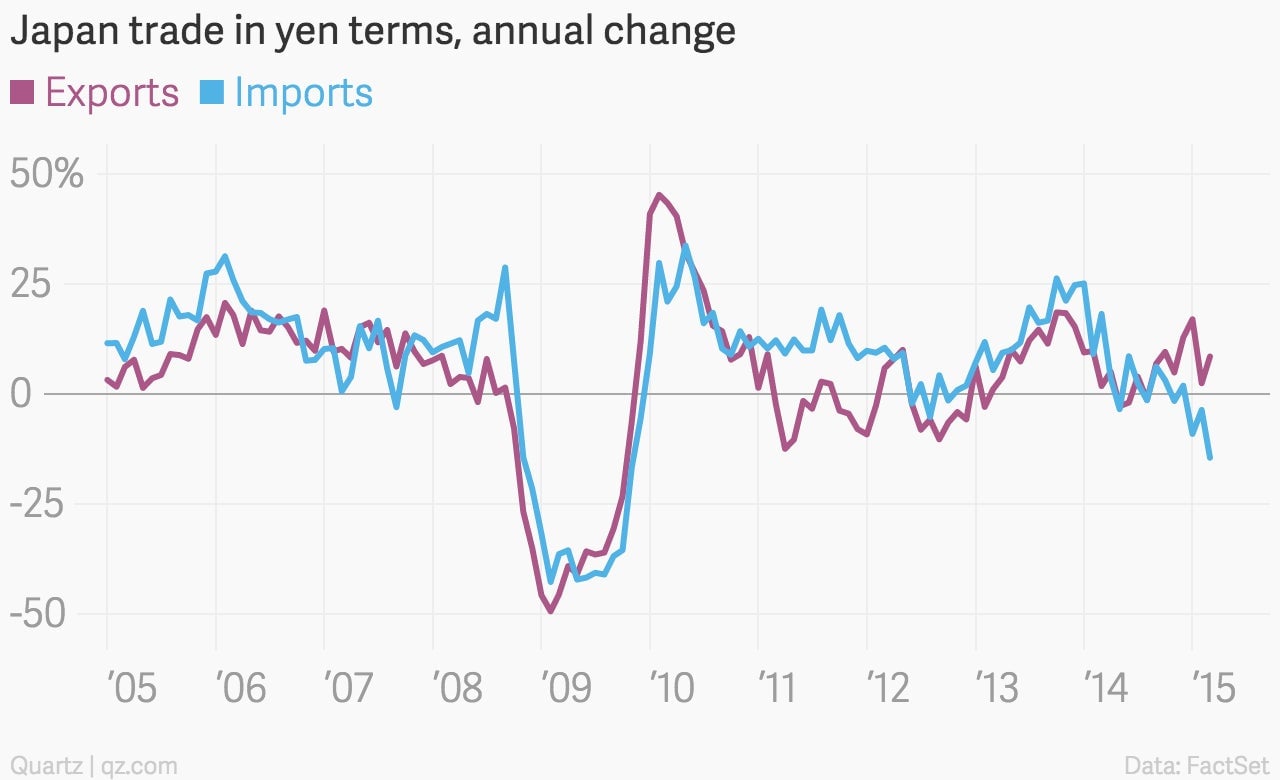

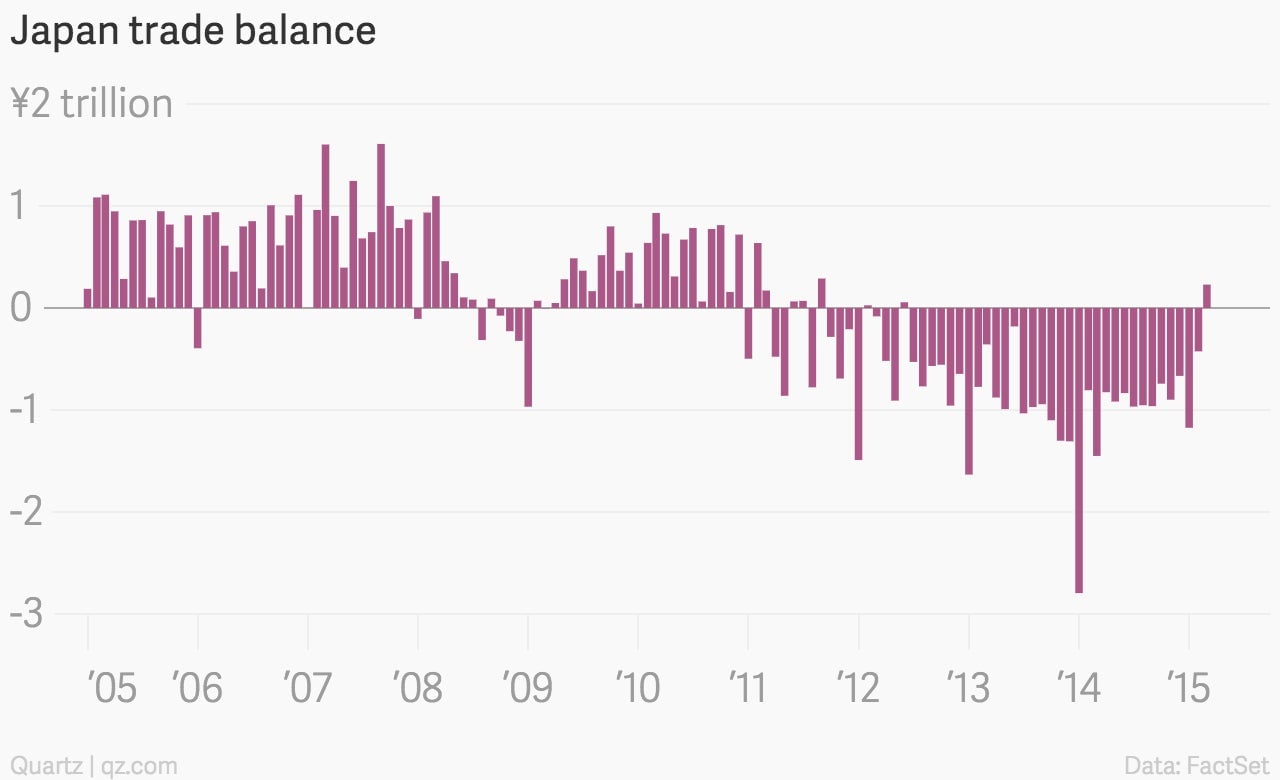

But the country’s trade surplus has also returned, last seen in 2012 and at its highest level since 2011.

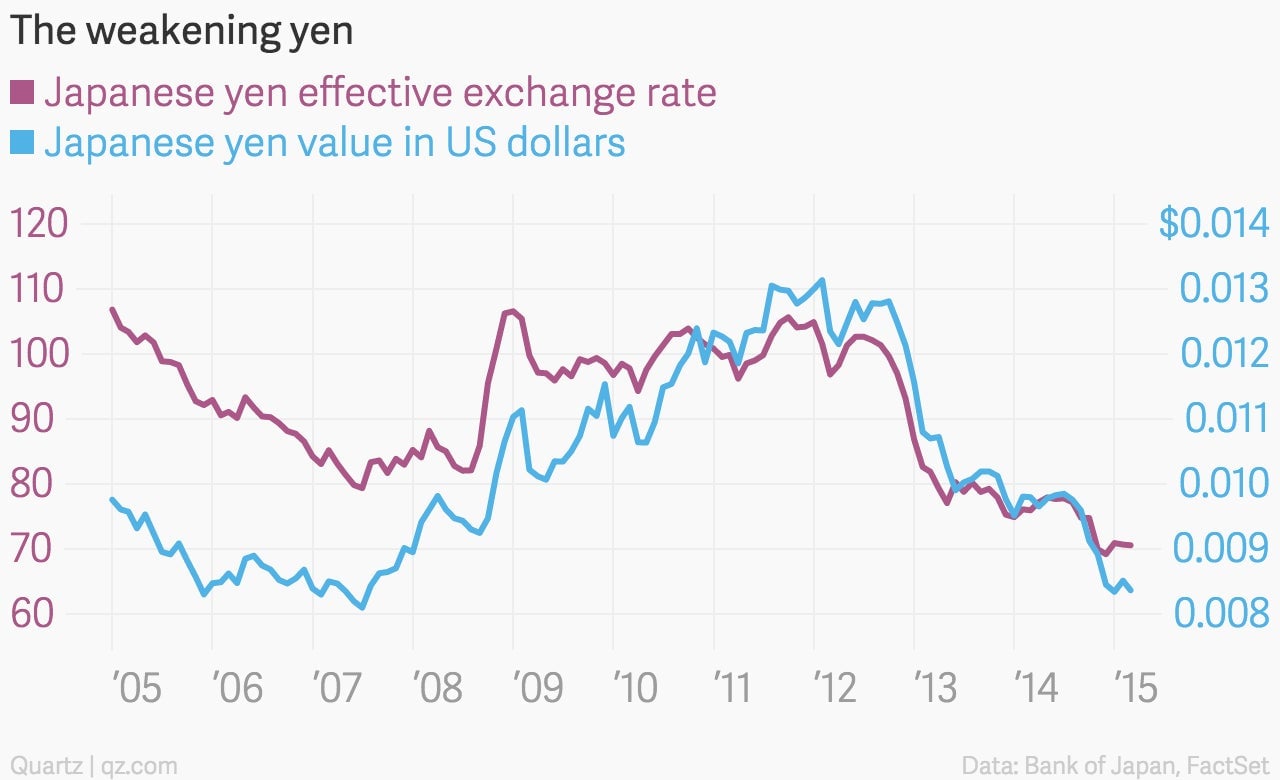

Both occurrences are tied up in the Bank of Japan’s battle to stimulate the economy through a massive bond-buying program that’s pushing the yen to its weakest level in years.

And while that’s been good for big multinational companies—Toyota is expecting record profits this year—consumers haven’t been as lucky.

The weak yen saddles consumers with with higher costs on imported goods. So the trade surplus is the result of a puissant export sector overpowering shrinking demand for imports in an economy just stumbling out of a recession.