This is the chart your landlord doesn’t want you to see

The years following the financial crisis have been kind to American landlords.

The years following the financial crisis have been kind to American landlords.

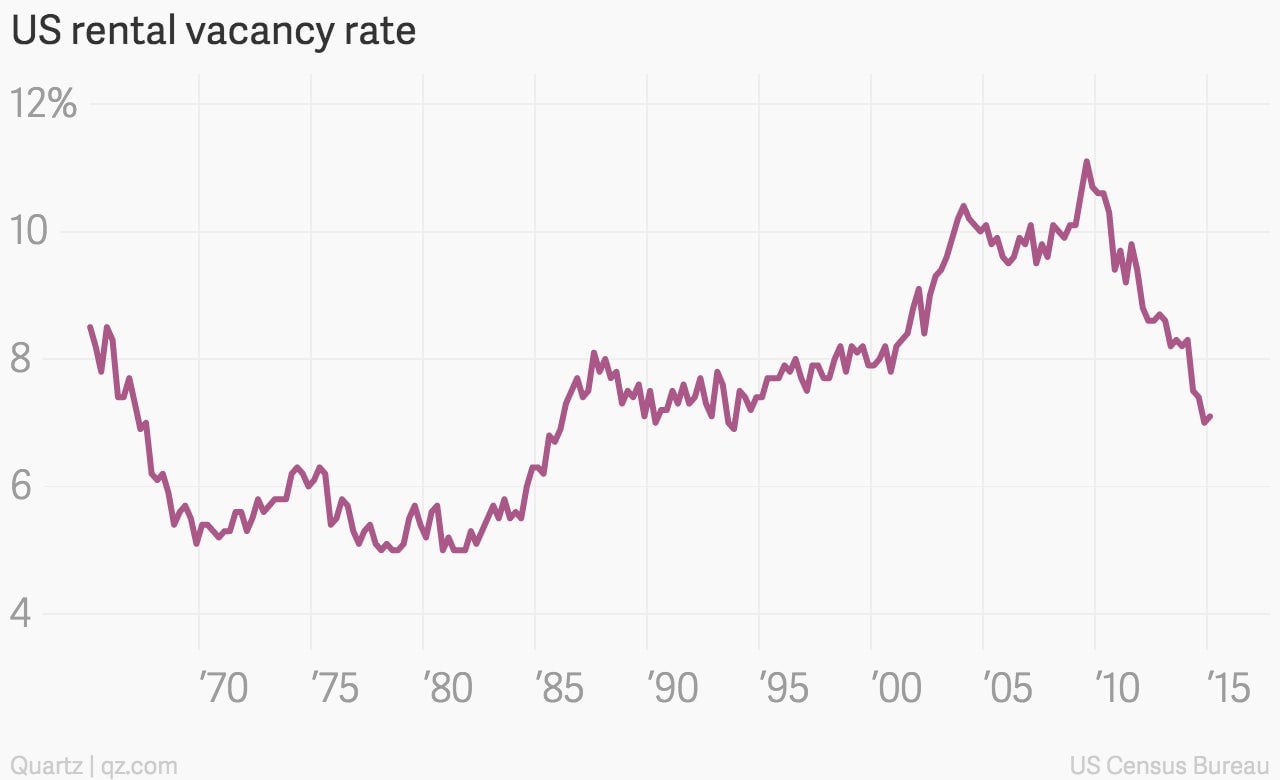

In recent months, the collapse of US homeownership rates have been mirrored by tumbling apartment vacancy rates.

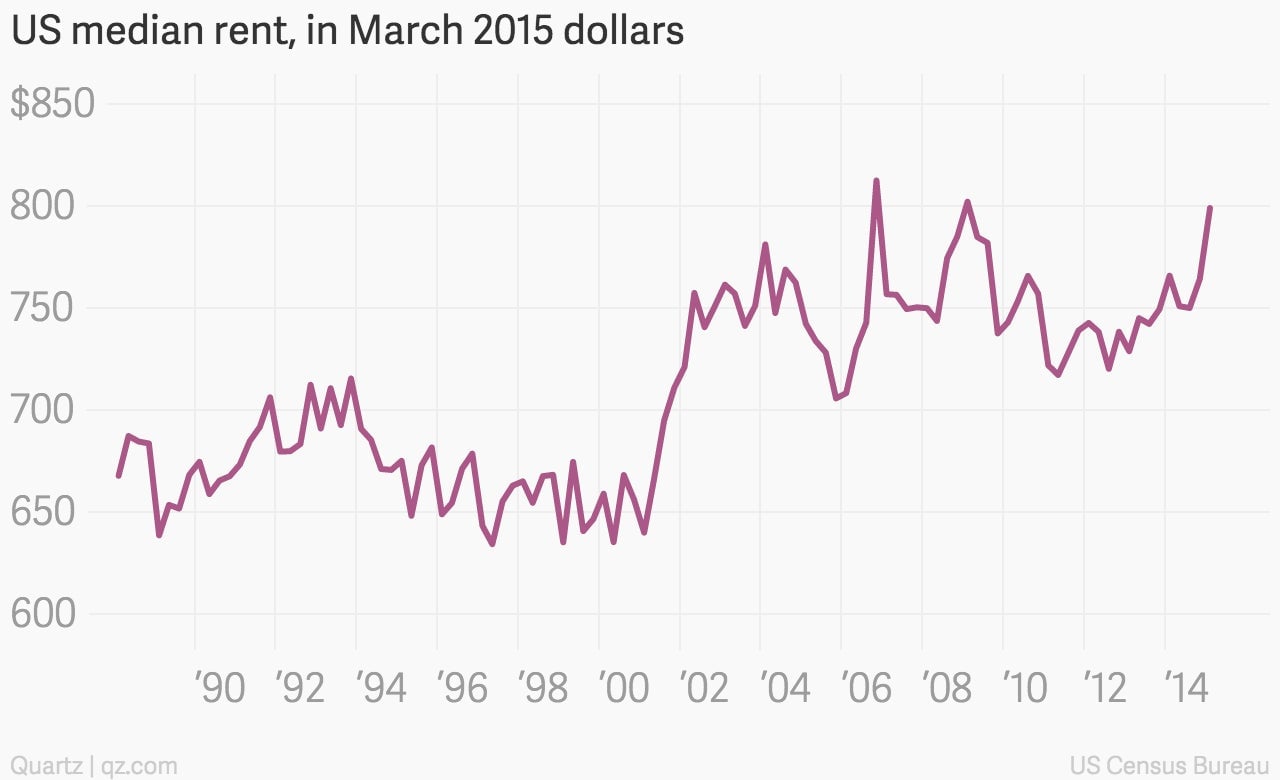

That’s pushing rents up.

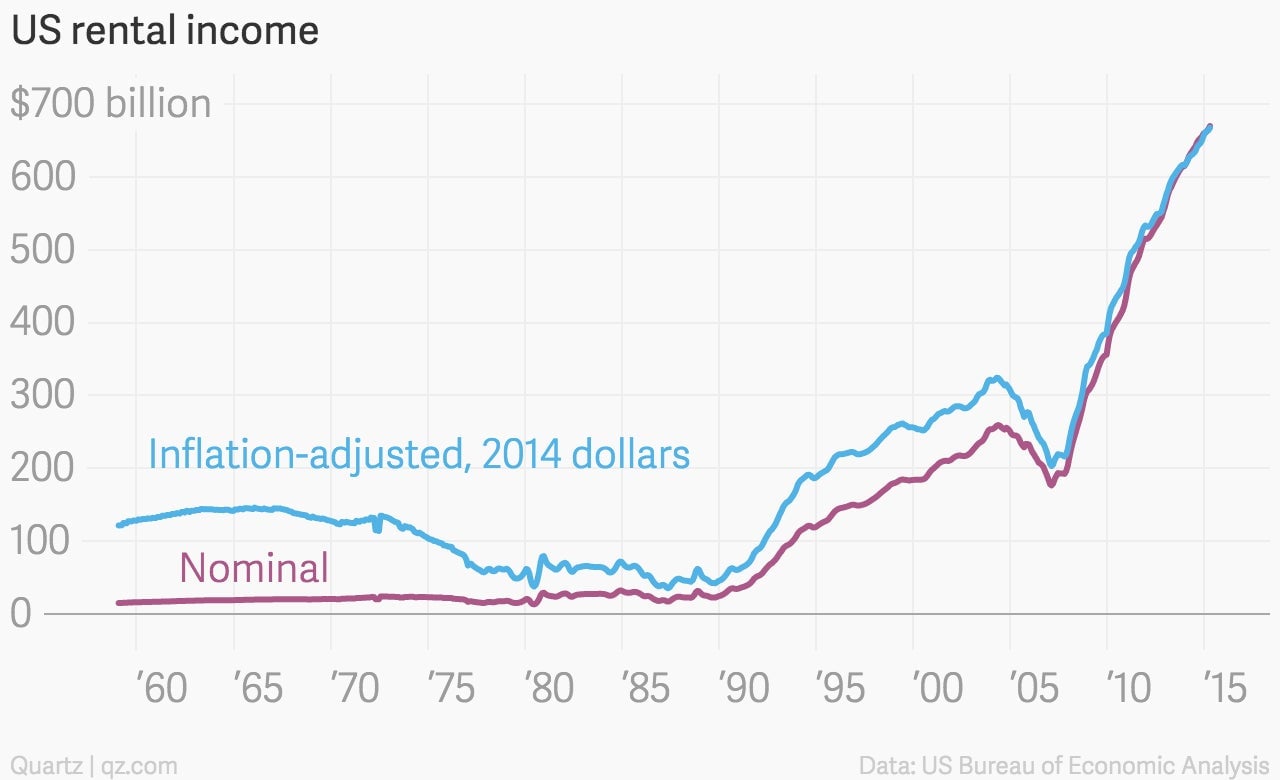

And that’s been a very good thing for the income of US landlords. The US Bureau of Economic Analysis’s gauge of “rental income of persons” has soared in recent years.

Of course, this is more than just rents of apartments and homes. It also includes, notably, royalty payments for mineral rights, which have soared in recent years amid the US gas and oil production boom.

On the other hand, it doesn’t include real estate-related rental income received by dedicated real estate companies, which is captured in a separate line known as “proprietors’ income”—suggesting the real level of rents being pulled in by landlords is is even higher.