This is what a dying banking system looks like

That whooshing sound you hear is the scads of euro notes being withdrawn from Greek banks.

That whooshing sound you hear is the scads of euro notes being withdrawn from Greek banks.

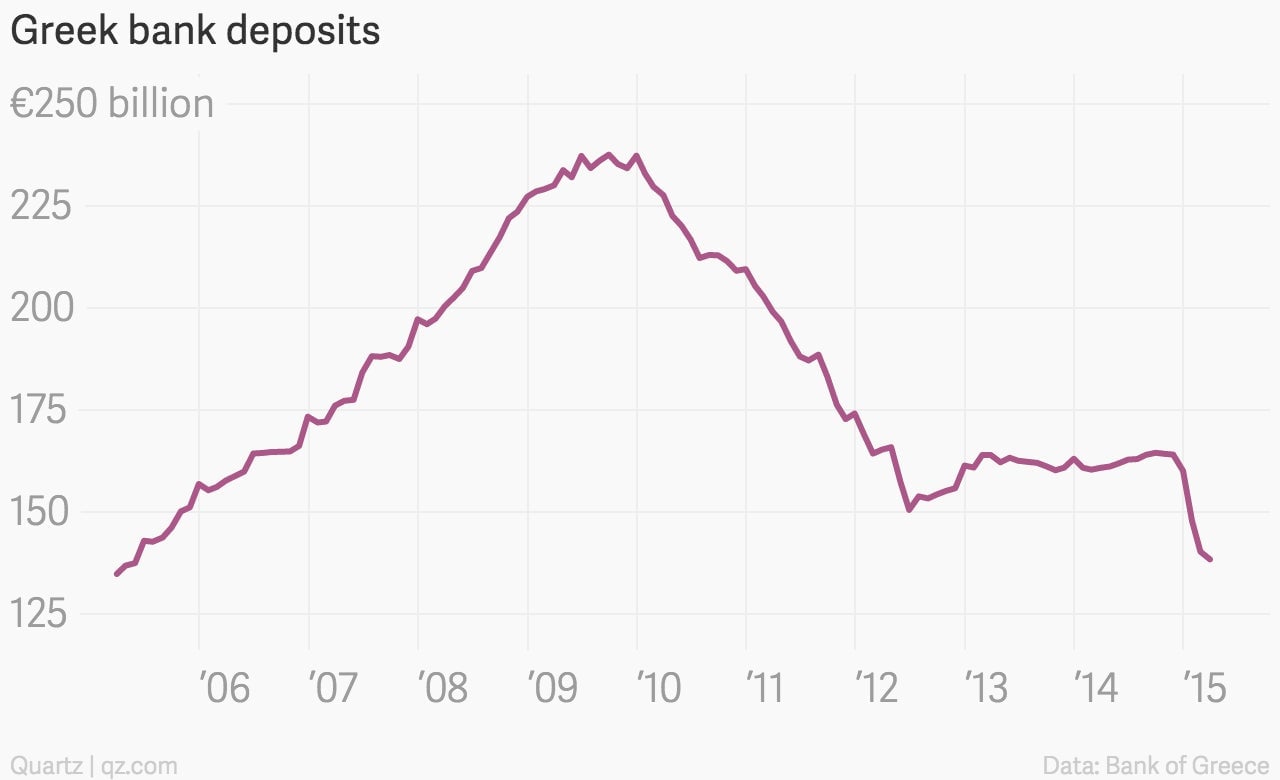

Rafts of deposits have left Greek banks in recent months, as the economically troubled Mediterranean country careens toward another clash with creditors.

In January, a gargantuan €12.3 billion ($13.4 billion) of deposits were withdrawn by Greek households and business, followed by €7.5 billion and €1.9 billion worth of withdrawals in February and March, according to the Bank of Greece. Now reports suggest that the outflows picked back up in April, to the tune of roughly €5 billion. (Fresh numbers are due on Thursday, according to Reuters.)

Not to put too fine a point on it, but this is how financial systems collapse.

Greeks are sensibly worried about either the imposition of capital controls or the outside chance that they will go to sleep one night with euros in the bank and wake up the next morning with a pile of rapidly depreciating drachmas. And they’re not waiting around to see what happens next.