Charted: Greece’s weak, debt-ridden, jobless future

The European Commission’s latest batch of economic forecasts is pretty encouraging, for the first time in a long time. Unless you’re Greek.

The European Commission’s latest batch of economic forecasts is pretty encouraging, for the first time in a long time. Unless you’re Greek.

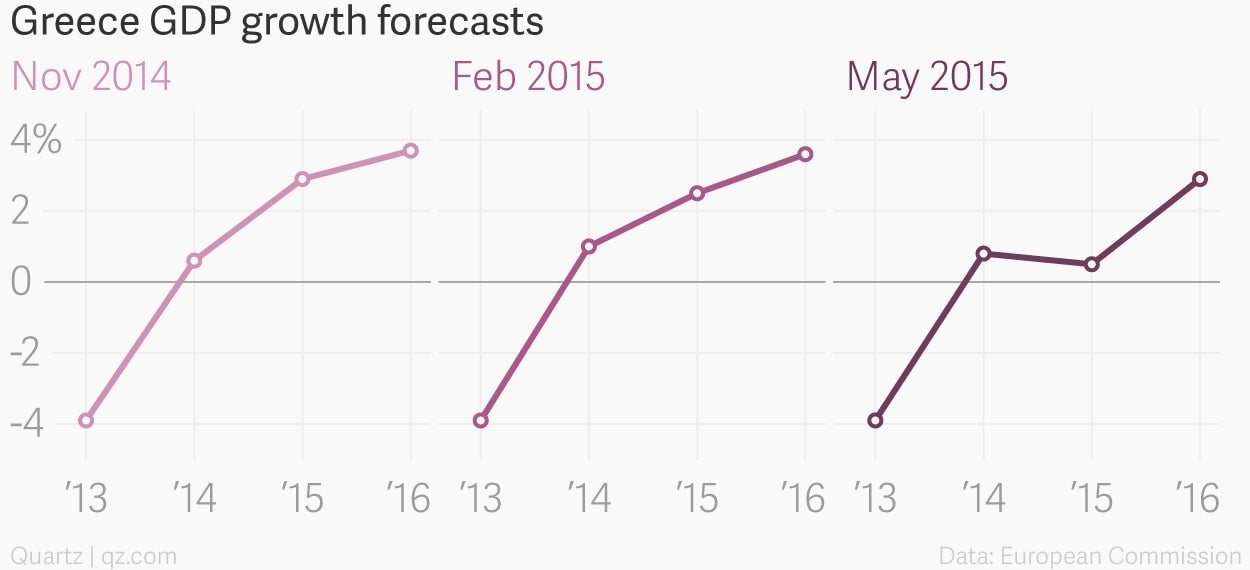

The commission upgraded its outlook for the euro zone as a whole—GDP is now expected to expand by 1.5% this year, up from a 1.3% projection in February. At the same time, it slashed its forecast for Greece, with GDP expected to grow by just 0.5% this year, down sharply from 2.5% projected in February and 2.9% in November.

The commission still expects rather robust economic growth in Greece of 2.9% next year, down from a scarcely-believable 3.6% in its previous forecast. But the way things are going, the smart money would be on this number coming down in future forecasts as well.

Like just about everything else to do with Greece these days, the commission’s forecasts are ”subject to a high degree of uncertainty,” it says. Indeed, the projections take into account developments through April 21, and the news since then has been mixed, at best.

Greece owes the IMF €1 billion ($1.1 billion) in loan repayments this month, and it isn’t clear that Greece has the money to pay this as well as honor government salaries, pension payments, and other obligations. There is little evidence to suggest that some €7 billion in promised bailout funds will be released any time soon, as the months-long deadlock between Greece and its creditors shows few signs of breaking.

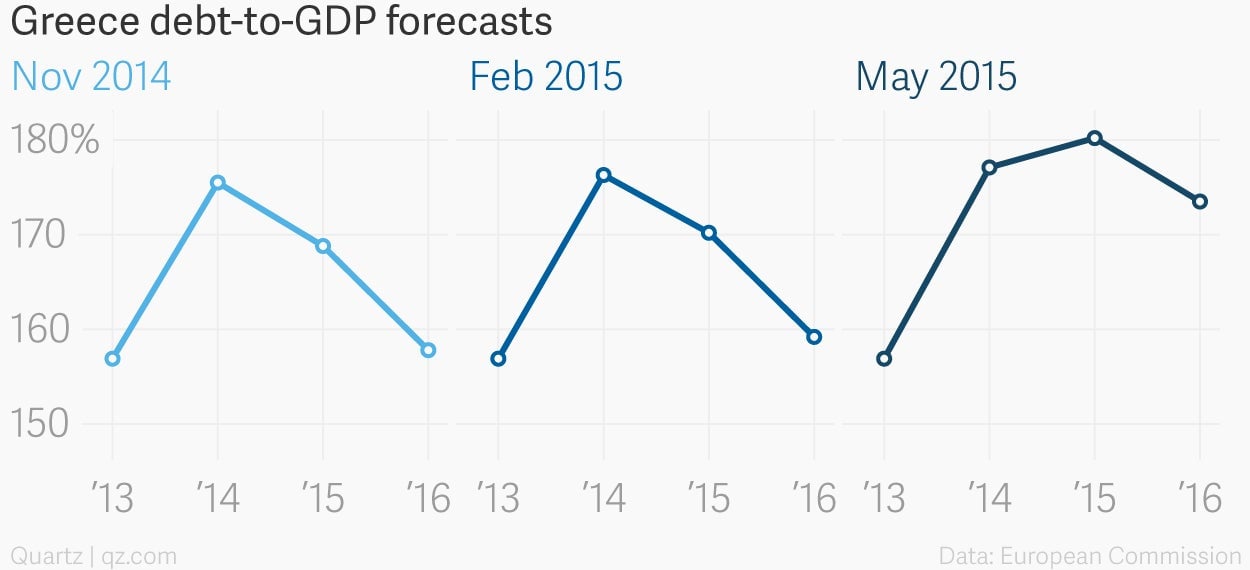

The rapidly deteriorating Greek economy makes its already daunting debt pile even harder to manage, a key point of contention between Athens and its lenders. The commission’s latest forecast reckons that Greece’s debt will reach a whopping 180% of GDP this year, much higher than expected in recent months. Greece’s most recent bailout agreement called for its debt-to-GDP ratio to fall to 110% by 2022, which looks nearly impossible without some sort of restructuring, write-down, or default.

Greek officials are reluctant to agree to reforms that might pile more economic misery on a country that has already suffered greatly. Amid the negotiations on loan repayment schedules, debt-to-GDP ratios, and other financial metrics, the human toll of Greece’s economic crisis is what makes for the ugliest numbers of all.

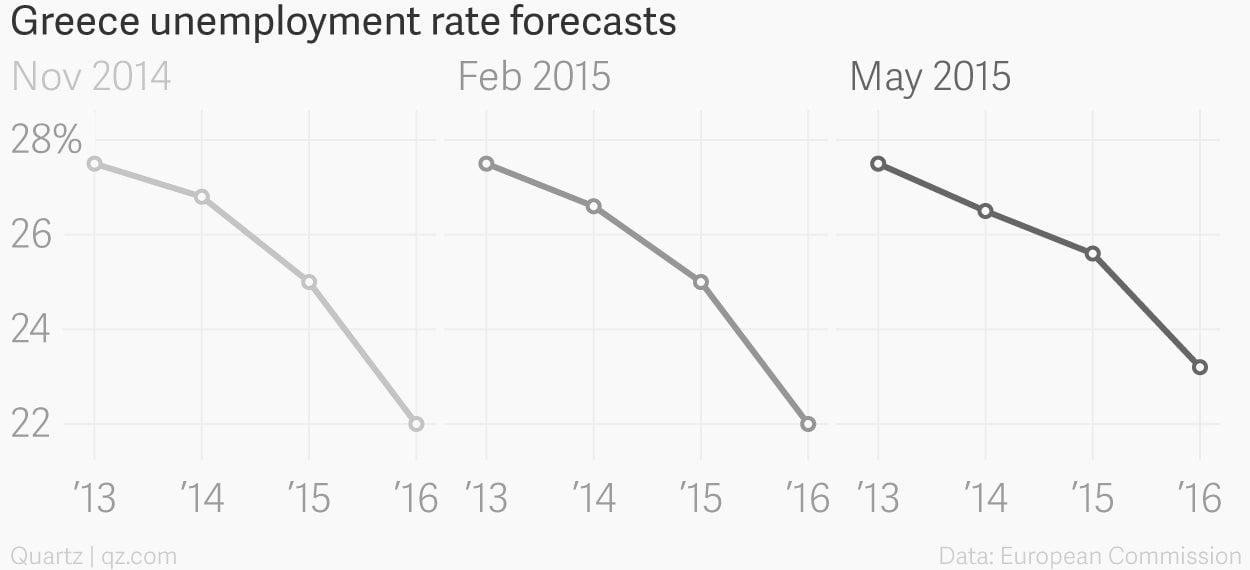

As it cuts its unemployment forecasts almost everywhere else, the commission raised its outlook for the jobless rate in Greece to 25.6% this year (from 25%) and 23.2% next year (from 22%). Those aren’t just the highest rates in the euro zone but the whole of the developed world.