Investors are ditching German debt

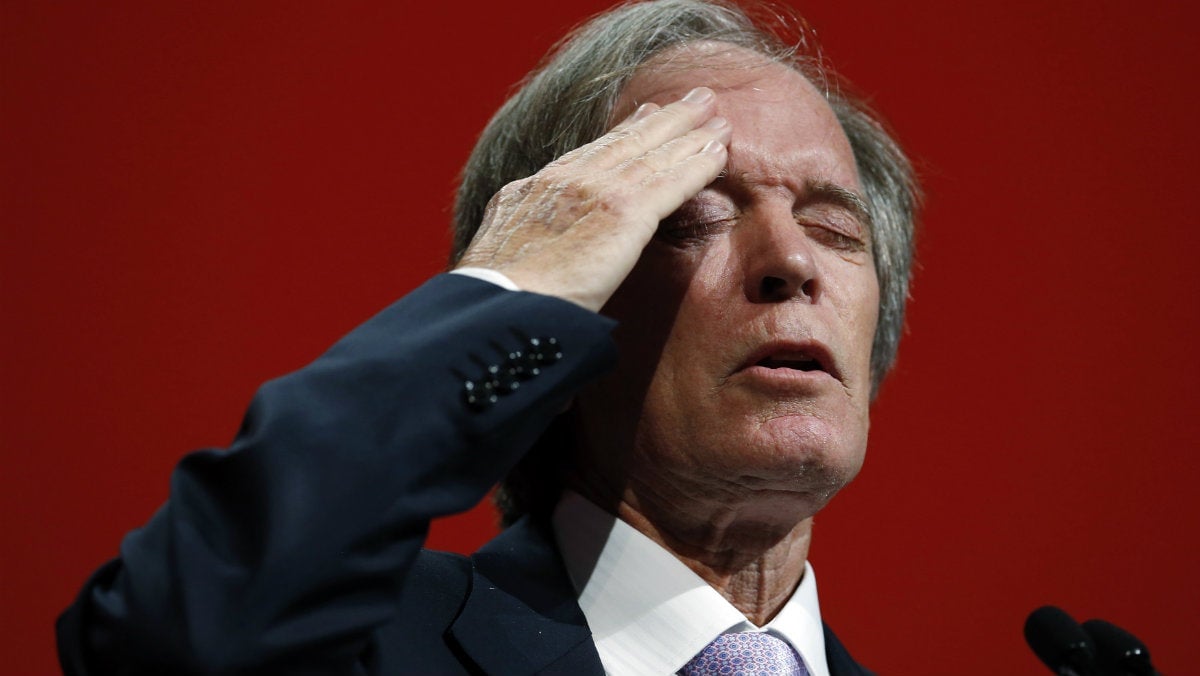

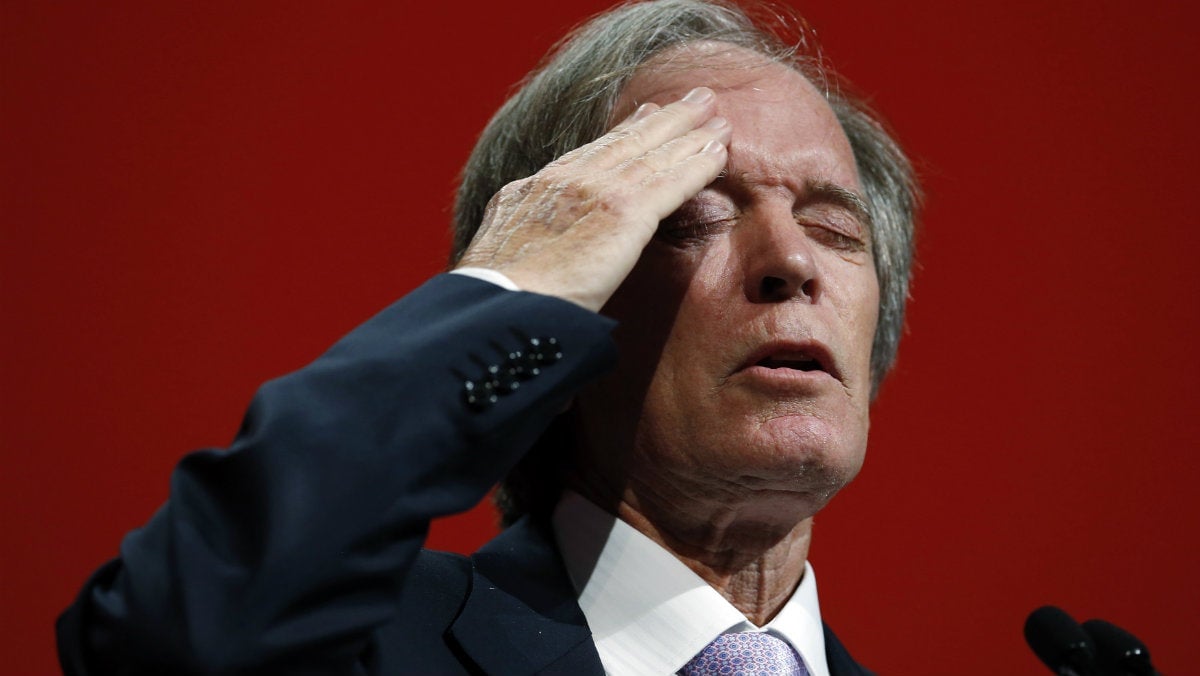

Investing legends Bill Gross and Jeffrey Gundlach have called the German 10-year bond (known as a “bund”) the “short of the century” (paywall) after it soared to record low yields (and high prices) per bond—and now their bets against it have been proved right. The yield on the 10-year is up to 0.59%, after reaching a low of 0.05% just a couple weeks ago.

Investing legends Bill Gross and Jeffrey Gundlach have called the German 10-year bond (known as a “bund”) the “short of the century” (paywall) after it soared to record low yields (and high prices) per bond—and now their bets against it have been proved right. The yield on the 10-year is up to 0.59%, after reaching a low of 0.05% just a couple weeks ago.

A few hints of actual inflation here, some economic green shoots there, and now the investors of the world can at least temporarily stop entertaining the possibility of a negative 10-year bund that would have them paying Germany to hold their cash for a decade.

Gross was even more right than he thought: the selloff was so sharp and so fast that Gross’s short call, announced near the top, ended up losing him money for not being bearish enough.