Normally risk-averse US pension funds are starting to bet big on Africa

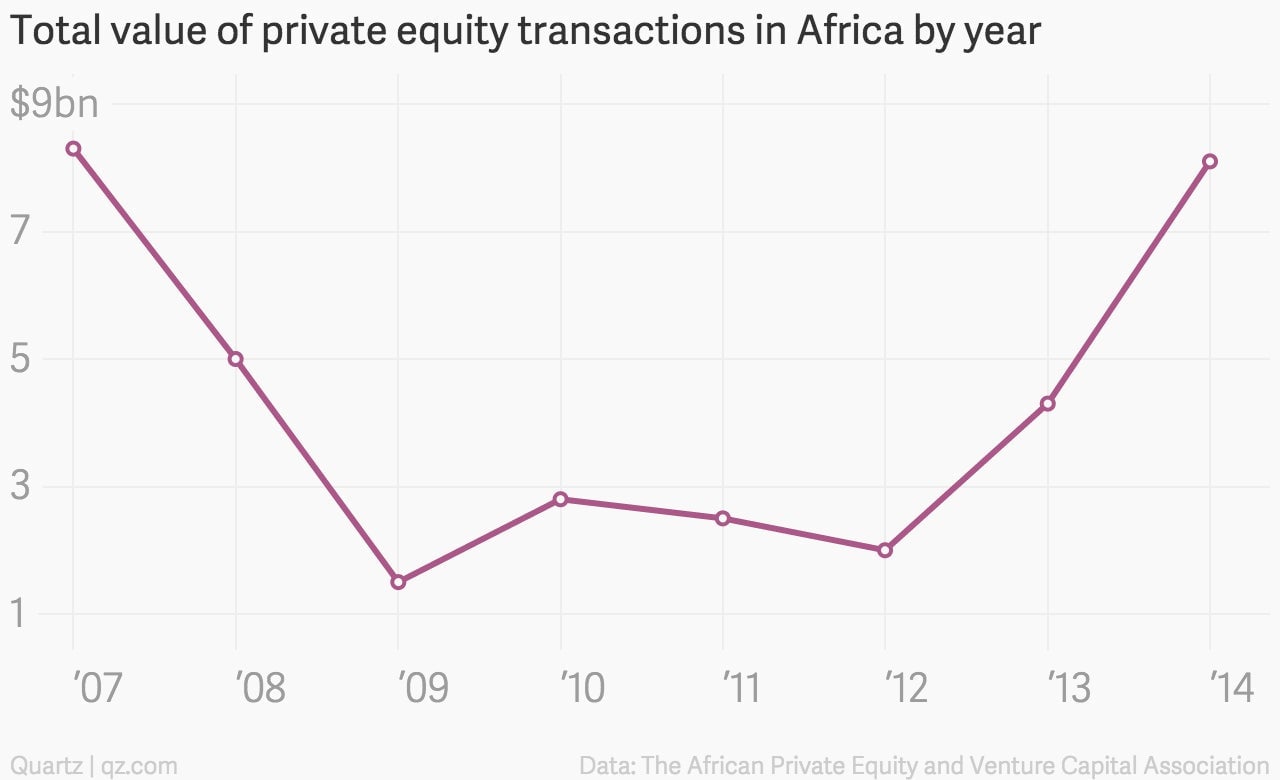

Private equity firms see Africa as the next big thing. But now US public pension funds are starting to look at the continent too.

Private equity firms see Africa as the next big thing. But now US public pension funds are starting to look at the continent too.

The Wall Street Journal recently reported that one of the largest pension funds in the U.S., the $180 billion New York State Common Retirement Fund, plans to invest about $5 billion in the next five years in Africa. A spokesman for the Office of the New York State Comptroller, Thomas P. DiNapoli, confirmed that the plan is under consideration in a statement to Quartz.

“[We are] considering investing up to 2% to 3% of assets across all sectors of the portfolio in Africa over the next five years, as opportunities arise and meet investment standards,” the statement said. “Africa is home to a variety of emerging markets and the diverse investment opportunities there will each be considered on its merits.”

With typically conservative pension funds showing an interest in Africa, analysts say this could be a significant inflection point, one that may help skeptical investors get more comfortable with the idea of investing on the continent.

“It is a strong statement around the potential investment opportunity that Africa provides,” says Ashley Bendell, the Head of Distribution, USA, at Africa Alliance, a pan-African investment banking group that operates in the region. And the fact the fund will be working with the private equity firm African Capital Alliance, a long-term player in Sub-Saharan Africa, only works to give the trend more credibility, Bendell told Quartz.

American investors have tended to invest in local subsidiaries of multinational companies such as Heineken, Lafarge, and Unilever. But increasingly American private equity firms are starting to invest in African businesses. The Carlyle Group buying 18% stake of Diamond Bank, a Nigerian lender, and their acquiring of TiAuto, a South African vehicle tyre and parts retailer are just recent examples of this development.

Other analysts, however, suggest that folks should contain their excitement. Yes, this is an important moment and does signify that some funds are being less “risk-averse.” But Manji Cheto, a vice-president at the political risk firm Teneo Intelligence, says it is not atypical for managers to dedicate a small chunk of their funds to less proven non-traditional markets.

“[It] broadly fits a historical trend,” she says. “Pension funds traditionally set aside a small chunk of their fund for what they consider more risky ventures.”

Additionally, by working with a “fund of funds manager”—Helios Investment Partners and African Capital in this instance—the retirement fund may be trying to reduce its risk. ”While Western pension funds will likely continue to seek out new markets to invest in, they are likely to pursue such ventures in such a way that de-risks the investments as much as possible,” Chenjo told Quartz via email.

Still, Bendell argues, a notable shift is underway. “Not all pension funds are heavily focused on emerging markets and Africa,” he says. “But we have seen a growing interest from US pension funds over the last five years.”

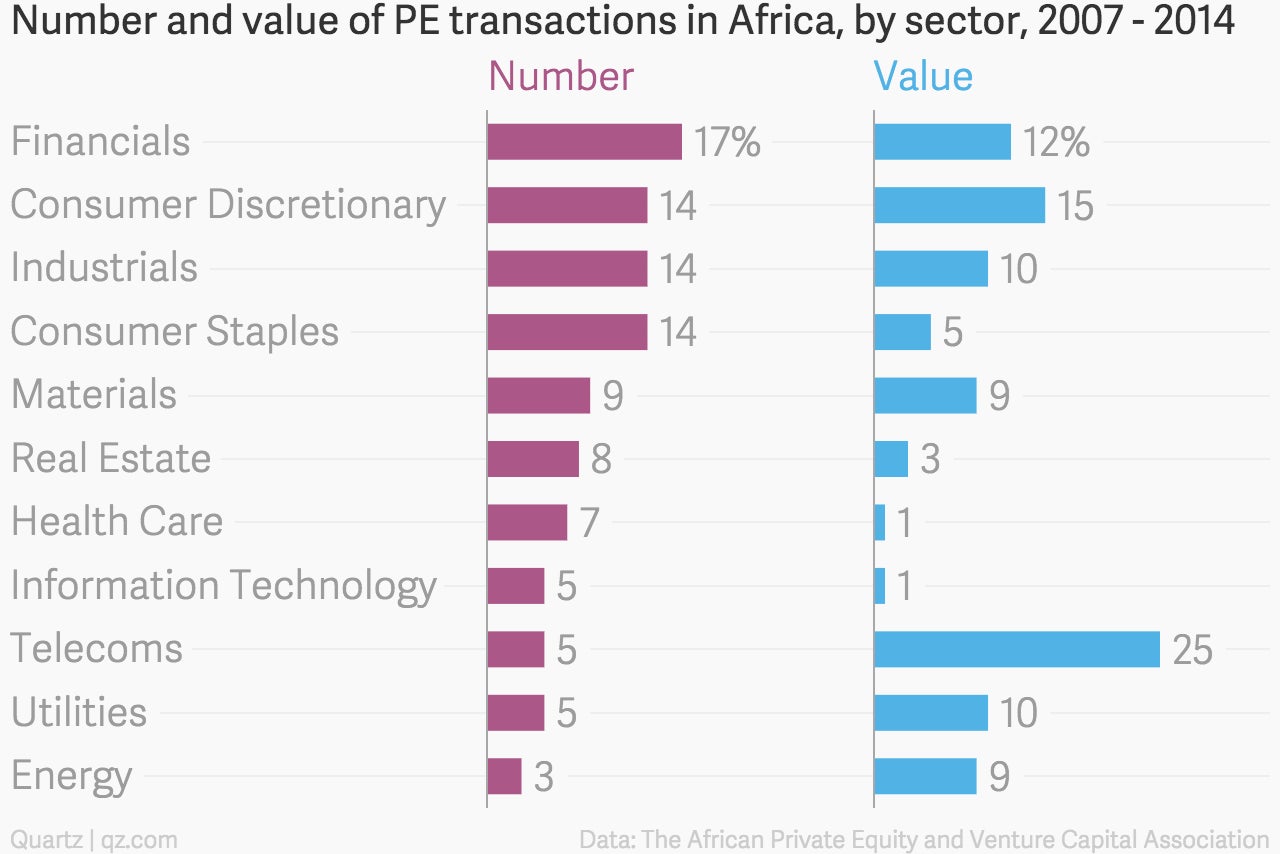

The areas attracting foreign investment in Africa are those connected with the growing infrastructure needs and an emerging middle class on the continent: financial institutions, consumer-focused local and multinational companies, cement companies, real-estate firms, and telecoms, to name a few.