South Korea’s economy can’t catch a break

South Korea, once a shining star among Asia’s emerging economies, isn’t burning as bright these days.

South Korea, once a shining star among Asia’s emerging economies, isn’t burning as bright these days.

An early estimate of last quarter’s growth came in better than expected, but it was still the slowest in two years and a continuation of a downward trend.

“Weak global demand is part of the story,” said Marcus Noland, executive vice president of the Peterson Institute for International Economics. “The slowdown in China is part of story.”

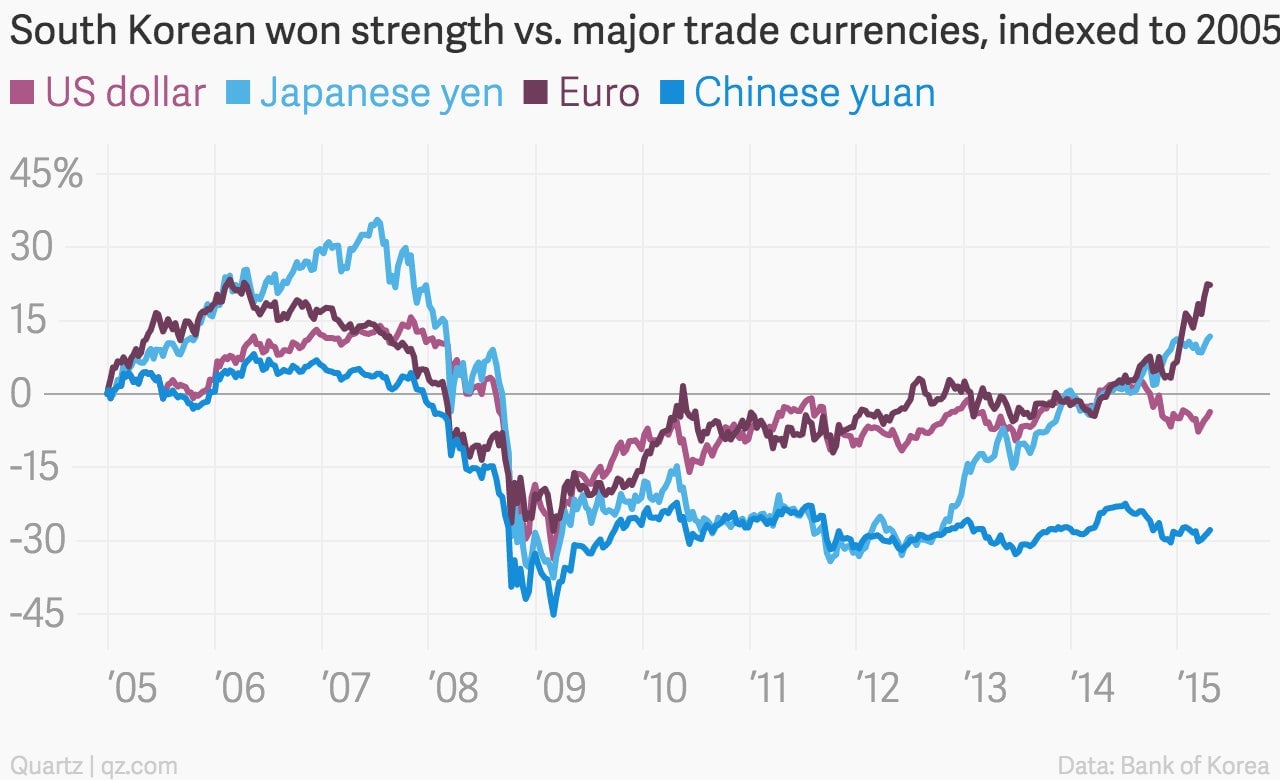

But there are other parts of the story, too. South Korea’s strengthening currency, for example, is getting in the way of export growth, and domestic consumption hasn’t been quite strong enough to pick up the slack.

“We would expect its economy to slow down for its own reason,” Noland told Quartz.

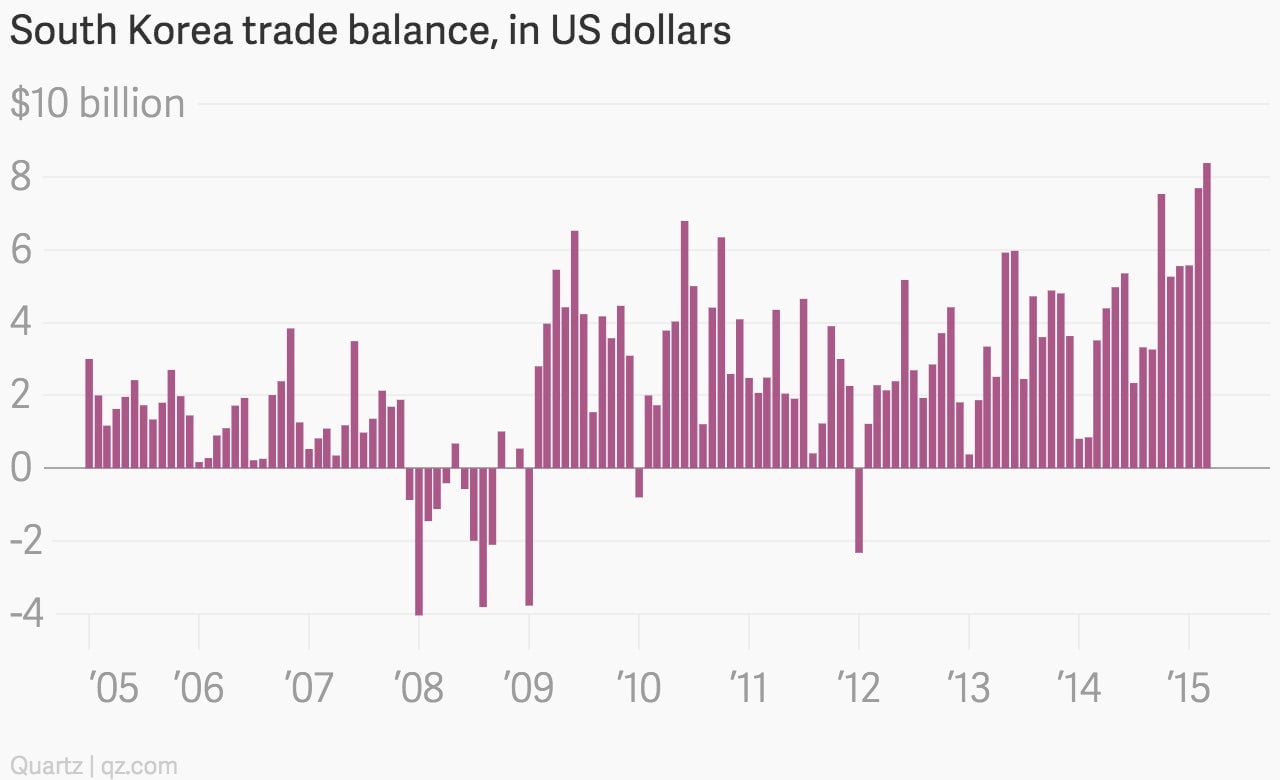

South Korea tends to be a net-exporter. It’s one of the few countries that has a trade surplus with China, Noland said, and the surpluses with its other main trading parters—the US, Japan, and Europe—are getting bigger and bigger. But this trend hides some deeper problems.

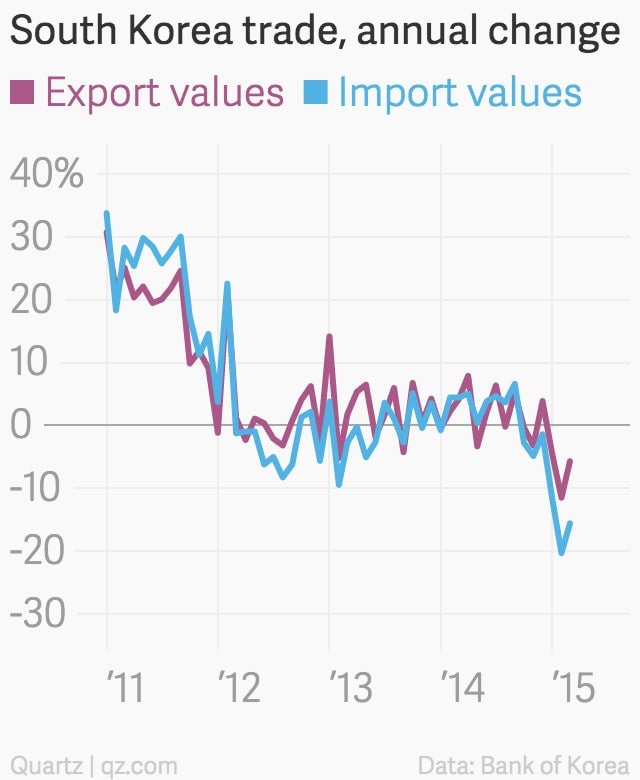

Trade volumes are doing fine, with both imports and exports up last month.

But the value of that trade has been falling steadily this year.

Part of the reason why is that the South Korean won has been strengthening steadily in recent years, which makes the country’s exports less affordable in other countries (and the steady drop in imports all the more worrying).

In response, the Bank of Korea cut interest rates three times in the last year to boost domestic demand while simultaneously (allegedly) jumping into foreign exchange markets to try to keep the won weak against other currencies.

The South Korean government has denied the alleged interventions (paywall). But the US Treasury, which has been on something of a naming-and-shaming campaign of late, specifically called out the Bank of Korea in an April 9 report (pdf) alleging a substantial increase in interventionist activity in December and January, and urging the Korean government to instead spend the money at home to boost its already vigorous fiscal stimulus efforts.

It’s been needed, as there’s been less and less fuel available elsewhere for economic expansion. Korean household debt has been climbing steadily for years (paywall) even as consumption has slowed or fallen, choking off one path for growth. An aging workforce is another issue. Immigration, though complicated, has been helpful—but it’s no panacea (pdf, p. 49).

The optimists on Korea—like Krystal Tan, an economist with the research firm Capital Economics—think that low oil prices, combined with record-low rates, will be enough to jolt South Korea from all the headwinds stacked against it.

“Domestic demand has struggled for a number of reasons…,” Tan recently wrote. “But there are some signs that suggest things may soon turn around.”

Young South Koreans could probably use the pep talk. They certainly aren’t getting one right now from the International Monetary Fund, nor from the Bank of Korea, both of which recently cut their growth forecasts for Korea’s economy.