First IPO on Iraqi stock market since invasion is a whopper: $1.3 billion for Asiacell

Iraqi mobile phone operator Asiacell is seeking to raise some $1.3 billion on the Baghdad stock market in the first major IPO since the 2003 US-led invasion. Company and government leaders are championing what will be the nation’s biggest initial public equity offer ever, hoping to raise money, as well as energize the market, attract foreign funds, and shore up investor confidence after a decade of strife and instability.

Iraqi mobile phone operator Asiacell is seeking to raise some $1.3 billion on the Baghdad stock market in the first major IPO since the 2003 US-led invasion. Company and government leaders are championing what will be the nation’s biggest initial public equity offer ever, hoping to raise money, as well as energize the market, attract foreign funds, and shore up investor confidence after a decade of strife and instability.

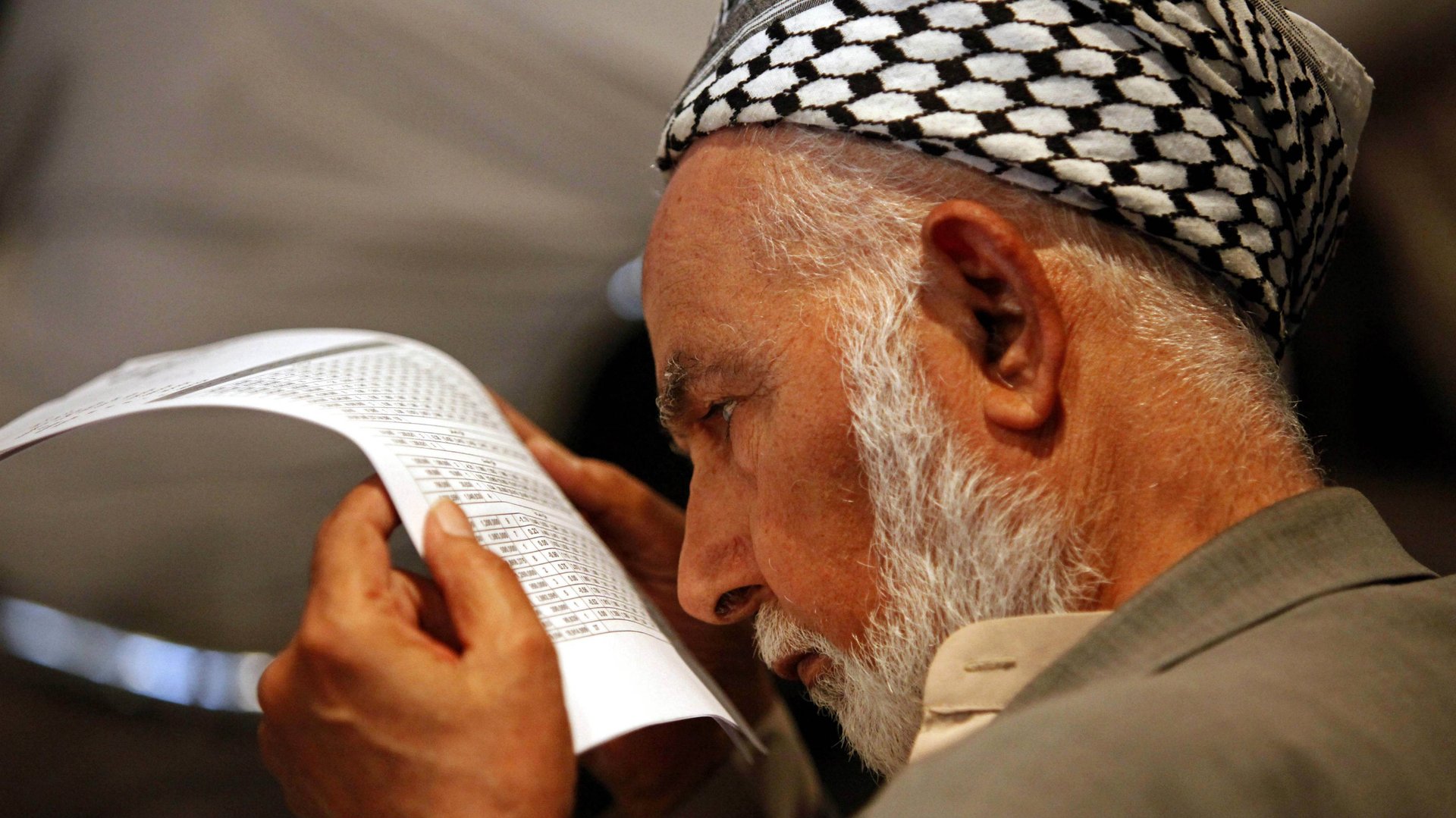

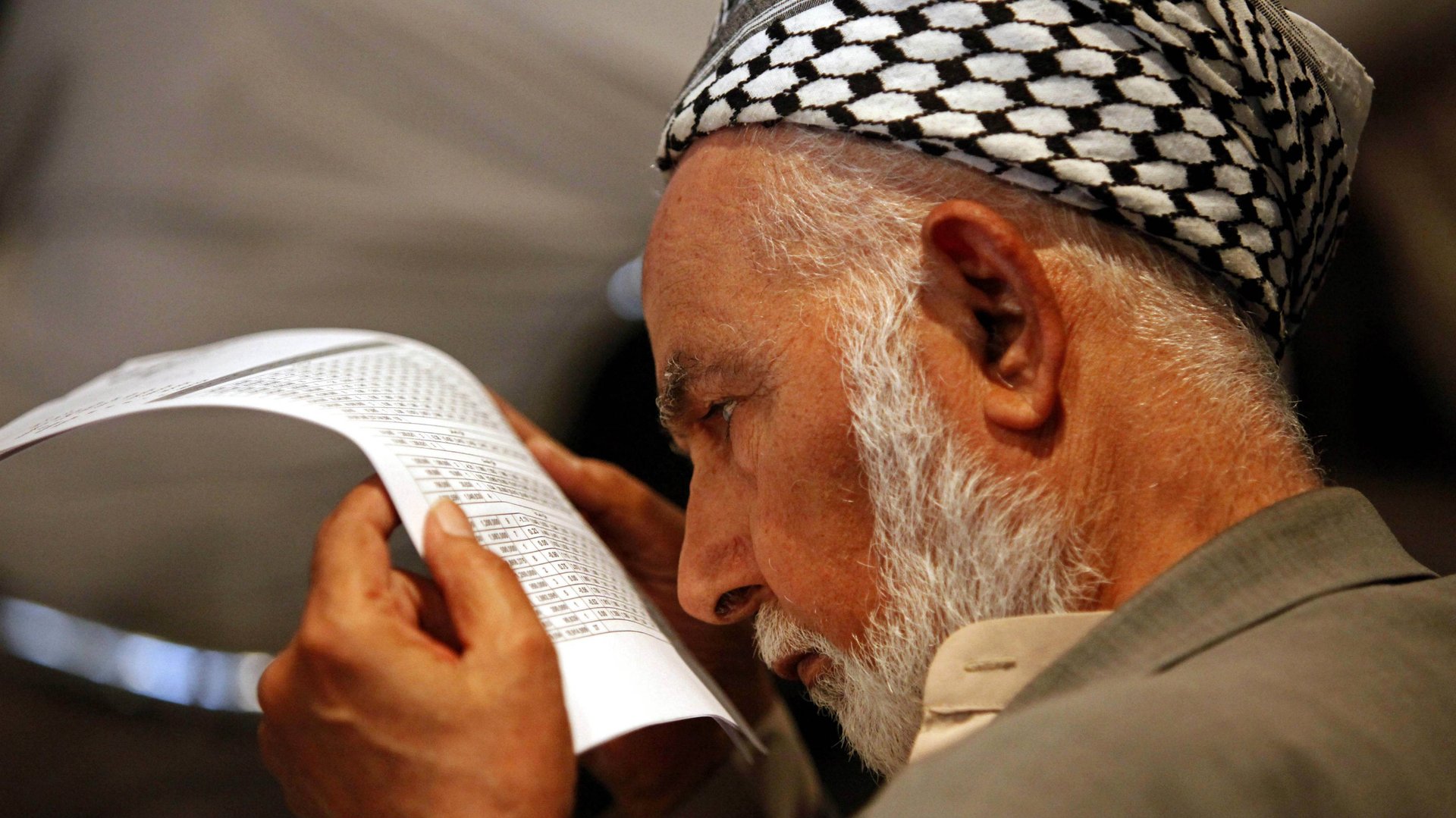

Asiacell will offer 25% of its share capital on the Baghdad exchange through a subscription period opening today and closing in February. (Qatar Telecom holds a majority stake). Ordinary investors have been courted through ads by Asiacell, as well as a media campaign by the Iraqi stock exchange, with local newspapers advertising that investing in shares is as easy as picking up a phone to a broker.

Leaving aside the question of whether it’s easy to reach a broker in Baghdad, there are other concerns about this IPO. Here are some of them:

- Asiacell claims to have a 43% market share, nearly 10 million subscribers—and some say it’s the best of the three Iraqi mobile telecom operators—but the market valuation doesn’t look cheap, according to Reuters’ numbers, which show that at 9.6 times expected 2012 earnings, they are more in line with the valuation of Qatar Telecom, based in a more advanced, less risky stock market. An estimate by a fund manager quoted by Bloomberg puts the valuation at roughly 9.7 times 2012 earnings.

- Questions have surfaced over whether such a tiny underdeveloped financial market can absorb the shares of this large offering. The IPO was originally planned for 2011, but the company delayed after saying the stock market wasn’t ready.

- Trading volume is thin on the Baghdad Stock Market and is dominated by banking shares. The Asiacell listing is expected to significantly increase volume, but there are concerns that the shares will be difficult to absorb quickly.

- Owning shares in public companies is a foreign experience for most Iraqis and distrust of it will not change with some newspaper ads. How well the IPO will be subscribed remains a question.

- Foreigners have increased their holdings in Iraqi public companies significantly since 2008, but ongoing concerns about continuing political instability in Iraq and the region could curb their appetite for this offering. Even if they are interested, it’s unclear how easy it will be to move money into Iraq, says Reuters.

- International banks have been skittish. Morgan Stanley and HSBC pulled out from managing the IPO last year, without saying why.