Wearables are sexy, but the smart money in health startups is elsewhere

The world of digital health is exploding. Hundreds of new startups have sprung up, and the venture capital to support them is growing rapidly. And it has outdone growth (slide 5) in venture funding in general, as well in the biotech, software, or the medical devices industries.

The world of digital health is exploding. Hundreds of new startups have sprung up, and the venture capital to support them is growing rapidly. And it has outdone growth (slide 5) in venture funding in general, as well in the biotech, software, or the medical devices industries.

In 2014, digital health startups attracted $4.1 billion, which is more than double what the sector attracted in 2013. Last year, more than 250 companies in the sector raised $2 million or more.

Two factors that have contributed to this trend: The rise of smartphones and wearables, and the Health Information Technology for Economic and Clinical Health (HITECH) Act passed in 2009, which has promoted the use of medical industry technology by changing how patients and insurance companies pay for healthcare services.

The wearables market is exploding, with big tech companies building their own products. The big players, such as Apple with its flashy new Apple Watch, are making it harder for even popular new entrants such as the Pebble Watch to survive. That is why the smart money for digital-health startups may lie in the mundane but important world of health-data management.

Going public

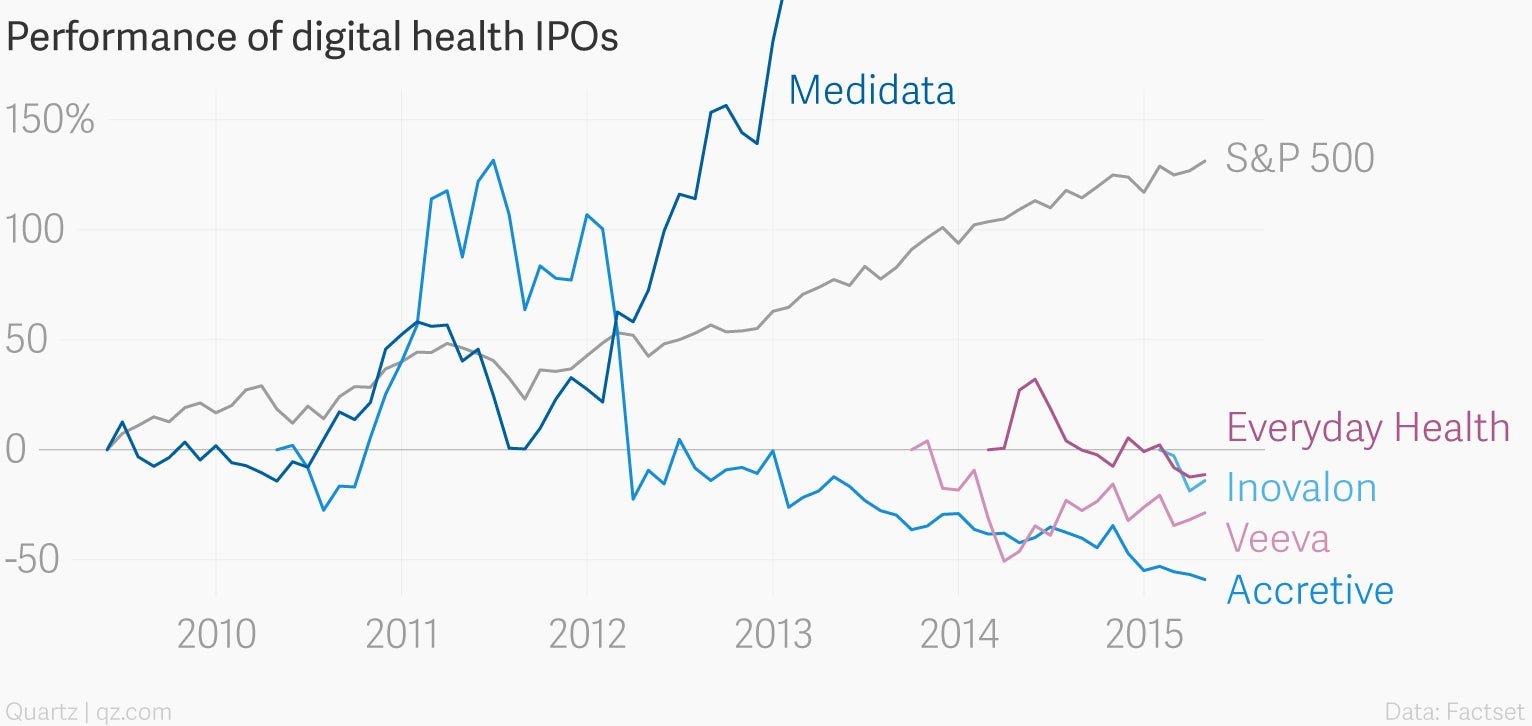

The growth of the market has also meant that many older startups have found it the right time to launch their initial public offerings (IPOs). Since 2009, at least eight companies have gone public.

Just this week Mindbody, a startup that makes software for gyms and yoga studios, filed for an IPO and is hoping to raise $100 million. If successful, the company would be valued at $700 million. However, barring a couple of exceptions, such as Medidata which provides cloud-computing for clinical data, almost all the IPOs have underperformed the S&P 500 benchmark.

Nevertheless, investors remain bullish, according to Malay Gandhi at Rock Health. In a poll published this week, he asked 43 investors actively interested in the sector which company they thought is most likely to file for IPO in 2015.

Apart from Jawbone, which makes fitness trackers and bluetooth speakers, and Proteus, which makes wearable sensors, none of the startups in the top-five list build consumer hardware. Instead, these startups are looking to provide software solutions and services.

In the US, the HITECH act of 2009, as well as the Medicare reforms that were a part of president Barack Obama’s Affordable Care Act, mean insurance companies are no longer paying just for hospital procedures. Instead they began paying hospitals to ensure that the promised health outcome for a patient is realized. Thus, hospitals had to find ways to predict which of their procedures led to success and which didn’t. They had to calculate the risk of taking on a patient and price their services accordingly. All this proved to be fertile ground for data-driven tech companies to grow into a new niche.

Both Practice Fusion and Health Catalyst, startups listed on the chart above as considered likely to IPO, have done that. They are software providers for hospital data recording and analysis, and are growing more versatile as hospitals increasingly become consumers of digital health solutions.